Thursday, May 04, 2006

Seeing the glass half empty

UPDATED - See below

With oil revenues way up and the economy booming you would think Venezuelan newspapers would be full of nothing but good economic news. For the most part they are. But leave it to the Venezuelan opposition to find a dark cloud for every silver lining – or at least try.

One example is an article that appeared in El Universal today under the headline of “Oil boom with few jobs”. Ok, based on that healine I guess not many new jobs have been created recently in Venezuela.

As it turns out however, quite a few jobs have been created. In fact, as the article points out over the past 12 months 542 thousand new jobs have been created. Not bad at all. To put it in perspective, for the United States, which has 12 times the population of Venezuela, to create a comparable number of new jobs it would have to create 6 million jobs in a year, something I’m pretty sure it has never done (Bush in his first term created a paltry 120,000 jobs).

Yet the article, in addition to its misleading title, has phrases like “where are the jobs” and “there are new jobs but they are few”. What is curious about this is that in general the opposition writes doom and gloom articles without giving any numbers to back up their assertions. In this case they do give numbers yet in their determination to say things are going badly (when clearly they aren’t) they just ignore them.

In another attempt to accentuate the negative the article then points out that while there were more than a half million new jobs about 350,000 young people enter the labor force each year so the “net” job creation of 150,000. Even the arithmetic on this isn’t right as the total number of new jobs was 542,000 so the number of jobs over and above new entrants in the work force was 192,000. That certainly seems like an excellent performance by any standard, unless they are somehow expecting Venezuela to become a first world country and have full employment in only a year or two.

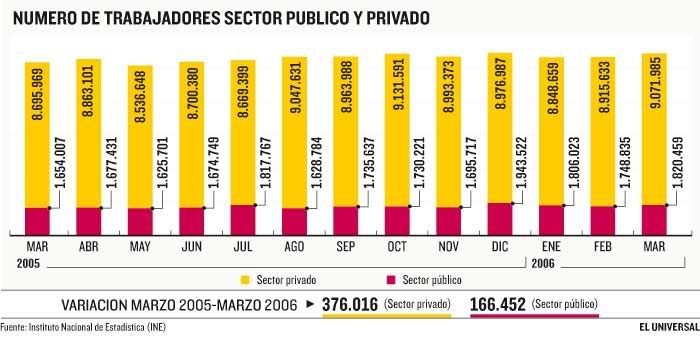

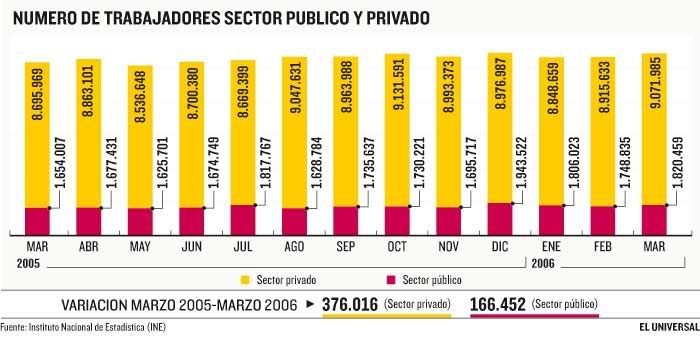

Seeing as we are obviously dealing with good news here, not bad, lets leave the opposition negativity behind for a bit and look at some more numbers. First, the article came with this graph:

The graph shows month by month employment numbers from March 2005 to March 2006. The yellow represents private sector employment (the number in the yellow section is total private sector employment) and the red portion is public sector employment (with the number of public sector employees written by the side). On the bottom it gives the total number of new private sector jobs, 376,016, and the number of new public sector jobs, 166,452.

UPDATE

OilWars readers, we have a problem.

I'm pretty sure I made a big mistake. I did the post as if those numbers were all jobs in the formal sector of the economy - ie, they were what most of us would consider "real" jobs. However, in thinking about it I realized that with almost half the labor force in the "informal" sector that if all the jobs in the numbers above were in the formal sector there would then have to be another 7 or 8 million informal jobs making the total number of people working in Venezuela 18 or 19 million people out of a population of 25 million. That is an unrealistic number.

In checking the INE site more they give they give the over 15 population as 18 million with a total of 12 million people active in the labor force. Sooo, the numbers I have in this post almost certainly INCLUDE INFORMAL sector jobs (everyone including street vendors).

That of course changes everything including the conclusions of the post. So I'm going to remove the bottom half of the post. Please be aware even the conslusions in the first part of the post may now be incorrect and require revision once this is all sorted out. I will try to find the numbers on the percentage of people in the formal and informal sectors so that I can then recalculate the numbers and tell you how many formal jobs were created and how many informal ones were created. I will then re-do the conclusions as appropriate.

Something never did seem quite right about these numbers and I should have reviewed them better before posting. I apoligize for the error.

|

With oil revenues way up and the economy booming you would think Venezuelan newspapers would be full of nothing but good economic news. For the most part they are. But leave it to the Venezuelan opposition to find a dark cloud for every silver lining – or at least try.

One example is an article that appeared in El Universal today under the headline of “Oil boom with few jobs”. Ok, based on that healine I guess not many new jobs have been created recently in Venezuela.

As it turns out however, quite a few jobs have been created. In fact, as the article points out over the past 12 months 542 thousand new jobs have been created. Not bad at all. To put it in perspective, for the United States, which has 12 times the population of Venezuela, to create a comparable number of new jobs it would have to create 6 million jobs in a year, something I’m pretty sure it has never done (Bush in his first term created a paltry 120,000 jobs).

Yet the article, in addition to its misleading title, has phrases like “where are the jobs” and “there are new jobs but they are few”. What is curious about this is that in general the opposition writes doom and gloom articles without giving any numbers to back up their assertions. In this case they do give numbers yet in their determination to say things are going badly (when clearly they aren’t) they just ignore them.

In another attempt to accentuate the negative the article then points out that while there were more than a half million new jobs about 350,000 young people enter the labor force each year so the “net” job creation of 150,000. Even the arithmetic on this isn’t right as the total number of new jobs was 542,000 so the number of jobs over and above new entrants in the work force was 192,000. That certainly seems like an excellent performance by any standard, unless they are somehow expecting Venezuela to become a first world country and have full employment in only a year or two.

Seeing as we are obviously dealing with good news here, not bad, lets leave the opposition negativity behind for a bit and look at some more numbers. First, the article came with this graph:

The graph shows month by month employment numbers from March 2005 to March 2006. The yellow represents private sector employment (the number in the yellow section is total private sector employment) and the red portion is public sector employment (with the number of public sector employees written by the side). On the bottom it gives the total number of new private sector jobs, 376,016, and the number of new public sector jobs, 166,452.

UPDATE

OilWars readers, we have a problem.

I'm pretty sure I made a big mistake. I did the post as if those numbers were all jobs in the formal sector of the economy - ie, they were what most of us would consider "real" jobs. However, in thinking about it I realized that with almost half the labor force in the "informal" sector that if all the jobs in the numbers above were in the formal sector there would then have to be another 7 or 8 million informal jobs making the total number of people working in Venezuela 18 or 19 million people out of a population of 25 million. That is an unrealistic number.

In checking the INE site more they give they give the over 15 population as 18 million with a total of 12 million people active in the labor force. Sooo, the numbers I have in this post almost certainly INCLUDE INFORMAL sector jobs (everyone including street vendors).

That of course changes everything including the conclusions of the post. So I'm going to remove the bottom half of the post. Please be aware even the conslusions in the first part of the post may now be incorrect and require revision once this is all sorted out. I will try to find the numbers on the percentage of people in the formal and informal sectors so that I can then recalculate the numbers and tell you how many formal jobs were created and how many informal ones were created. I will then re-do the conclusions as appropriate.

Something never did seem quite right about these numbers and I should have reviewed them better before posting. I apoligize for the error.

|

Tuesday, May 02, 2006

What exactly is unclear about this?

Sometimes people can writing about Venezuela can be a little thick. For someone reason they pretend they can figure out how popular Chavez is or that maybe he isn't that popular at all. Some are so clueless they somehow believe that only fourteen percent of Venezuelan's support the "government", whatever it is they mean by that.

Hopefully the following slide will help clearify things for those who are still confused:

These charts were created by the opposition polling firm Keller & Associates. The graph on the left hand side shows how many people have a favorable opinion of Chavez (in red) and the graph on the right shows how many people would vote for him if the elections were today (again in red). So 63% of Venezuelans hold a favorable opinion of Chavez as opposed to 24% who have an unfavorable opinion of him and in an election today 57% would vote for him as opposed to only 35% who would vote against him.

Clearly even this very anti-Chavez polling firm recognizes that Chavez is highly popular and would handily win any free elections. Any questions?

Now, while I'm on the subject of elections let me discuss one other matter. A big slogan among Chavez supporters these days is "Ten million votes for Chavez". In other words, the stated goal of the Chavez campaign is to get 10 million votes in the December 3rd election. If the polling numbers above are accurate and Chavez gets, say, 60% of the vote the 10 million goal won't be realized. At 60% and with about 14 millin registered voters even if all registered voters cast ballots Chavez still wouldn't get 10 milllion votes. The goal is almost certainly unrealistic.

Some opposition pundits like to pounce on how unlikely that goal is to be realized and act as if it shows that Chavez is crazy and unrealistic. Of course, it is the opposition pundits who are clueless.

Almost certainly Chavez knows very well that the 10 million goal is unlikely to be met. So why set it as a goal in the first place? Simple. In Venezuela it matters not only that you win the election (which Chavez is all but certain to do) but how much you win by. It doesn't matter when it comes to governing - Chavez will be president if he wins by 5 million votes or just 1 vote. But Venezuela has a key feature in its constitution, the recall referendum. Half way through Chavez's term the opposition could organize a recall referendum where if they get more votes than Chavez got in his initial election they can vote him out (assuming that there isn't an even greater number of people who vote to keep him). This gives any president a very big incentive to try to get as many votes as they can in their initial election. The more votes they get the harder it would be for opponents to vote them out in a recall referendum.

So while Chavez may not get 10 million votes he does want to get 7 or 8 million votes as opposed to 5 or 6 million. With 7 or 8 million it would be very hard for the opposition to revoke his mandate even if his popularity were to fall. How best to get those 7 or 8 million votes? Set high goals and even when you don't meet them you will still have enough votes to make your mandate unrevocable. After all Chavez wants another six years, not just another three years.

Even if our opposition friends are too clueless to figure it out the concept behind the "10 million votes for Chavez" slogan is pretty easy to understand. Its as easy as understanding the slogan "6 more years".

|

Hopefully the following slide will help clearify things for those who are still confused:

These charts were created by the opposition polling firm Keller & Associates. The graph on the left hand side shows how many people have a favorable opinion of Chavez (in red) and the graph on the right shows how many people would vote for him if the elections were today (again in red). So 63% of Venezuelans hold a favorable opinion of Chavez as opposed to 24% who have an unfavorable opinion of him and in an election today 57% would vote for him as opposed to only 35% who would vote against him.

Clearly even this very anti-Chavez polling firm recognizes that Chavez is highly popular and would handily win any free elections. Any questions?

Now, while I'm on the subject of elections let me discuss one other matter. A big slogan among Chavez supporters these days is "Ten million votes for Chavez". In other words, the stated goal of the Chavez campaign is to get 10 million votes in the December 3rd election. If the polling numbers above are accurate and Chavez gets, say, 60% of the vote the 10 million goal won't be realized. At 60% and with about 14 millin registered voters even if all registered voters cast ballots Chavez still wouldn't get 10 milllion votes. The goal is almost certainly unrealistic.

Some opposition pundits like to pounce on how unlikely that goal is to be realized and act as if it shows that Chavez is crazy and unrealistic. Of course, it is the opposition pundits who are clueless.

Almost certainly Chavez knows very well that the 10 million goal is unlikely to be met. So why set it as a goal in the first place? Simple. In Venezuela it matters not only that you win the election (which Chavez is all but certain to do) but how much you win by. It doesn't matter when it comes to governing - Chavez will be president if he wins by 5 million votes or just 1 vote. But Venezuela has a key feature in its constitution, the recall referendum. Half way through Chavez's term the opposition could organize a recall referendum where if they get more votes than Chavez got in his initial election they can vote him out (assuming that there isn't an even greater number of people who vote to keep him). This gives any president a very big incentive to try to get as many votes as they can in their initial election. The more votes they get the harder it would be for opponents to vote them out in a recall referendum.

So while Chavez may not get 10 million votes he does want to get 7 or 8 million votes as opposed to 5 or 6 million. With 7 or 8 million it would be very hard for the opposition to revoke his mandate even if his popularity were to fall. How best to get those 7 or 8 million votes? Set high goals and even when you don't meet them you will still have enough votes to make your mandate unrevocable. After all Chavez wants another six years, not just another three years.

Even if our opposition friends are too clueless to figure it out the concept behind the "10 million votes for Chavez" slogan is pretty easy to understand. Its as easy as understanding the slogan "6 more years".

|

Not brutal enough to win?

Now that the U.S. has been in Iraq for 3+ years and hasn't yet managed to subjugate those pesky Iraqis the recriminations have begun. A couple of weeks ago it was the generals turn as they took turns blaming everything on Rumsfeld. Now we have Shelby Steele blames it on the U.S. supposedly being too soft (?) due to white guilt (?!?!). It might be hard to believe that someone is actually saying this but read the following exerpts from todays Wall Street Journal for yourself:

Those with a strong stomach can read the entire article here.

All I can say is ignorance is bliss. This man either has no clue what he is talking about or simply pretends not to know so as to be able to make his point.

He thinks the U.S. took it easy on Vietnam? I guess he isn't aware that the U.S. dropped a greater amount of bombs on Vietnam than was used by ALL combatants in WWII. Think of the Blitz, the day in day out bombings on Germany, the firebombings of Dresden, Hamburg, and Tokyo, and of course the atomic bombs on dropped on Japan. Yeah, I'm sure Shelby Steele himself would have held up just fine under such a miniscule effort. Lets not forget that millions of Vietnamese were put in mini concentration camps called "Strategic Hamlets". Lets not forget the tens of thousands assisinated through the CIA led "Operation Phoenix". Lets not forget defoliating a very large portion of the country, turning it moon-like, with the highly toxic Agent Orange.

So when Mr. Steele says that the U.S. hasn't used "anything approaching the full measure of our military power" one has to wonder what more he thinks they could have or should have done? Given that insurgents, as Mao famously pointed out, are like fish in a sea of civilians, maybe he thinks the U.S. should have just killed every last civilian in Vietnam.

And now to Iraq. He thinks the U.S. is holding back there? First off, he needs to tell that to Bush who swears the military has everything in Iraq it has asked for an could possibly need. And again what does he think the U.S. should do? This is a guerilla war where civilians and insurgents are mixed together. Maybe he thinks the U.S. should just declare all Sunnis the enemy and carpet bomb areas where they live. Of course, the Shiites of Baghdad who seem to like that anti-American cleric Sadr aren't too cooperative. So I guess next they would have to carpet bomb the Shiite areas of Baghdad and kill the one or two million Shiites who live there too.

Maybe Steele's problem is that he spends to much time watching TV. Given that American television shows little of what is happening in Iraq he could be forgiven for thinking the U.S. isn't lifting a finger to defeat the insurgency. I bet though the Iraqis who are targets of daily U.S. airstrikes would have a different opinion. So too would those who have their towns and cities surrounded by barbed wire (Strategic Hamlet - II). And so would the people of Falluja who got to watch their city be destroyed so it could be saved (a saying coined in the Vietnam War no less).

Anyways, if Mr. Steele thinks the problem is the war just isn't violent enough maybe he could become a reporter embedded in a regular neighborhood of Ramadi for a couple of months. It might be an eye opening experience for him.

|

BY SHELBY STEELE

Tuesday, May 2, 2006

There is something rather odd in the way America has come to fight its wars since World War II.

For one thing, it is now unimaginable that we would use anything approaching the full measure of our military power (the nuclear option aside) in the wars we fight. And this seems only reasonable given the relative weakness of our Third World enemies in Vietnam and in the Middle East. But the fact is that we lost in Vietnam, and today, despite our vast power, we are only slogging along--if admirably--in Iraq against a hit-and-run insurgency that cannot stop us even as we seem unable to stop it. Yet no one--including, very likely, the insurgents themselves--believes that America lacks the raw power to defeat this insurgency if it wants to. So

clearly it is America that determines the scale of this war. It is America, in fact, that fights so as to make a little room for an

insurgency.

Certainly since Vietnam, America has increasingly practiced a policy of minimalism and restraint in war. And now this unacknowledged policy, which always makes a space for the enemy, has us in another long and rather passionless war against a weak enemy.

Why this new minimalism in war?

It began, I believe, in a late-20th-century event that transformed the world more profoundly than the collapse of communism: the world-wide collapse of white supremacy as a source of moral authority, political legitimacy and even sovereignty. This idea had organized the entire world, divided up its resources, imposed the nation-state system across the globe, and delivered the majority

of the world's population into servitude and oppression. After World War II, revolutions across the globe, from India to Algeria and from Indonesia to the American civil rights revolution, defeated the authority inherent in white supremacy, if not the idea itself. And this defeat exacted a price: the West was left stigmatized by its sins. Today, the white West--like Germany after the Nazi

defeat--lives in a kind of secular penitence in which the slightest echo of past sins brings down withering condemnation. There is now a cloud over white skin where there once was unquestioned authority.

...........................

This is a fact that must be integrated into our public life--absorbed as new history--so that America can once again feel the moral authority to seriously tackle its most profound problems. Then, if we decide to go to war, it can be with enough ferocity to win.

Those with a strong stomach can read the entire article here.

All I can say is ignorance is bliss. This man either has no clue what he is talking about or simply pretends not to know so as to be able to make his point.

He thinks the U.S. took it easy on Vietnam? I guess he isn't aware that the U.S. dropped a greater amount of bombs on Vietnam than was used by ALL combatants in WWII. Think of the Blitz, the day in day out bombings on Germany, the firebombings of Dresden, Hamburg, and Tokyo, and of course the atomic bombs on dropped on Japan. Yeah, I'm sure Shelby Steele himself would have held up just fine under such a miniscule effort. Lets not forget that millions of Vietnamese were put in mini concentration camps called "Strategic Hamlets". Lets not forget the tens of thousands assisinated through the CIA led "Operation Phoenix". Lets not forget defoliating a very large portion of the country, turning it moon-like, with the highly toxic Agent Orange.

So when Mr. Steele says that the U.S. hasn't used "anything approaching the full measure of our military power" one has to wonder what more he thinks they could have or should have done? Given that insurgents, as Mao famously pointed out, are like fish in a sea of civilians, maybe he thinks the U.S. should have just killed every last civilian in Vietnam.

And now to Iraq. He thinks the U.S. is holding back there? First off, he needs to tell that to Bush who swears the military has everything in Iraq it has asked for an could possibly need. And again what does he think the U.S. should do? This is a guerilla war where civilians and insurgents are mixed together. Maybe he thinks the U.S. should just declare all Sunnis the enemy and carpet bomb areas where they live. Of course, the Shiites of Baghdad who seem to like that anti-American cleric Sadr aren't too cooperative. So I guess next they would have to carpet bomb the Shiite areas of Baghdad and kill the one or two million Shiites who live there too.

Maybe Steele's problem is that he spends to much time watching TV. Given that American television shows little of what is happening in Iraq he could be forgiven for thinking the U.S. isn't lifting a finger to defeat the insurgency. I bet though the Iraqis who are targets of daily U.S. airstrikes would have a different opinion. So too would those who have their towns and cities surrounded by barbed wire (Strategic Hamlet - II). And so would the people of Falluja who got to watch their city be destroyed so it could be saved (a saying coined in the Vietnam War no less).

Anyways, if Mr. Steele thinks the problem is the war just isn't violent enough maybe he could become a reporter embedded in a regular neighborhood of Ramadi for a couple of months. It might be an eye opening experience for him.

|

Monday, May 01, 2006

Giving away the store.

While we are heavily into the subject of oil I thought I would talk about an excellent article written by Oliver Campbell over at Vheadline. It is about the recently terminated Service Contracts. I highly encourage people to go read it.

For those who don't remember these service contracts are private oil companies that were brought in by the old PDVSA management to run old oil fields. The companies produced the oil and gave it to PDVSA who then sold it on the international market. The thing was, PDVSA was obligated to pay these companies whatever they claimed their costs were - the so called cost-plus method. Whatever a company said were its costs, plus a built in profit, had to be paid by PDVSA, no questions asked. It's the same sort of system that Halliburton uses in Iraq to charge the army $8 for a gallon of gas it buys for $1.50 in Kuwait and thereby makes a fortune with.

Needless to say, the production costs were very high, up to $15 per barrel according to Mr. Campbell, compared to regular oil produced by PDVSA which costs only $4. As this oil displaced other oil Venezuela could have been producing at $4 per barrel this cost the country $11 ($15 - $4) X 500,000 barrels per day x 365 days per year = $2 billion dollars per year. Venezuela could certainly have done a lot of things with that $2 billion dollars per year. Fortunately, Venezuela has put an end to these arrangements by assuming control over all these oil projects. It will now be able to control all costs and hopefully ensure that they are not inflated.

Why did the old PDVSA management even set up these service agreements when they were costing the country so much money? Not even Mr. Campbell can figure that out as he indicates when he says "Why the investment was made in brown field sites-mature fields -- rather than green field sites-new production areas -- has never been clear to me, but it is now water under the bridge."

Clearly, whoever negotiated these deals didn't have Venezuela's best interests at heart. It certainly wouldn't surprise me if a some money from these private oil companies wound up in the bank accounts of some of the PDVSA executives who negotiated these deals.

And this is part of a rather disturbing pattern. For example in the heavy oil projects of the Faja del Orinoco the oil companies were only charged a measly 1% royalty. The excuse always given is that oil prices at the time were very low and it wasn't known if these projects would be profitable so they charged extra low royalties. Ok, that actually makes sense and I can understand it. But why were the contracts written so that if the price went up to 50, 60, or even 70 dollars per barrel the royalty stayed at the same lousy 1% royalty? Wouldn't anyone with a little bit of forethought been able to put in a "escalator clause" that would increase royalties as the price increase? One would think so.

Ultimately, Chavez had to unilaterally increase the royalties on these projects to keep all those billions of dollars from just flying right out of the country. And the opposition then attacked him for "not respecting contracts". But what I would like to know is who negotiated these horrible deals? Why didn't they put in simple clauses to protect Venezuela's financial interests? Whose interests were they acting in if not the country's? And, what would be most interesting to know, was there any double dealing or kickbacks involved? I've have no evidence to offer on that score. But considering how unjustifiably bad these contracts were for Venezuela one would be very naive not to realize something else was probably going on under the table. And maybe this helps explain why the old management went to the mat in their fight to try to keep PDVSA under their exclusive control.

|

For those who don't remember these service contracts are private oil companies that were brought in by the old PDVSA management to run old oil fields. The companies produced the oil and gave it to PDVSA who then sold it on the international market. The thing was, PDVSA was obligated to pay these companies whatever they claimed their costs were - the so called cost-plus method. Whatever a company said were its costs, plus a built in profit, had to be paid by PDVSA, no questions asked. It's the same sort of system that Halliburton uses in Iraq to charge the army $8 for a gallon of gas it buys for $1.50 in Kuwait and thereby makes a fortune with.

Needless to say, the production costs were very high, up to $15 per barrel according to Mr. Campbell, compared to regular oil produced by PDVSA which costs only $4. As this oil displaced other oil Venezuela could have been producing at $4 per barrel this cost the country $11 ($15 - $4) X 500,000 barrels per day x 365 days per year = $2 billion dollars per year. Venezuela could certainly have done a lot of things with that $2 billion dollars per year. Fortunately, Venezuela has put an end to these arrangements by assuming control over all these oil projects. It will now be able to control all costs and hopefully ensure that they are not inflated.

Why did the old PDVSA management even set up these service agreements when they were costing the country so much money? Not even Mr. Campbell can figure that out as he indicates when he says "Why the investment was made in brown field sites-mature fields -- rather than green field sites-new production areas -- has never been clear to me, but it is now water under the bridge."

Clearly, whoever negotiated these deals didn't have Venezuela's best interests at heart. It certainly wouldn't surprise me if a some money from these private oil companies wound up in the bank accounts of some of the PDVSA executives who negotiated these deals.

And this is part of a rather disturbing pattern. For example in the heavy oil projects of the Faja del Orinoco the oil companies were only charged a measly 1% royalty. The excuse always given is that oil prices at the time were very low and it wasn't known if these projects would be profitable so they charged extra low royalties. Ok, that actually makes sense and I can understand it. But why were the contracts written so that if the price went up to 50, 60, or even 70 dollars per barrel the royalty stayed at the same lousy 1% royalty? Wouldn't anyone with a little bit of forethought been able to put in a "escalator clause" that would increase royalties as the price increase? One would think so.

Ultimately, Chavez had to unilaterally increase the royalties on these projects to keep all those billions of dollars from just flying right out of the country. And the opposition then attacked him for "not respecting contracts". But what I would like to know is who negotiated these horrible deals? Why didn't they put in simple clauses to protect Venezuela's financial interests? Whose interests were they acting in if not the country's? And, what would be most interesting to know, was there any double dealing or kickbacks involved? I've have no evidence to offer on that score. But considering how unjustifiably bad these contracts were for Venezuela one would be very naive not to realize something else was probably going on under the table. And maybe this helps explain why the old management went to the mat in their fight to try to keep PDVSA under their exclusive control.

|

Sunday, April 30, 2006

Subversive Oil

Below I am posting an article called "Subversive Oil" by Bernard Mommer. It is a fairly long article and possibly not everyone will read it in its entirety. However, it is a very important article that explains not only why oil is so central to the ongoing battle between Venezuela and parts of the industrialized world (principly the U.S.) but why oil is so central to the bitter internal fight between the the government of Hugo Chavez and those opposed to him.

At every step of the battle between Chavez and his opponents, the Venezuelan state oil company, Petroleos de Venezuela SA, or PDVSA, has been in the forefront. Those who led PDVSA up until recently have been radically opposed to the Chavez government even going so far as refusing state control of their company and leading several oil production shutdowns, one of which coincided with the April 2002 coup against the government and another of which also sought Chavez's ouster.

Ultimately, Chavez won this confrontation and he has been successful in asserting control over the oil industry - much to the chagrin of the old management which is now unemployed and to the foreign oil companies which have lost a number of very favorable deals they used to enjoy. With the end of the conflict it is easy to forget what a central role the fight over oil policy played in creating an opposition movement to Chavez and its even easier to forget what what it was that brought the conflict about. While Chavez has consistently supported participation in OPEC to seak higher prices and maximizing government revenues from oil to fund social and development programs PDVSA's management had completely different ideas. They wanted to ignore OPEC, maximize production, minimize payments to the government and construct as large and independant of an oil company as possible. This clash of ideas brought about a serious conflict that dominated the first 5 years of the Chavez administration. The excellent article by Mommer, written in 2002, gives the best explanation of the origins of this conflict I have ever seen. So here it is (with key passages bolded - ow):

|

At every step of the battle between Chavez and his opponents, the Venezuelan state oil company, Petroleos de Venezuela SA, or PDVSA, has been in the forefront. Those who led PDVSA up until recently have been radically opposed to the Chavez government even going so far as refusing state control of their company and leading several oil production shutdowns, one of which coincided with the April 2002 coup against the government and another of which also sought Chavez's ouster.

Ultimately, Chavez won this confrontation and he has been successful in asserting control over the oil industry - much to the chagrin of the old management which is now unemployed and to the foreign oil companies which have lost a number of very favorable deals they used to enjoy. With the end of the conflict it is easy to forget what a central role the fight over oil policy played in creating an opposition movement to Chavez and its even easier to forget what what it was that brought the conflict about. While Chavez has consistently supported participation in OPEC to seak higher prices and maximizing government revenues from oil to fund social and development programs PDVSA's management had completely different ideas. They wanted to ignore OPEC, maximize production, minimize payments to the government and construct as large and independant of an oil company as possible. This clash of ideas brought about a serious conflict that dominated the first 5 years of the Chavez administration. The excellent article by Mommer, written in 2002, gives the best explanation of the origins of this conflict I have ever seen. So here it is (with key passages bolded - ow):

Subversive Oil

By Bernard Mommer

The IV th Republic, as the political regime prior to 1998 has been posthumously baptized, was torn apart by two subversive movements, one in the military and the other in the national oil industry. The story of military subversion is well known, but not the story of subversion in the national oil company, Petróleos de Venezuela, Sociedad Anónima (PDVSA). After nationalization of the oil industry in 1976, PDVSA became something of a ‘state within a state.’ Its Venezuelan executives shared the outlook of international oil companies, for whom they had worked for many years. Furthermore, successive governments of AD and Copei during and after the boom period of the 1970s failed to create a new efficient fiscal and regulatory system, at the same time that they implemented disastrous developmental policies characterized by poor planning and waste. This ultimately led, after 1989, to the ‘oil opening policy’ (Apertura), which put Venezuelan oil policy on a path toward re-privatisation of the industry. It also put Venezuelan oil policy on a path toward minimization of fiscal oil revenues. President Hugo Chávez arrested the momentum, but the direction of oil policy remains very divisive not only in Venezuelan society but within the Chavista movement as well.

There are some remarkable parallels between the ways each of these two subversive movements arose. Chávez founded his movement around 1982; PDVSA executives embarked on their strategy of internationalisation in 1983. Internationalisation was devised by PDVSA to create a conveyor belt to relocate profits out of the reach of the government through transfer pricing (i.e., the price charged by one affiliate to another affiliate in the accounts of the mother company). Both PDVSA executives and Chávez and his followers believed that the current political regime was beyond repair. In the judgment of both groups of conspirators, the squandering of oil revenues played a crucial role in this steady decline. Both the military and PDVSA took a moralizing approach, blaming corruption for the crisis. The military dreamed about saving the country; PDVSA executives dreamt about saving the oil industry from the country.

The Aftermath of Nationalization

Nationalization in Venezuela in 1976 was the outcome of a long-term policy of maximizing fiscal revenues collected from oil exports. For the last two years prior to nationalization, for every dollar of oil exports, the government collected 80 cents in rents, royalties and taxes. By 1970 the government had asserted a right to levy export taxes at its sole discretion, effectively leaving the companies with nothing but a regulated profit.

The foreign companies were losing control of their businesses. They could no longer maximize their own profits because additional earnings were subject to appropriation by the government via the export levy. They hardly resisted when President Carlos Andrés Pérez nationalized the industry on January 1, 1976. However, only a few years after Pérez left office, his plans to create ‘Great Venezuela’ and develop the country through an overnight program of industrialization had failed disastrously. PDVSA then began to develop its own ‘hidden agenda’ to break away from state control.

Nationalization changed ownership of the oil industry but not, for the most part, management. Prior to nationalization, there were three major foreign companies operating concessions in Venezuela: Exxon, Shell, and Mobil. Over the years, partly in response to political pressure, the companies selected Venezuelan nationals for executive positions. These executives accepted nationalization in 1976 only because they had no choice. Once they were in charge of PDVSA, their prime objective was to displace the Ministry of Energy and Mines (MEM), the traditional steward of the ‘landlord’ state. The company certainly did not have in mind the maximization of fiscal revenues (royalties, income taxes, and export levies). On the contrary, once the ‘Great Venezuela’ of Pérez had crashed, PDVSA sought to limit its own fiscal obligations. The failures of development policy only reinforced the company’s determination. Why generate fiscal revenues that would be squandered anyway? Why maximize profits when the state would inevitably siphon them into the Treasury? Instead, the company concentrated on its own agenda: the development of the oil sector in real terms, maximizing volume, turnover and sales (not profits) in all the segments of the industry, both at a national and an international level, at the same time that fiscal revenues were disregarded. PDVSA thus undermined nationalization and paved the way for the return of private investors. By 1989, when Pérez was back in office and implementing his ‘Great Turnabout,’ which included the Apertura to foreign capital, an alliance emerged between the national oil company, on the one hand, and the international oi1 companies and the consuming countries, on the other. Contrary to what is widely believed, outright privatisation was not the top priority of this alliance. The international companies and the consuming countries were primarily worried about dismantling the political and institutional framework that had led to nationalization in the first place. That is, they wanted to reduce the power of the state to maximize its share of oil revenues and to control prices and supply. Their strategy was to put in place a new governance structure designed to prevent the government (in the form of the MEM) from ever again pursuing a strategy of maximizing fiscal revenues. Only then would full-scale privatisation move to the top of the agenda (Mommer 2002a). In the meantime, foreign capital in association with PDVSA became again a major producer in Venezuela. At present about 25 percent of Venezuelan oil is produced in this form. According to the contracts signed under the terms of the post-1989 period of Apertura, this percentage will increase to over 40 percent by the year 2010 (Mommer 1998).

When foreign companies controlled oil production and set prices, the state was naturally vigilant over their operations. After nationalization, vigilance seemed unnecessary. Worse, in response to the explosive growth of oil prices and, hence, fiscal revenues in 1973/74, the newly elected Congress passed an Enabling Law that gave President Pérez complete liberty to spend the money at his discretion, in accordance with his vision of a ‘Great Venezuela.’ In other words, Congress shirked its most elementary and essential task: the control of public finances. Pérez launched a series of huge investment projects, nationalized the iron industry, and forced foreign capital out of many other key economic areas, such as banking and chains of retail commerce, while a system of state enterprises arose in the heart of the new economy. Simultaneously, private Venezuelan enterprise was marginalized. Fedecámaras, the peak organization of the business community, had grown on the eve of nationalization into a politically (even economically) relevant body. Once the foreign members of the organization left, among them the international oil companies, what remained was only a shadow of its former self.

During the post-nationalization years, the government – or more precisely, the President – appeared to hold all the trump cards. Fiscal income from oil increased from $1.4 billion in 1970 (about ten percent of GDP), to $9 billion in 1974 (a staggering 40 percent of GDP). Such an influx relative to the nation’s productive structure was far beyond the absorptive capacity of the economy. Worse, in the rush to build his ‘Great Venezuela’, the Pérez government contracted international loans, in effect spending future oil revenues on top of huge current earnings. With foreign enterprises leaving, the capacity of the economy to absorb capital was actually falling. The country did not need the money of foreign investors at the time, but it certainly needed their managerial skills in order to bring its ambitious investment plans to fruition.

Thus, at the end of the day, the government, isolated and helpless, was to drown in its financial wealth. Political clients, not citizens or business partners, surrounded the state, which was supposedly possessed of magical powers to develop the economy (Coronil 1997). This was a recipe for disaster. Congress never recovered control over public finances; nor would the private sector ever recover its proper role. Only foreign creditors were eventually able to force the government and state enterprises to change policies, and then with their own particular agenda. After 1983, there was only one strong and working institution left standing within the national economy: PDVSA. The lack of checks and balances was to become of consequence for this company as its virtually autonomous status allowed it to go ahead with its own particular agenda.

The Internationalisation Policy of PDVSA and Transfer Pricing

PDVSA’s first response to the implementation of exchange controls in 1983 was its internationalisation policy (Boué 1997). In a last minute and unsuccessful effort to contain the developing foreign debt and currency crisis, the government fell back on the investment fund of the company, totalling about $5.5 billion, which it had been allowed to accumulate during the years of high prices. At the same time, however, oil price hikes led to sharply falling demand and to ever more restrictive OPEC quotas, which left the company no outlets for new investments in Venezuela. In order to prevent the government from appropriating its liquid assets again, PDVSA decided not to have any.

As investing in the country was not feasible, accumulated profits had to be spent abroad. But where could the money be spent at a time when production was to be cut? The answer was PDVSA’s internationalisation policy. In 1983 PDVSA bought its first share of a foreign refinery (VEBA) in Germany. At the time, the company argued that this refinery would provide a market for Venezuela’s heavy crude, which were difficult to market otherwise. To this very day, however, the German refinery has never processed heavy crude. Over the years, PDVSA has supplied VEBA lighter crude oil that could have been easily placed on the world market anyway. Furthermore, PDVSA has sold the oil to its European interests at substantially discounted ‘transfer’ prices, thereby shifting a portion of its profits beyond the reach of the Venezuelan government (Guevara 1983).

Some politicians belonging to Acción Democrática (AD) – Rafael Guevara and Celestino Armas – became aware of the maneuver and raised the alarm in Congress, but to no avail. On the contrary, the issue of transfer pricing was settled entirely in favor of PDVSA when the government of President Jaime Lusinchi (1984-1989), himself a member of AD, decreed that the company would henceforth set its own prices. This decree gave the internationalization policy a new boost. Subsequently, PDVSA shifted its attention to the U.S. market, where it operates under the name of Citgo. Once again PDVSA bought systematically into refineries, signing long-term supply contracts and granting substantial discounts to its new affiliates for the purpose of transferring significant portions of its profits abroad. In order to ensure that this money was definitively beyond of the reach of the government, the contracts were used as collateral to secure foreign loans. Thus, before Chávez or any other future government can change the terms of the contracts between PDVSA and its own subsidiaries, it will have to cancel all of PDVSA’s debts, which now total nearly $10 billion. (a possible reason why the government has now been paying down PDVSAs debt? - ow)

This goal of shifting profits abroad is the real motive for internationalization and explains the unchecked growth of PDVSA’s international refinery network, presently capable of handling about two million barrels per day (b/d), and its retail business, consisting of over 14,000 gasoline stations in the U.S. By the second half of the 1990s, PDVSA was remitting through transfer pricing an average of about half a billion dollars annually from its domestic accounts to its foreign affiliates (Mendoza Potellá 1995; Boué 2002). For eighteen years after the beginning of internationalization, the foreign affiliates of PDVSA never paid dividends to the holding company in Caracas. But earning profits for the country was never the objective of the policy in the first place. In December 2001 the Chávez government obliged them to pay dividends for the first time.

OPEC Quotas and PDVSA

In the early 1980s, after world-wide demand began to flag, OPEC created a quota system in an attempt to maintain high prices. Both PDVSA and the financially troubled Venezuelan government started to look for ways to minimize the impact of, or to bypass, these quotas. Thus, in 1983, Venezuela began to measure production subject to quotas at refinery gates and ports of exports rather than in the storage tanks of the producing fields (as usual everywhere in the world for the purpose of royalty payments). At the time, PDVSA promised MEM that it would install modern meters in the fields. This never happened, despite the repeated and formal protests of the Ministry over the next fifteen years. As a result, MEM effectively lost its ability to monitor and control levels of production of crude oil and natural gas, giving PDVSA significant leeway to minimize its royalty payments.

PDVSA looked for other ways to manipulate the definition of crude oil subject to OPEC quotas: increasing production of the extra-heavy (i.e. heavier than water) crude of the Orinoco Belt, by far the largest reserves of its kind in the world. The company argued that Orinoco deposits – which are processed into a product called “Orimulsión” – did not fall under the definition of crude oil. (This assertion is technically correct, as they do not constitute a liquid at normal temperatures.) Therefore, PDVSA argued, the Orinoco Belt should be classified as ‘bitumen’ and, hence, not be subjected to OPEC quotas. In 2000, PDVSA produced approximately 100,000 b/d of Orimulsión derived from about 70,000 b/d of extra-heavy oil – and it planned to triple this figure in the near future.

After 1989, with the initiation of Apertura, PDVSA entered into joint ventures with foreign companies in four integrated projects for the production of synthetic crude (‘syncrude’) from the same extra-heavy grades of oil. PDVSA planned to increase production of syncrude to 1.2 million barrels per day (requiring about 1.5 million b/d of extra-heavy crude) by the year 2010. Like Orimulsión, syncrude is subject to lower levels of taxation (one percent royalty and 34 percent income tax). If this oil were included in Venezuela’s OPEC quota, it would displace more highly taxed conventional crude from PDVSA’s exports. Calculated on prices in the first half of 2001, the loss in revenue for the government would be as high as ten dollars per barrel.

The rush into the Orinoco Belt was justified during the years of Apertura with the argument that it was not subject to OPEC quota. A more far-reaching purpose, however, was to force Venezuela into conflict with OPEC, possibly forcing it out of the organization, by committing the country once and for all to an oil policy predicated on high volumes and low prices. This strategy is consistent with goals of the International Energy Agency (IEA), which was founded by the consumer countries in the early 1970s in order to confront OPEC. Indeed, Andrés Sosa Pietri, PDVSA president in the early 1990s, has consistently advocated Venezuela’s withdrawal from OPEC and its membership in the IEA.

The Chávez government had to confront this situation. The practical compromise has been to include syncrude in the OPEC-quota, but not Orimulsión. Nevertheless, the recent cuts in production (2001) are causing very substantial and disproportionate losses in fiscal revenues. Lower prices, however, would even be worse. Leaving OPEC is not an option the Chávez government is about to consider.

Apertura in the Context of Neoliberal Policy after 1989

In 1988, Pérez was elected President for a second term, but he faced a totally different situation than fifteen years earlier. Notwithstanding the oil price collapse in 1986, the preceding administration of Jaime Lusinchi had carried on spending as usual. Thus, at the time Pérez took office in February 1989, the Central Bank was left without foreign reserves. Pérez immediately accepted agreements with the International Monetary Fund and the World Bank that included an increase in domestic gasoline prices. Pérez now promised a ‘Great Turnabout,’ which came as a surprise to the Venezuelan people who had never been told that there was anything fundamentally wrong with the economy in the first place. Indeed, an increase in gasoline prices, reflected in higher transport fares, sparked the Caracazo of the week of February 27, 1989.

Pérez also began to allow private investors back into the Venezuelan oil industry. As part of the opening of the Venezuelan economy to the outside world, PDVSA was put in charge of the Apertura Petrolera. The role of MEM, which prior to nationalization had overseen contractual and fiscal relations with oil companies, was reduced to rubber-stamp status. PDVSA preached the gospel of competitiveness to the government, arguing that royalties and taxes would have to be lowered to attract foreign investors. The government followed its advice. In addition to the aforementioned joint ventures for extra-heavy oil, PDVSA opened ‘marginal’ fields producing conventional grades to private investments (arrangements known as ‘operating services agreements’), which by 2001 accounted for about 500 thousand b/d. The greater part of this oil is not subject to OPEC quotas, and is low-taxed. In the process, the higher-taxed production of PDVSA was cut. Moreover, in these agreements PDVSA acts as an ‘umbrella’ shielding private capital from the state, guaranteeing that the state company will pay an indemnity to its ‘partners’ if there is any ‘detrimental’ legislative change. These contracts were made subject to international arbitration, an arrangement Venezuela had never accepted until then. Last but not least, in case of disputes PDVSA exports are subject to sequestration. Nevertheless, Congress approved all of them.

Having acted on behalf of private foreign investors, PDVSA also insisted on lower taxation for itself as well. Its best opportunity came in the chaotic year of 1993. President Pérez was removed from office, mainly as a consequence of the two coup attempts in 1992. A very weak provisional government took over and accepted a new Income Tax Law with generous allowances for inflation. In addition, the government’s power of discretion over the export levy, which had been created in 1970 to allow capture of extraordinary profits in periods of high prices, was phased out, and finally abolished in 1996. These measures contributed to a significant drop in fiscal revenue from oil.

Statistics put in evidence the government’s declining share of oil income. In 1981, gross income from hydrocarbon production, including refining, peaked at $19.7 billion. In 2000, a new peak was reached of $29.3 billion. Nevertheless, in 1981 PDVSA paid $13.9 billion in fiscal revenues, but only $11.3 billion in 2000. In other words, for every dollar of gross income, PDVSA paid 71 cents to the government in rents, royalties and taxes in 1981, but only 39 cents in 2000. Moreover, government revenue derived from syncrude production coming on stream in the near future will be substantially lower. Thus the trend of falling fiscal revenue is bound to continue.

The End of the IV Republic

In the general elections of 1998, the two subversive movements – one led by PDVSA executives and the other by elements in the military – confronted each other (Arrioja 1998; see also Hellinger’s chapter in this volume). PDVSA had become powerful enough to play a high-profile political role, and its leadership was convinced that the time had come to implement fully its liberal agenda. Liberalism, in the context of international oil politics, is to be understood in its original revolutionary conception based on replacing the visible hand of the landlords with the invisible hand of the market. Like their forbearers, today’s liberals would reduce the power of ‘landlords’ (i.e., sovereign nation-states) to restrict access of capital (i.e., international corporations). It is this restriction on access that is the basis for the landowner, private or public, to collect a rent. The goal for liberals is ‘land to the tiller,’ or, to be more precise, ‘minerals to the miner’. They want natural resources considered a free gift of nature, freely available to the producing companies and consumers. ‘Free’ thus refers to elimination of the obligation to pay rent.

Is Venezuelan oil a free gift of nature to international producing companies and foreign consumers? PDVSA’s liberal agenda answers this question with an unqualified ‘Yes.’ This view is antithetical to everything that Venezuelan oil nationalism has ever achieved, including the founding of OPEC and nationalization. It is imperialism in its most ancient of definitions: the conquest of foreign land and its mineral resources.

Not surprisingly, PDVSA enjoyed strong backing from the governments of the developed consuming countries as well as international oil companies. Their experts designed the changes in Venezuela’s fiscal system following the example of the British North Sea, the most liberal oil-producing region in the world in terms of allowing capital free access to natural resources. PDVSA thus came to play an important role in bringing the country into a global world where the territorial state is supposed to have disappeared.

Venezuela joined the World Trade Organization (WTO) without reserving any special rights regarding its oil (in contrast to Mexico). According to the vision adopted by PDVSA, natural resources are an advantage in attracting investment, more than it is a leverage to promote national development. In contrast to earlier periods, the nation no longer should require foreign investors to transfer technology or to purchase needed components from national producers.

PDVSA argued that any insistence upon measures to maximize oil revenue would obstruct the free flow of much needed investment. If the paramount goal of the state as owner of natural resources is to attract foreign investment, then the more investment the better. Hence, the lower the levels of taxation and the more flexible the fiscal regimes, the better. Consequently, the fiscal revenue maximization policy of the past was replaced with a policy of minimization. In February 1998, it seemed very likely that independent candidate Irene Sáez would easily win the elections and that PDVSA would play a central role in her government. Venezuela was on the brink of becoming Latin America’s model pupil of natural resource-liberalism and globalization. A nation that had played a key role in founding OPEC, the epitome of an organization dedicated to strengthening national sovereignty over exhaustible natural resources, was now to become a leader in dismantling what had been achieved within the OPEC framework.

Then, to spoil it all, Chávez turned up as a popular candidate. The small political groups that had opposed PDVSA’s liberal oil policy supported Chávez, although he had no specific agenda for oil beyond a more or less vaguely formulated commitment to follow a nationalistic approach. He and his followers were still unaware of subversive oil, but one thing was certain: his victory would at the very least slow down the implementation of the liberal agenda. And there was nothing the PDVSA leadership and the traditional political parties could do about it. Desperate, AD and COPEI joined in a last minute common electoral front, but to no avail. During the electoral campaign Chávez moved steeply and inexorably upward in the opinion polls as world petroleum prices moved downwards. PDVSA had been publicly boasting about never again cutting a single barrel of output. It was already no longer a question of extra-heavy oil not being subject to OPEC quotas, but to put an end to the quota system per se. Even the formidable public relations machinery of PDVSA – which contended that lower prices would secure more markets for Venezuela with the overall balance being positive – could not convince the country that falling prices was good news, try as hard as it might.

The V Republic

Hugo Chávez took over the Presidency in February 1999 in the middle of the worst price collapse in world petroleum markets in over fifty years. The situation, however, soon turned around radically and favorably, and there is no doubt that the Chávez government played a crucial role in the recovery. The last government of the ancien régime had come close to abandoning OPEC. PDVSA’s publicly heralded policy to maximize volume in disregard of OPEC quotas and price objectives was a major cause of the 1998 oil price crisis. Even the Caldera government, which had shown little resistance to PDVSA initiatives, had to reverse its policy, and in its last months agreed to new OPEC quotas, but at home a weakened MEM was unable to impose them. Had it not been for the victory of Chávez, PDVSA would have been transformed into little more than a licensing agency, and the privatization of its subsidiaries would have been the inevitable outcome.

President Chávez and his oil minister, Alí Rodríguez Araque, reversed the policy of spurning OPEC quotas, and began to defend prices. Together with Mexico and Saudi Arabia, Venezuela successfully promoted a new understanding on quotas between OPEC members and other exporting countries. Venezuela also promoted and hosted in September 2000 the second summit meting of OPEC heads-of-state. Prices recovered.

The gross proceeds from hydrocarbon exports peaked at $29.3 billion in 2000. However, price was only one aspect of oil problems confronting Chávez. His other task was to find a way to arrest the fall in fiscal revenues due to long-term structural and legal problems that may also be extremely difficult to redress.

Re-Gaining Control of the Nation’s Natural Resources

As soon as Rodríguez Araque took over the Ministry in 1999, he began to implement a policy aimed at asserting control over natural resources and fiscal policy. Rodríguez Araque opposed the previous government’s decision to leave the negotiation of upstream contracts to PDVSA. At the heart of the issue of formulation of fiscal policy is the question of royalty, which is the most secure form of revenue for the owners of natural resources (Mommer 1999). The virtue of royalties is the ease with which they can be collected, as there are only two variables involved: volumes and prices. Unlike in the case of income tax, they are immune against the manipulation of production costs. For that very reason PDVSA wanted the royalty scrapped; in its place it was willing to accept increased income tax rates on highly profitable fields (Espinasa 1998). The problem with this proposal is that effective collection of income taxes is more difficult to achieve, especially for a state whose bureaucratic capabilities were declining. The Venezuelan government, as we have seen, was struggling just to measure and control volumes and prices. Although only partially successful, MEM, under the direction of Rodríguez Araque began to monitor the volumes produced in some fields and rejected ‘transfer prices’ (prices charged by PDVSA to its foreign affiliates) as the basis for calculating royalty payments. PDVSA was thus obliged to pay royalties on the basis of international market prices. However, the Ministry of Finance continued to accept transfer prices in calculating what the company had to pay in income taxes.

Under Rodríguez Araque, MEM also redesigned the terms of contracts for natural gas, which had been in preparation when the new government took over. A new Natural Gas Law, enacted in 1999, established a minimum royalty rate of 20 percent, and in practice they reached as high as 32 percent. At the same time, this sector was completely opened up to private investors. A new Organic Law of Hydrocarbons, enacted in 2001 – drafted by Álvaro Silva Calderón, who succeeded Rodríguez Araque as Minister (Rodríguez Araque became Secretary General of OPEC) – establishes a minimum royalty rate of 30 percent for oil (with some downward-flexibility to 20 percent for conventional oil, and to one-sixth in the case of extra-heavy oil). At the same time, the law lowers income tax on conventional crudes from 59 per cent to 50 per cent; for extra-heavy oil the tax rate remained at 32 per cent. All in all, there is an increase in taxation based on the increase of royalty rates. The law also reserves for the state majority shareholding in any joint venture for exploration and production.

The new Hydrocarbon Law will apply only to new licenses, concessions, and contracts. Under existing arrangements, private companies will continue to pay less in royalties and taxes for access to Venezuela’s highly profitable petroleum deposits than they pay for leases in marginal fields in the U.S. Indeed, since 1993, even PDVSA pays less in royalty and taxes than private oil companies in Alaska (Mommer 2001b).

Controlling PDVSA

The Ministry under Rodríguez Araque and Silva Calderón hoped to force PDVSA to spend less and to pay more taxes. This goal will not be easy to achieve. In late 2001, the Ministry remained in the hands of officials belonging to two small parties, Patria Para Todos (PPT) and Movimiento Electoral del Pueblo (MEP). Their weak status was further eroded when both parties lost their small representation in the National Assembly in the general election of 2000. Hence, the Ministry lacked political support in the legislature, whereas PDVSA continued lobbying Chávez’s MVR. In November 2000, PDVSA convinced the Committee of Energy and Mines of the National Assembly to declare publicly its intention to promote legislation in favor of lower royalty rates. This was the very day an Enabling Law was approved, according to which the government was authorized to do exactly the contrary – to raise royalties. The latter position prevailed at the governmental level, but it is unclear whether it will be defended in the National Assembly. PDVSA’s president General Guaicaipuro Lameda publicly criticized the new Organic Law of Hydrocarbons for increasing royalties. In February 2002, President Chávez dismissed Lameda and appointed in his place Gastón Parra, a University teacher with a strong nationalist background in line with the MEM.

At first glance, the new Constitution also appears to reinforce sovereign ownership of oil, but in reality the liberal agenda of PDVSA fared well in the Constituent Assembly. According to the new Bolivarian Constitution, PDVSA, which is in reality a holding company, cannot be privatized, but this restriction does not apply to its affiliates. PDVSA, unlike its affiliates, does not produce a single barrel of oil. Most Venezuelans believe that the Bolivarian Constitution has actually strengthened nationalization, but ironically it may have paved the road for the transformation of PDVSA into a liberal licensing agency for a private industry.

In the year 2000, costs and expenditures of the company increased by a staggering 44.6 percent as reported officially by PDVSA. This is mainly explained by the Apertura’s operating services agreements with private companies, which were designed to be flexible enough to allow the company to produce very high-cost (and low-taxed) oil. PDVSA’s costs now passed the ten-dollar-per-barrel mark. PDVSA also stuck to its old policy: whenever OPEC quotas limit the possibilities of investing its revenue in Venezuelan oil production, it is spent abroad. PDVSA continues to expand into the refining and retail business, but now all over Latin America and not just the U.S. and Europe.

The two businesses of oil – the business of the investor, on the one hand, and the business of the natural resource owner, on the other – were easy to distinguish as long as the first was in the hands of foreign investors and the latter was vested in the government of the nation. Institutionally, MEM represented the latter. With nationalization in 1976 the two businesses became completely confused. If anything, nationalization required stricter and more clear-cut fiscal control on the part of the state, but the opposite happened. Fiscal control became more and more relaxed over the years, and control of the company by its single shareholder – the state – really never worked. The Ministry wields no power of its own over the company because the President appoints all of its directors. They are peers of the Minister. The only real shareholder is the President, with virtually no institutional or structural support. PDVSA always advanced the same argument for relaxation of state control: the need to strengthen the national oil company, which was the pride of the nation, and to enhance its competitiveness. In fact, the company acted according to the maxim that it was always better to spend a dollar than to pay that dollar in taxes. Investment was a matter of principle, not a question of maximizing profits. Greater production at lower prices was always considered a better option than defending prices by limiting supply. Hence, PDVSA, contrary to its public claims, does not act as a commercial enterprise. It does not maximize profits (which might be converted into dividends for the government), but rather volumes all the way down the line, from production to refining, transport and retail. Along the way it clears away profits from its Venezuelan accounts through the practice of ‘transfer pricing’ (Boué 2002).

To control PDVSA effectively again, the new Hydrocarbon Law requires the company to present accounts properly, separated according to its different activities. It should thus become evident where profits are made, and where they are not, a sine qua non for any rational oil policy. PDVSA’s opaque accounting methods are designed to hide discounts in their transfer prices as well as their deliberately inflated cost. For example, PDVSA transfers an important part of the costs of its internationalization program, including the service of its ten billion-dollar debt, to its Caracas headquarters. In many ways PDVSA has even lost control over itself, most notably regarding its internationalization policy. The company has structured itself in the course of many years to prevent its shareholder (the state) from interfering. In doing so, it has made itself increasingly difficult to steer.

Concluding Remarks

PDVSA turned its back to nationalization as early as 1983 with its policy of ‘internationalization’. By 1989, it actually no longer claimed to be a national but a global company. Indeed, the gist of its message is that globalization requires elimination of national barriers to investments in the area of natural resources. As odd as it may seem, there is strong public support for this approach – whereby PDVSA aligns itself with the international oil companies and consumer countries – among Venezuelan professionals and the middle class in general. Until nationalization, it was clear to all Venezuelans that higher fiscal revenues in oil generated material well-being for the entire population. After nationalization, however, the validity of this thinking was questioned due to the appalling performance of the political and economic system. Hence, to bring PDVSA again under fiscal control may be much more difficult a task than one might imagine.

A large part of Venezuela’s professional classes support PDVSA’s reasoning that higher volumes are more important than defense of prices. Completely in the dark about oil policy (Baptista and Mommer 1987), and under the influence of PDVSA’s public relations department, they are not likely to challenge the neoliberal logic. They seek a decent professional working environment in a modern (private) company and, of course, a decent salary, all of which the IV th Republic was no longer able to offer. They do not believe that the V th Republic can offer it to them either. They thus believe that privatizing PDVSA would better their prospects. At a popular level, however, the outlook is quite different. The underprivileged sectors of the population fear that they will be excluded and left behind if the nation were to privatize the oil industry. Hence, oil policy has been caught up in the general process of polarization that characterized the country in early 2002.

The whole country has been spellbound since nationalization. One government after another has concentrated all of its attention on PDVSA and forgotten about the MEM. One President after another has spent many hours in PDVSA; not one has set foot in the Ministry of Energy and Mines. The latter was progressively dismantled, and most of its best-qualified personnel lured away to PDVSA. MEM has fallen prey to physical decay, its workers impoverished together with other public employees. PDVSA moved to fill the gap in the heyday of Apertura Petrolera by paying a monthly bonus to employees of the Ministry working in the hydrocarbon section (a continuing practice), effectively doubling their paltry salaries. Today the budget of PDVSA represents no less than 40 percent of public spending. PDVSA’s financial leverage extends deep into the world of politics, journalism and public opinion making in general, where people are easily convinced to work for PDVSA as part-time public relations consultants -- not to speak of the international consultant companies which have established themselves in Caracas after the initiation of Apertura Petrolera in 1989.

In short, PDVSA was transformed into a ‘state within the state’ a long time ago, becoming more powerful the more the country became impoverished. Under the Chávez government this trend has been reversed; as a result, the country has made significant progress in recovering control over its most important natural resource. In achieving this goal, however, the government failed to win over PDVSA’s top personnel. Today, company executives are no more willing to co-operate with the Vth Republic, as they were with the IVth Republic.

These conclusions were fully confirmed by the April 2002 events in Venezuela. The failed coup left behind a highly fluid situation, and it left unsettled the ultimate fate of oil policy. Alí Rodríguez Araque, who at the time was serving as Secretary General of OPEC, agreed to take over the presidency of PDVSA as a candidate of a political consensus -- at least as far as a political consensus was possible in Venezuela at that time.

Rodríguez faced the task of carrying out a systematic reform of the oil sector for the first time since nationalization. The Chávez administration will have to demarcate the three roles of the state, politically and institutionally: as the sovereign generally, as the owner of the natural resource, and as the sole shareholder of the company. At the same time, it will have to define a new role for the private sector, national and foreign. Given the instability of Venezuelan politics, success remained very much in doubt.

|