Saturday, January 12, 2008

Stuck in reverse when they should be in overdrive

The final number for automobile sales in Venezuela are in and 2007 was another record year - by a mile.

Auto sales skyrocketed by more than 43% to 491,000 units. This could be viewed by some as a sign of economic strength.

Certainly it is one more indication of what we already knew, that the Venezuelan economy is booming.

Still, some, such as development economist Ha-Joon Chang, would point out that spending on luxury consumer items such as private automobiles is wasteful and detracts from the investment a poor country desperately needs in order to grow. That alone is reason enough to not feel like celebrating these numbers.

But the worst and most unforgivable aspect of all this is to be found in the detail of the numbers. It turns out that of all those cars only 155,000 were produced in Venezuela and that is actually a decline of 1.5% from the previous year. Further, exports suffered an even more precipitous decline of 38%, declining from 22,000 to a paltry 13,000 units.

So while the Venezuelan auto market is experiencing an unprecedented boom Venezuelan automobile production is actually declining!!!

Now I suppose someone could try to make the argument that it doesn't matter how many actual cars are manufactured in Venezuela - that maybe now more components used in those cars are made in Venezuela and that therefore the Venezuelan automobile industry is in better shape after all.

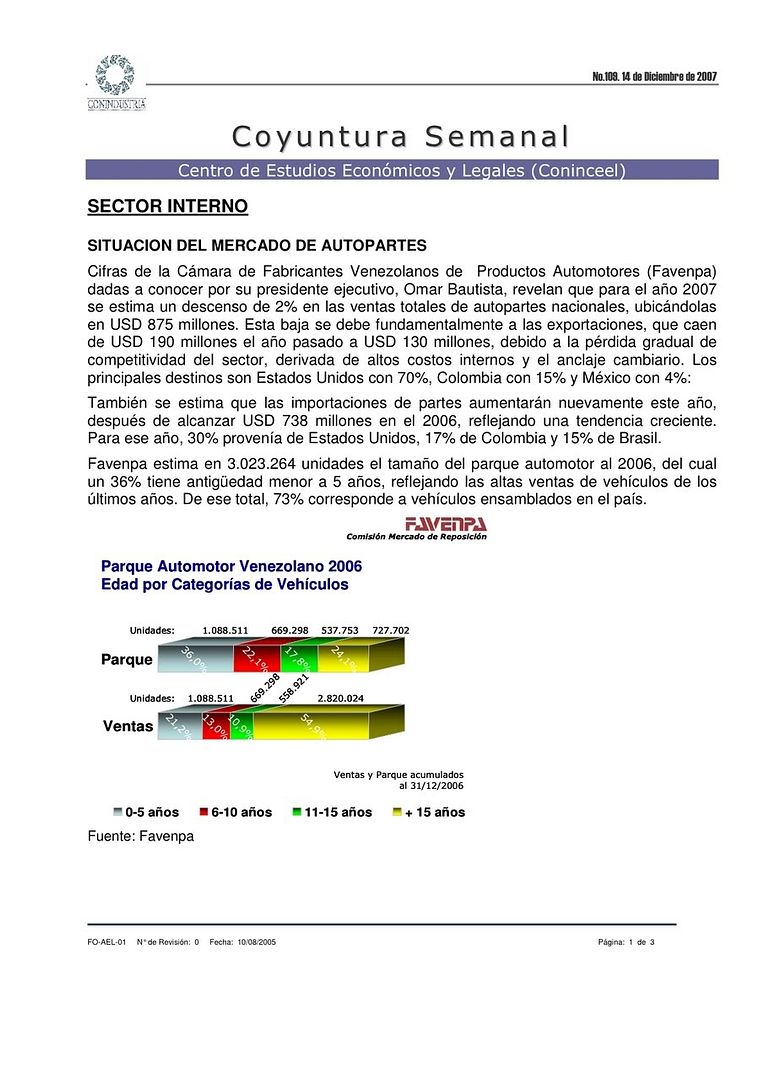

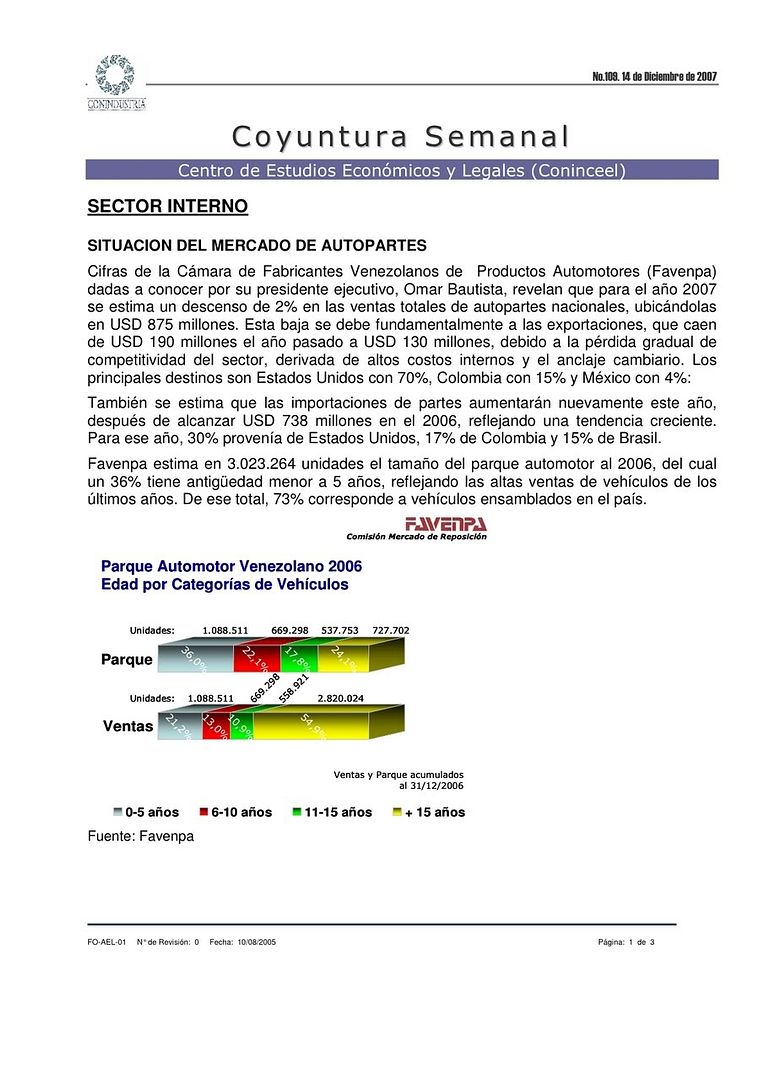

Unfortunately there is no luck there either. According to Coindustria and the Venezuelan Automobile Manufacturer Association Venezuelan production of auto components declined 2% last year:

So on every front this key industry is going backwards at the same time that its market is booming. If this isn't a clear indication of the fact that something is wrong with Venezuela's economic policies I don't know what is.

Of course, as readers of this blog will know, it's not that difficult to figure out what is wrong. And while the Chavez government may be clueless on this the people who wrote the above report had no difficulty figuring it out - the Venezuelan currency being way overvalued stymies exports, undercuts domestic production, and makes imports artificially cheap.

Of course, if oil prices remain as they are 2008 will certainly be another year of economic growth in Venezuela. Unfortunately for the long term welfare of Venezuelans the benefits of that boom will largely accrue to foreign manufacturers, not Venezuelan ones, and oil will continue to being the be all and end all of the Venezuelan economy.

|

Auto sales skyrocketed by more than 43% to 491,000 units. This could be viewed by some as a sign of economic strength.

Certainly it is one more indication of what we already knew, that the Venezuelan economy is booming.

Still, some, such as development economist Ha-Joon Chang, would point out that spending on luxury consumer items such as private automobiles is wasteful and detracts from the investment a poor country desperately needs in order to grow. That alone is reason enough to not feel like celebrating these numbers.

But the worst and most unforgivable aspect of all this is to be found in the detail of the numbers. It turns out that of all those cars only 155,000 were produced in Venezuela and that is actually a decline of 1.5% from the previous year. Further, exports suffered an even more precipitous decline of 38%, declining from 22,000 to a paltry 13,000 units.

So while the Venezuelan auto market is experiencing an unprecedented boom Venezuelan automobile production is actually declining!!!

Now I suppose someone could try to make the argument that it doesn't matter how many actual cars are manufactured in Venezuela - that maybe now more components used in those cars are made in Venezuela and that therefore the Venezuelan automobile industry is in better shape after all.

Unfortunately there is no luck there either. According to Coindustria and the Venezuelan Automobile Manufacturer Association Venezuelan production of auto components declined 2% last year:

So on every front this key industry is going backwards at the same time that its market is booming. If this isn't a clear indication of the fact that something is wrong with Venezuela's economic policies I don't know what is.

Of course, as readers of this blog will know, it's not that difficult to figure out what is wrong. And while the Chavez government may be clueless on this the people who wrote the above report had no difficulty figuring it out - the Venezuelan currency being way overvalued stymies exports, undercuts domestic production, and makes imports artificially cheap.

Of course, if oil prices remain as they are 2008 will certainly be another year of economic growth in Venezuela. Unfortunately for the long term welfare of Venezuelans the benefits of that boom will largely accrue to foreign manufacturers, not Venezuelan ones, and oil will continue to being the be all and end all of the Venezuelan economy.

|

Tuesday, January 08, 2008

Bad Samaritans

In all the discussions and debates that have been had here regarding development economics there has been one common point of contention - how exactly did countries which are today wealthy, industrialized societies come to be such? Did they follow neo-liberal precepts (or in the context of Latin America "the Washington consensus") of free markets and free trade? Or did they do something else?

It has always struck me as a rather silly discussion when kept on the theoretical level, as it often is. After all, plenty of countries have developed through the centuries - the United States, Germany, Japan, and South Korea to name but a few. So instead of having abstract debates why not just look at what they did and, to the extent possible, just copy it?

Fortunately, I am not the only one to have had that thought and some economists have actually sought to determine what course of action would be best for developing countries by looking at history. Cambridge university economist, Ha-Joon Chang does exactly that in his recently released book, Bad Samaritans - The Myth of Free Trade and the Secret History of Capitalism.

Chang compares the advice often given by present day economists, particularly those working for entities such as the World Bank and I.M.F., to what the policies were that Britain, the United States, Japan, and South Korea followed.

To those of us who are already familiar with this aspect of economic history the answer was unsurprising - rather than allowing free trade and minimizing the role of the state those countries all employed a varied mix of very heavy protectionism, government subsidies, and other state protections of nascent industries. Only once they industrialized and were they on the top of the heap did they start advocating "free trade", mainly because their industries then no longer needed protecting and their economies could benefit from opening other markets and being able to import cheap natural resources and low tech manufactures from others.

However, even for those of us who knew most of that there was still some enlightening information. For example, I had always though that Britain, being the home of the original "industrial revolution", had in fact followed free trade polices given that there wouldn't have been any country its industries needed protecting from.

Yet even that turned out to be a misconception that gives free trade too much credit. Britain was in point of fact behind the Low Countries (Belgium and the Netherlands) and simply exported raw wool to them which they then processed and turned into finished products. To remedy this unacceptable situation the British first heavily taxed and later banned the export of raw wool to promote its processing in Britain. This not only served the purpose of building up British industry but also drove their principal competitors out of business.

These first steps were taken to another level by the country's first Prime Minister, Robert Walpole who famously said before Parliament: "it is evident that nothing so much contributes to promote the public well-being as the exportation of manufactured goods and the importation of foreign raw materials".

To turn that thought into reality Walpole raised import tariffs on manufactured goods, lowered or eliminated them on imported raw materials, actually created export subsidies for key industries, and started regulating the quality of exported manufactures to ensure that Britain would have a reputation for high quality goods. These policies continued for over a century with Britain having the highest tariff rates on manufacturing imports of any country in the world - from 45 to 55%. It also banned the development of many manufacturing activities in its colonies - for example it prohibited the American colonies from developing a steel industry. With these policies Britain blew past the rest of Europe and became the worlds pre-eminent industrial power.

Of course, leave it to the students to outdo the master. Once the United States was established as an independent country it didn't take long for it to utilize those very same methods on behalf of its own industry. In fact, it was an American "Founding Father" who gave some of the first theoretical underpinnings to this - in 1791 Alexander Hamilton wrote for the U.S. Congress a "Report on the Subject of Manufactures" wherein he described the necessity of the United States developing industry if it was to progress as a country (this was in contrast to Jefferson who wanted the country to remain agrarian) and that "industries in their infancy" would need protection from foreign competition until they were nurtured to the point that they could fend for themselves.

Hamilton's ideas were not immediately adopted (Thomas Jefferson was after all elected president) but as the 19th Century progressed they were increasingly used. For example, during the War of 1812 tariffs were doubled from 12% to 25%, by 1820 they were increased to 40% and under Abraham Lincoln they were pushed to over 50%. Between the Civil War and WW I the U.S. had the highest average tariff rate of any country at any time - and during this period the U.S. went from being just another country trailing Britain to the world's pre-eminent industrial power.

So in fact, the two countries most often held up of paradigms of free trade and free markets themselves followed highly protectionist and state interventionist policies when they were climbing up the ranks. In fact, Chang often likens countries using these policies to industrialize but then once industrialized insisting that OTHERS not use them to a person kicking away a ladder after climbing it to prevent others from reaching the same position.

Chang goes further and shows not only how free trade has NOT been used by anyone who actually industrialized but he aptly explains why the theoretical underpinnings of free trade, which came from David Ricardo, aren't apt for countries that want to progress. From page 47 of Chang's book:

Britain could have accepted the status quo of being a wool exporter. But instead it took action to transform itself. The United States could have contented itself with farming and exporting cotton. But instead, at the cost of civil war, it too transformed itself into an industrial power. Japan could have lived off its comparative advantage of weaving silk. Instead, it worked to transform a lowly maker of silk weaving machines into the largest manufacturer of automobiles in the wold - Toyota. The authors home country of South Korea decided it wasn't going to get very far with shrimp farming so it created its own comparative advantage in steel, autos, ship building and semi-conductors.

In much the same way as individual human beings don't get anywhere if they leave everything in fates hands so to countries must actively pursue industrialization - it is not something that will ever just happen on its own as pretty much the entire continents of South America and Africa show us.

In addition to reinforcing those concepts, which many of us may already have had, Chang takes on some very key myths. For example, as we've seen even in the debates on this blog inflation is often brought up as a general purpose excuse for making key changes. Yet Chang points out that inflation is generally about the least important economic indicator that exists (GDP growth and real income count for FAR more) and that unless it is completely out of control it does little damage. When Brazil had inflation of over 40% in the 1960s and 1970s it boomed and its per capita income increased 3% per year. After it embraced neo-liberal ideas in the 1990s inflation was brought down to 7% but growth in real income dropped to a measly 1.3%.

South Korea sets an even clearer example of the irrelevancy of moderate inflation. During its spectacular growth between 1960 and 1980 it averaged 20% inflation which was even higher than many Latin American countries. In fact, as Chang notes, economic studies have shown that inflation of under 40% has no impact on economic growth.

Busting another myth Chang points out that corruption is not an impediment to growth. Both England and the U.S. were famously corrupt during their boom years (remember when Tammany Hall was? The Tea-Pot Dome scandal? etc.). In the U.S. most all government jobs were patronage jobs given to political supporters - the Civil Service didn't come into existence until 1888. And of course, South Korea has been famously corrupt (remember Koreagate?) right up to the present.

Like other issues, the problem of corruption only gets addressed AFTER development when countries have the resources to pay people better and build an effective legal system.

Another myth that Chang addresses is one one that has come into fashion now that free trade and neo-liberal policies have clearly failed many countries - the idea that some countries are culturally predisposed to develop while others aren't. Chang almost comically disposes of this myth recalling that in the 19th century British visitors viewed Germans as, plodding, thieving and technically incompetent and at the beginning of the turn of the 20th Century Japanese were seen as laid back to the point of lazy and overly emotional. Of course now that both of those countries have become industrial powers that is not exactly how they are perceived.

As Chang points out, most all cultures have traits that can help economic progress as well as traits that can hinder it. It is the success or failure of economic policies that determine which come to the fore and which even change those traits.

Chang gives an interesting example of this from when he was growing up during Korea's industrialization:

In all, this book presents a thorough, well documented, and well written rebuttal to those who think any country can develop without its government being very pro-active in fostering that development process. I highly recommend that all read it.

However, there is one area in which the book was sorely lacking and that is what the political preconditions are for a country to carry out any real development project. Chang does say that lack of democracy is not an impediment to development given the obvious success of countries like South Korea and China and even the lack of true democracy in the U.S. and Britain when they were developing.

But for some reason he never poses a very obvious question - is the reverse true, is democracy itself an obstacle to development? All the policies that Chang outlines in the book impose at least temporary economic hardship on a country's population. Having high investment levels makes things even more difficult as it further reduces the consumption of these already poor people.

So the question needs to be asked - will people with already low levels of consumption, probably little understanding of economic theory, and lots of experience with broken promises by governments voluntarily agree to policies that will make things initially even worse for them? And if the answer is no, which it likely is, then are democracy and economic development themselves fundamentally incompatible?

Of course this leads to what is very uncomfortable territory for most of us - most all of us believe in fundamental human rights, democracy, and freedom of choice. So we would be loath to say that it would be a good thing for any country to be less free. But ignoring this question and refusing to even entertain the notion that democracy might not always be such a good thing is not helpful if this is indeed a real problem to which a solution must be found.

And in the end, Chang's avoidance of this issue left at least this reader with a hollow feeling. After all, as clear as these economic prescriptions may be what good are they if governments find it next to impossible to follow them? Or put differently, why have some countries had political leadership which followed very enlightened and often difficult policies that allowed them to progress while so many others (the overwhelming majority in fact) have not?

Until Chang or someone else manages to answer that question countries like Venezuela will still find themselves on the wrong side of a very big chasm without knowing how to cross it.

|

It has always struck me as a rather silly discussion when kept on the theoretical level, as it often is. After all, plenty of countries have developed through the centuries - the United States, Germany, Japan, and South Korea to name but a few. So instead of having abstract debates why not just look at what they did and, to the extent possible, just copy it?

Fortunately, I am not the only one to have had that thought and some economists have actually sought to determine what course of action would be best for developing countries by looking at history. Cambridge university economist, Ha-Joon Chang does exactly that in his recently released book, Bad Samaritans - The Myth of Free Trade and the Secret History of Capitalism.

Chang compares the advice often given by present day economists, particularly those working for entities such as the World Bank and I.M.F., to what the policies were that Britain, the United States, Japan, and South Korea followed.

To those of us who are already familiar with this aspect of economic history the answer was unsurprising - rather than allowing free trade and minimizing the role of the state those countries all employed a varied mix of very heavy protectionism, government subsidies, and other state protections of nascent industries. Only once they industrialized and were they on the top of the heap did they start advocating "free trade", mainly because their industries then no longer needed protecting and their economies could benefit from opening other markets and being able to import cheap natural resources and low tech manufactures from others.

However, even for those of us who knew most of that there was still some enlightening information. For example, I had always though that Britain, being the home of the original "industrial revolution", had in fact followed free trade polices given that there wouldn't have been any country its industries needed protecting from.

Yet even that turned out to be a misconception that gives free trade too much credit. Britain was in point of fact behind the Low Countries (Belgium and the Netherlands) and simply exported raw wool to them which they then processed and turned into finished products. To remedy this unacceptable situation the British first heavily taxed and later banned the export of raw wool to promote its processing in Britain. This not only served the purpose of building up British industry but also drove their principal competitors out of business.

These first steps were taken to another level by the country's first Prime Minister, Robert Walpole who famously said before Parliament: "it is evident that nothing so much contributes to promote the public well-being as the exportation of manufactured goods and the importation of foreign raw materials".

To turn that thought into reality Walpole raised import tariffs on manufactured goods, lowered or eliminated them on imported raw materials, actually created export subsidies for key industries, and started regulating the quality of exported manufactures to ensure that Britain would have a reputation for high quality goods. These policies continued for over a century with Britain having the highest tariff rates on manufacturing imports of any country in the world - from 45 to 55%. It also banned the development of many manufacturing activities in its colonies - for example it prohibited the American colonies from developing a steel industry. With these policies Britain blew past the rest of Europe and became the worlds pre-eminent industrial power.

Of course, leave it to the students to outdo the master. Once the United States was established as an independent country it didn't take long for it to utilize those very same methods on behalf of its own industry. In fact, it was an American "Founding Father" who gave some of the first theoretical underpinnings to this - in 1791 Alexander Hamilton wrote for the U.S. Congress a "Report on the Subject of Manufactures" wherein he described the necessity of the United States developing industry if it was to progress as a country (this was in contrast to Jefferson who wanted the country to remain agrarian) and that "industries in their infancy" would need protection from foreign competition until they were nurtured to the point that they could fend for themselves.

Hamilton's ideas were not immediately adopted (Thomas Jefferson was after all elected president) but as the 19th Century progressed they were increasingly used. For example, during the War of 1812 tariffs were doubled from 12% to 25%, by 1820 they were increased to 40% and under Abraham Lincoln they were pushed to over 50%. Between the Civil War and WW I the U.S. had the highest average tariff rate of any country at any time - and during this period the U.S. went from being just another country trailing Britain to the world's pre-eminent industrial power.

So in fact, the two countries most often held up of paradigms of free trade and free markets themselves followed highly protectionist and state interventionist policies when they were climbing up the ranks. In fact, Chang often likens countries using these policies to industrialize but then once industrialized insisting that OTHERS not use them to a person kicking away a ladder after climbing it to prevent others from reaching the same position.

Chang goes further and shows not only how free trade has NOT been used by anyone who actually industrialized but he aptly explains why the theoretical underpinnings of free trade, which came from David Ricardo, aren't apt for countries that want to progress. From page 47 of Chang's book:

Before Ricardo, people thought foreign trade makes sense only when a country can make something more cheaply than its trading partner. Ricardo, in a brilliant inversion of this commonsensical observation, argued that trade between two countries makes sense even when one country can produce everything more cheaply than another. Although this country is more efficient in producing everything than the other, it can still gain by specializing in things in which it has the greatest cost advantage over its trading partner. Conversely, even a country that has no cost advantage over its trading partner in producing any product can gain from free trade if it specializes in products in which it has the least cost disadvantage. With this theory, Ricardo provided the 19th-century free traders with a simple but powerful tool to argue that free trade benefits every country.

Ricardo's theory is absolutely right - within its narrow confines. His theory correctly says that, accepting their current levels of technology as given, it is better for some countries to specialize in things that they are relatively better at. One cannot argue with that.

His theory fails when a country wants to acquire more advanced technologies so that it can do more difficult things that few others can do - that is, when it wants to develop its economy. It takes time and experience to absorb new technologies, so technologically backward producers need a period of protection from international competition during this period of learning. Such protection is costly, because the country is giving up the chance to import better and cheaper products. However, it is a price that has to be paid if it wants to develop advanced industries. Ricardo's theory is, thus seen, for those who want to accept the status quo but not for those who want to change it.

Britain could have accepted the status quo of being a wool exporter. But instead it took action to transform itself. The United States could have contented itself with farming and exporting cotton. But instead, at the cost of civil war, it too transformed itself into an industrial power. Japan could have lived off its comparative advantage of weaving silk. Instead, it worked to transform a lowly maker of silk weaving machines into the largest manufacturer of automobiles in the wold - Toyota. The authors home country of South Korea decided it wasn't going to get very far with shrimp farming so it created its own comparative advantage in steel, autos, ship building and semi-conductors.

In much the same way as individual human beings don't get anywhere if they leave everything in fates hands so to countries must actively pursue industrialization - it is not something that will ever just happen on its own as pretty much the entire continents of South America and Africa show us.

In addition to reinforcing those concepts, which many of us may already have had, Chang takes on some very key myths. For example, as we've seen even in the debates on this blog inflation is often brought up as a general purpose excuse for making key changes. Yet Chang points out that inflation is generally about the least important economic indicator that exists (GDP growth and real income count for FAR more) and that unless it is completely out of control it does little damage. When Brazil had inflation of over 40% in the 1960s and 1970s it boomed and its per capita income increased 3% per year. After it embraced neo-liberal ideas in the 1990s inflation was brought down to 7% but growth in real income dropped to a measly 1.3%.

South Korea sets an even clearer example of the irrelevancy of moderate inflation. During its spectacular growth between 1960 and 1980 it averaged 20% inflation which was even higher than many Latin American countries. In fact, as Chang notes, economic studies have shown that inflation of under 40% has no impact on economic growth.

Busting another myth Chang points out that corruption is not an impediment to growth. Both England and the U.S. were famously corrupt during their boom years (remember when Tammany Hall was? The Tea-Pot Dome scandal? etc.). In the U.S. most all government jobs were patronage jobs given to political supporters - the Civil Service didn't come into existence until 1888. And of course, South Korea has been famously corrupt (remember Koreagate?) right up to the present.

Like other issues, the problem of corruption only gets addressed AFTER development when countries have the resources to pay people better and build an effective legal system.

Another myth that Chang addresses is one one that has come into fashion now that free trade and neo-liberal policies have clearly failed many countries - the idea that some countries are culturally predisposed to develop while others aren't. Chang almost comically disposes of this myth recalling that in the 19th century British visitors viewed Germans as, plodding, thieving and technically incompetent and at the beginning of the turn of the 20th Century Japanese were seen as laid back to the point of lazy and overly emotional. Of course now that both of those countries have become industrial powers that is not exactly how they are perceived.

As Chang points out, most all cultures have traits that can help economic progress as well as traits that can hinder it. It is the success or failure of economic policies that determine which come to the fore and which even change those traits.

Chang gives an interesting example of this from when he was growing up during Korea's industrialization:

Twenty, maybe even 15, years ago, we used to have the expression, 'Korean time'. It described the widespread practice whereby people could be an hour or two late for an appointment and not even feel sorry about it. Nowadays, with the pace of life far more organized and faster, such behaviours has disappeared, and with it the expression itself.

In all, this book presents a thorough, well documented, and well written rebuttal to those who think any country can develop without its government being very pro-active in fostering that development process. I highly recommend that all read it.

However, there is one area in which the book was sorely lacking and that is what the political preconditions are for a country to carry out any real development project. Chang does say that lack of democracy is not an impediment to development given the obvious success of countries like South Korea and China and even the lack of true democracy in the U.S. and Britain when they were developing.

But for some reason he never poses a very obvious question - is the reverse true, is democracy itself an obstacle to development? All the policies that Chang outlines in the book impose at least temporary economic hardship on a country's population. Having high investment levels makes things even more difficult as it further reduces the consumption of these already poor people.

So the question needs to be asked - will people with already low levels of consumption, probably little understanding of economic theory, and lots of experience with broken promises by governments voluntarily agree to policies that will make things initially even worse for them? And if the answer is no, which it likely is, then are democracy and economic development themselves fundamentally incompatible?

Of course this leads to what is very uncomfortable territory for most of us - most all of us believe in fundamental human rights, democracy, and freedom of choice. So we would be loath to say that it would be a good thing for any country to be less free. But ignoring this question and refusing to even entertain the notion that democracy might not always be such a good thing is not helpful if this is indeed a real problem to which a solution must be found.

And in the end, Chang's avoidance of this issue left at least this reader with a hollow feeling. After all, as clear as these economic prescriptions may be what good are they if governments find it next to impossible to follow them? Or put differently, why have some countries had political leadership which followed very enlightened and often difficult policies that allowed them to progress while so many others (the overwhelming majority in fact) have not?

Until Chang or someone else manages to answer that question countries like Venezuela will still find themselves on the wrong side of a very big chasm without knowing how to cross it.

|