Friday, December 14, 2007

When will they put their money where their mouths are?

Recently a minor scandal has erupted in Venezuela over the extravagant tastes of some ministers in the "socialist" government. So bad is it that even some revolutionary bloggers can't help blushing.

Yet wearing thousands of dollars of expensive clothes could be the least of their transgressions.

Recall that not too long ago the Venezuelan government announced that it was going to start building up its chemical industry? Well, they've started. And that is good, Venezuela certainly needs productive industry. So that is to be applauded.

Unfortunately, their choice of who they are using to help build it is bizarre, to put it mildly, as today we learn that they are contracting with the KBR corporation.

KBR - remember them? No? How 'bout if I use their full name - Kellog, Brown and Root? Remember them now?

That is right, KBR is the old Halliburton subsidiary of Dick Cheney fame. They are also the same company contracted with the U.S. military to rebuild Iraq - hey, maybe it is the great job they did in building up Iraq's infrastructure that made Venezuela sign them up!!!

Seriously, even though this may sound like a sick joke, but its not. They just got a $57 million dollar contract to work on a Venezuelan ammonia plant.

So with no apparent sense of irony the "revolutionary" government of Venezuela hired a company that used to be run by Dick Cheney, got its start building bases around the world for the U.S. military , is currently the largest non-union construction company in the U.S. and has robbed both the U.S. taxpayers and Iraqi government blind with all their fraudulent work in Iraq.

It is certainly more than a little ironic that Chavez, for all his anti-Bush rhetoric, contracts with the same corrupt and incompetent companies that Bush has been using in Iraq.

I can remember when the Chavez government used to complain about previous Venezuelan governments giving key contracts to U.S. companies tied to the U.S. military/industrial complex. Apparently they've had a change of heart.

Now, wouldn't it be nice if they had another change of heart, and start putting their money where their mouths are?

|

Yet wearing thousands of dollars of expensive clothes could be the least of their transgressions.

Recall that not too long ago the Venezuelan government announced that it was going to start building up its chemical industry? Well, they've started. And that is good, Venezuela certainly needs productive industry. So that is to be applauded.

Unfortunately, their choice of who they are using to help build it is bizarre, to put it mildly, as today we learn that they are contracting with the KBR corporation.

KBR - remember them? No? How 'bout if I use their full name - Kellog, Brown and Root? Remember them now?

That is right, KBR is the old Halliburton subsidiary of Dick Cheney fame. They are also the same company contracted with the U.S. military to rebuild Iraq - hey, maybe it is the great job they did in building up Iraq's infrastructure that made Venezuela sign them up!!!

Seriously, even though this may sound like a sick joke, but its not. They just got a $57 million dollar contract to work on a Venezuelan ammonia plant.

So with no apparent sense of irony the "revolutionary" government of Venezuela hired a company that used to be run by Dick Cheney, got its start building bases around the world for the U.S. military , is currently the largest non-union construction company in the U.S. and has robbed both the U.S. taxpayers and Iraqi government blind with all their fraudulent work in Iraq.

It is certainly more than a little ironic that Chavez, for all his anti-Bush rhetoric, contracts with the same corrupt and incompetent companies that Bush has been using in Iraq.

I can remember when the Chavez government used to complain about previous Venezuelan governments giving key contracts to U.S. companies tied to the U.S. military/industrial complex. Apparently they've had a change of heart.

Now, wouldn't it be nice if they had another change of heart, and start putting their money where their mouths are?

|

Wednesday, December 12, 2007

Job one

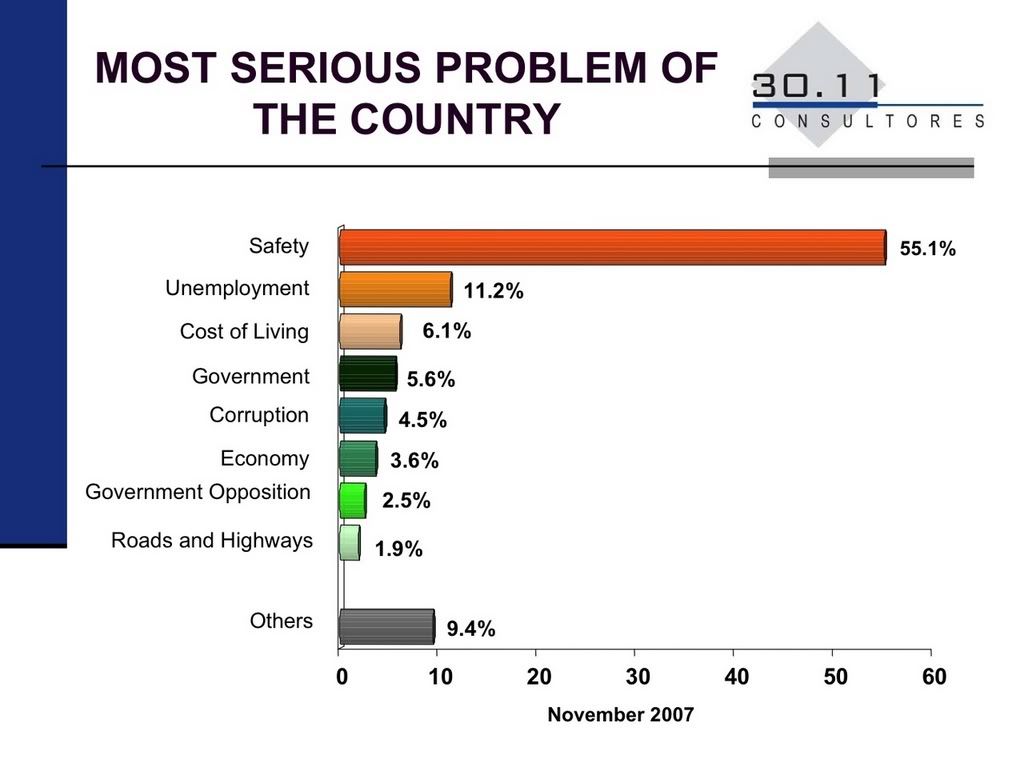

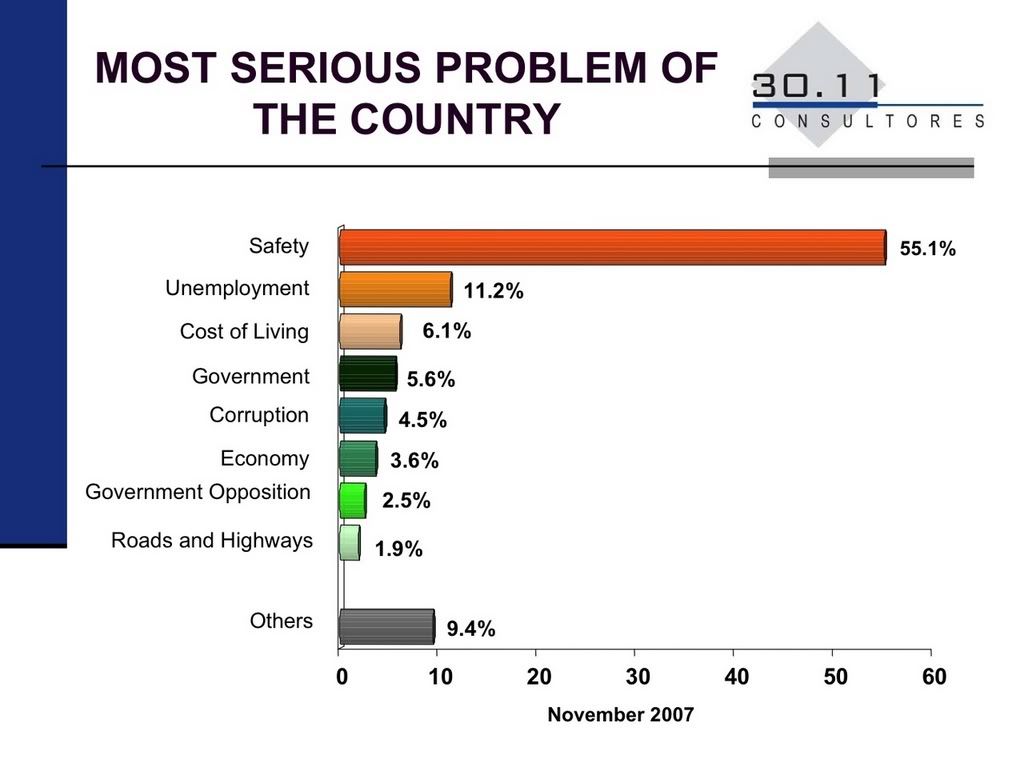

As I mentioned in the wake of the defeat of the constitutional reform Chavez would do well to spend some time now simply governing and fixing some festering problems. One of the first problems to get Chavez's attention should be crime.

Why?

Well look at this:

Now before you laugh thinking "these fools who couldn't have been more wrong on the vote two weeks ago?" remember most everyone else got that vote wrong too. Further, this is only the last in a long line of polls showing that crime is far and away the number one concern of Venezuelans.

And it makes perfect sense. Their standard of living is way up, the economy is booming, health care is much improved, the country isn't at war with anyone, and even the recent vote went well. Yet virtually everyone in Venezuela has been personally effected by crime or knows someone who has in recent years. As anyone who reads newspapers like Ultimas Noticias (a pro-government paper) knows there is a daily bloodbath in cities throughout Venezuela.

Today, Ultimas Noticias reported some numbers from the respected Venezuelan Human Rights organization Provea that quantify exactly how bad that blood bath is.

Between January and September of 2007 9,567 Venezuelans have been murdered. This comes to nearly 13,000 annually.

This represents an increase of 10.28% from the same period in 2006 when 8,675 were murdered.

Just for sake of comparison the United States, which has a significant crime problem of its own and a population of more than 10 times the size of Venezuela's, had less than 17,000 murders in 2005.

Clearly Venezuela has a very, very big problem. Also, the responsibility for this problem clearly falls to the pro-Chavez forces as they control the large majority of law enforcement forces in the country.

Further, Venezuela's bad numbers don't even include deaths classified as "undetermined" and the stunning 1,153 people who died "resisting authorities".

How can this be dealt with? There probably isn't one solution. Though given that Venezuela has about 20,000 people in prison with the above murder rate it is safe to say there are plenty of murderers freely walking Venezuela's streets maybe getting them off the streets would be a good idea. Further, maybe some of the first real power that could be given to the community councils would be to give them control over Venezuela's notoriously corrupt and inefficient police forces.

Regardless, it is clear Chavez needs to spend some time in the most effected communities discussing with people how this can be solved. Then he probably needs to lock himself in a room with his advisers and not come out until they have a plan in hand. Too many lives are being destroyed for this problem to go unsolved any longer.

And if that isn't reason enough to do something about it I'm sure he can figure out the impact this constant worsening of crime is likely to have on his poll numbers.

UPDATE:

Here are the murder numbers by State 2007 versus 2006:

|

Why?

Well look at this:

Now before you laugh thinking "these fools who couldn't have been more wrong on the vote two weeks ago?" remember most everyone else got that vote wrong too. Further, this is only the last in a long line of polls showing that crime is far and away the number one concern of Venezuelans.

And it makes perfect sense. Their standard of living is way up, the economy is booming, health care is much improved, the country isn't at war with anyone, and even the recent vote went well. Yet virtually everyone in Venezuela has been personally effected by crime or knows someone who has in recent years. As anyone who reads newspapers like Ultimas Noticias (a pro-government paper) knows there is a daily bloodbath in cities throughout Venezuela.

Today, Ultimas Noticias reported some numbers from the respected Venezuelan Human Rights organization Provea that quantify exactly how bad that blood bath is.

Between January and September of 2007 9,567 Venezuelans have been murdered. This comes to nearly 13,000 annually.

This represents an increase of 10.28% from the same period in 2006 when 8,675 were murdered.

Just for sake of comparison the United States, which has a significant crime problem of its own and a population of more than 10 times the size of Venezuela's, had less than 17,000 murders in 2005.

Clearly Venezuela has a very, very big problem. Also, the responsibility for this problem clearly falls to the pro-Chavez forces as they control the large majority of law enforcement forces in the country.

Further, Venezuela's bad numbers don't even include deaths classified as "undetermined" and the stunning 1,153 people who died "resisting authorities".

How can this be dealt with? There probably isn't one solution. Though given that Venezuela has about 20,000 people in prison with the above murder rate it is safe to say there are plenty of murderers freely walking Venezuela's streets maybe getting them off the streets would be a good idea. Further, maybe some of the first real power that could be given to the community councils would be to give them control over Venezuela's notoriously corrupt and inefficient police forces.

Regardless, it is clear Chavez needs to spend some time in the most effected communities discussing with people how this can be solved. Then he probably needs to lock himself in a room with his advisers and not come out until they have a plan in hand. Too many lives are being destroyed for this problem to go unsolved any longer.

And if that isn't reason enough to do something about it I'm sure he can figure out the impact this constant worsening of crime is likely to have on his poll numbers.

UPDATE:

Here are the murder numbers by State 2007 versus 2006:

|

Sunday, December 09, 2007

Is this the way to go?

Generally its not good form to blog by just lifting in their entirety other peoples articles. But when you do, you are actually paying them a pretty big complement.

Such is the case with this very imformative article comparing the recent economic performance of Chile and Venezuela. Given that Chile has frequently been presented as a model that Venezuela should emulate this really is essential reading:

It would seem Chile is not all it has been cracked up to be.

The sad reality here is that neither of these countries are in very good shape. Venezuela is poor and very heavily dependent on one export commodity. And so far attempts to diversify the economy seen either not to exist or not to have had success.

Chile, contrary to popular perception, is also very dependent on export of a single commodity. And while it has had more success than Venezuela in increasing other exports those other exports seem also to be commodities or agricultural products. In other words, both countries are on the bottom of the world wide food chain exporting only natural resources and agricultural products - for some reason value added manufactures seem to be beyond them.

But one point is crystal clear. Chile, being to a large extent stuck in the same swamp of underdevelopment that Venezuela is, can hardly serve as a model for how Venezuela is to get out that underdeveloped state.

For that Venezuela would do MUCH better to look east towards South Korea and Tawain than to look south towards Chile.

|

Such is the case with this very imformative article comparing the recent economic performance of Chile and Venezuela. Given that Chile has frequently been presented as a model that Venezuela should emulate this really is essential reading:

Chile - Venezuela: The Hidden Weakness of a Strong Economy

By Mark Turner

Here is a quiz for you: Which South American nation:

a) depends on one single product for the majority of its exports?

b) derives 35% of its total GDP from said product?

c) has relied on the sharp rise in world market prices for its product to fuel growth?

d) has not added significantly to its international currency reserves in the period?

e) is often lauded as the LatAm model economy by world peers?

f) may possibly be worried about forward macro effects of the recent drop of over 20% in world market prices for its main product?

If you guessed Venezuela then began to doubt your choice, this analyst would not be at all surprised. The answer is Chile, and the major product in question is copper.

Most people with interest in hard commodities know that Chile is the world’s number one copper producing nation, and it is also owner of the world’s biggest copper producer in state-run Codelco. What most people do not realize is the growing dependence Chile has on commodity growth due to the rise in price of copper in this decade. Copper has always been central to Chile’s economy of course, but in recent times this dependence seems to have become a veritable addiction. While revisiting the Chilean macroeconomic situation recently, we were immediately struck by the similarity between the positions of Chile and Venezuela, and began to wonder why Venezuela was the recipient of such bad press for its virtual petroleum monoculture economy while the growing dependence Chile has on copper was all but ignored by otherwise astute economists.

Firstly, some basic parameters. With a population of 15 million, Chile has a little over half the citizens of Venezuela. Therefore when we see the 2006 GDP figures for Chile at U$205Bn and Venezuela at U$176Bn (both purchasing power parity figures from the respective central banks) and GDP per capita at around U$9000 for Chile and U$6100 for Venezuela, it makes sense that Chile is classed the “richer” of the two countries. The general perception is that growth in Chile is of the “steady and sustainable” type, which is based on exports, direct foreign investment and demand from a developed internal economy.

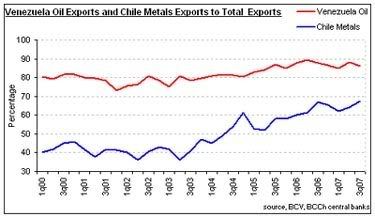

As the above chart shows, GDP growth has been fluctuating per quarter around this 5% level, but has been far below that of Venezuela. Venezuela’s well-publicized growth has come almost entirely from the rise in oil prices, of course. But Chile’s growth has been largely dependent on copper in the same period, as the following chart begins to demonstrate.

Since 2004, the export mix from Chile has changed substantially. Previously, copper made up between 35% and 40% of total exports by revenue, but this figure has ballooned to 60% in recent months. The correlation between this rise and the spot price of copper is fairly straightforward.

And as the next graph further illustrates, copper is the clear driving force behind the rise in export revenues.

According to central bank figures, Chile obtains 35% of GDP from copper and copper alone, revenue coming from the state run Codelco and from tax revenues from private mining companies. Taxes on mining are comparatively low in Chile, with the base rate set at 17%. Added to this is a 35% repatriation tax on earnings for foreign mining companies as well as royalty payments that range between 0.5% and 5% of gross revenues depending on amount of production per company, tax regime and spot commodity prices. However the state also offers significant tax breaks to foreign companies in the form of asset depreciation credits. In recent times, Chile has also tightened up tax loopholes that previously allowed foreign miners to avoid the full burdens via transfer pricing to parent companies abroad.

Coincidentally, according to the Banco Central de Venezuela (BCV), 35% of Venezuela’s GDP also comes via its main export, that of oil. In the case of Venezuela, around 80% of revenues come via its state-run oil company, PdVSA, with around 20% currently made by private (and mostly foreign) oil companies. In the next chart we see the total percentage of export revenues that come via oil in Venezuela and copper in Chile, and although Venezuela’s dependence is clearly stronger, copper in Chile is playing catch-up. To recap, 35% of Chile’s GDP and 67% of its exports currently come from copper. 35% of Venezuela’s GDP and 88% of its exports come from oil. But despite this, the perception is that Chile has a far more diversified economy.

Exports alone do not tell the full macro story, of course. We shall therefore take a look at some other macro indicators to measure the two countries. When it comes to inflation, Chile runs headline figures that beat Venezuela easily. Although Chile’s inflation rate has recently crept up from under 3% to the present 3.7%, it is still well below the Venezuelan rate that has fluctuated between 15% and 20% this year. However the following chart demonstrates that, surprisingly, the real world effects of inflation have been more severe in Chile than in Venezuela. The chart compares salary growth of the two nations with inflation via the consumer price indices. As we can see, Salaries have kept up with and in fact beaten the price rises in Venezuela, but in Chile’s case the reverse is true.

Venezuela has also made the best progress in combating unemployment. The next chart shows the seasonally unadjusted rates for both countries, and Venezuela has managed to cut unemployment in half since the dog days of the PdVSA strike in 2003. Chile has also made progress on this score, but the progress has been more moderate.

But on the subject of international reserves, there is no contest. Venezuela has managed to grow its safety cushion of international reserves significantly in this period, and even allowing for the U$5Bn withdrawn from the system by President Hugo Chávez in early 2007 to fund social programs, Venezuelan reserves have more than doubled since January 2003. On the other hand, Chilean reserves have stayed stubbornly at the same level in all this time, despite the boom in copper prices that has been every bit as impressive as oil prices. However, for whatever reason Chilean international reserves never seem to command the column inches of the Venezuelan figures. This analyst remembers the shock and gloom stories from publications a reputable as the London Financial Times in May 2007, bemoaning the drop in Venezuelan reserves to U$24Bn and predicting all sorts of problems in the near future. Since then reserves have risen to the current U$30Bn level, and the press has been strangely quiet on the subject. One wonders why.......

So which country is more prepared for any downturn in international commodities prices? The above figures seem to suggest that Venezuela is better placed than many imagine to ride out any forward weakness, but Chile’s more diversified economy should also be taken into account. Although Chile is obviously dependent on copper, it is worth noting that exports of other products have increased in the period in question. As the next chart shows, exports in absolute terms of non-metallic goods have risen in the course of this decade as Chile is also a major exporter of products such as fish, fish meal, fruits, wines etc. Chilean exporters though are fighting an uphill struggle against a perpetually rising currency.

Notwithstanding, the progress made by Venezuela in accumulation of international reserves far outstrips that of Chile, even though the more southerly nation runs a type of current account with the IMF that allows it to deposit and withdraw funds at any given moment in an attempt to allow smoother expenditure over the irregular period of income from commodities.

As for that future, recent price action suggests that Chile’s main export is looking weaker than that of Venezuela’s. LME spot copper has fallen over 20% in recent weeks, but the rise of oil on world markets to near U$100/bbl levels hardly needs much further comment here. Present copper weakness has been fuelled by the 18% YoY production rise inside China, with many analysts predicting that the world’s largest consumer will not be buying so much at the world market in 2008. ICSG figures currently point to world supply and demand at an equilibrium, which differs sharply from the supply constraints in petroleum products that come more from limited capacity growth in refineries more than the supply of crude from the ground or geopolitical pressures.

It should be stressed that direct employment in Chilean mining and Venezuelan oil makes up around 1% of the total workforce of each country, so the effects of a downturn would not show themselves in any layoff measures from either sector. However, in the same way that PdVSA is the main wealth producer in Venezuela, the copper mining industry in Chile plays the same role. In a 2006 survey by Ecoconsult, 92% of wealth creation in Chile was confined to Codelco and two other major copper miners.

Politically, Chile has been coming under greater pressure from its populace to spend more of its copper windfall. Polls suggest that two out of three Chileans want its government to relax the saving rules with the IMF and spend more of the windfall on social projects. This makes sense in a country that is ostensibly prosperous, but in fact runs the second highest level of social inequality in the LatAm region.

Conclusion

We chose Venezuela as the mirror to reflect on the state of play in today’s Chile for two main reasons, namely the dependence on one single export for the ongoing well-being in the countries and the vast difference in perception amongst other nations towards the countries. The administrations of both countries profess to be socialist, but the government of Hugo Chávez in Venezuela has, rightly or wrongly and for various reasons, a polemic position amongst fellow nations, with many seemingly desperate for the time that its president is toppled due to a sudden drop in oil prices. However the sound reputation and good standing of today’s Chile is to a very great extent also highly economically dependent on a single export, but for whatever reason it does not grab the limelight in the same way as Hugo’s black gold.

We therefore wonder how much the ‘A’ rating S&P has on Chilean sovereign bonds has to do with purely economic concerns and how much political stability seeps into the equation. We are sure the stability (or the lack thereof) will be front and center in both countries if the price of copper and oil take a sudden and drastic turn for the worse in the next few years.

Mark Turner is a cognitive scientist, linguist, and author.

It would seem Chile is not all it has been cracked up to be.

The sad reality here is that neither of these countries are in very good shape. Venezuela is poor and very heavily dependent on one export commodity. And so far attempts to diversify the economy seen either not to exist or not to have had success.

Chile, contrary to popular perception, is also very dependent on export of a single commodity. And while it has had more success than Venezuela in increasing other exports those other exports seem also to be commodities or agricultural products. In other words, both countries are on the bottom of the world wide food chain exporting only natural resources and agricultural products - for some reason value added manufactures seem to be beyond them.

But one point is crystal clear. Chile, being to a large extent stuck in the same swamp of underdevelopment that Venezuela is, can hardly serve as a model for how Venezuela is to get out that underdeveloped state.

For that Venezuela would do MUCH better to look east towards South Korea and Tawain than to look south towards Chile.

|

So obvious even loons can't help but notice

Roger Cohen is certainly not a columnist I would recommend reading, if you are at all interested in preserving your mental health. Certainly his Op-Ed pieces on Venezuela have ranked right up there with the best in terms of being off the wall and uninformed at the same time. And I really don't think Hugo Chavez is on his list for sending holiday cards to:

But guess what? He went to Venezuela, observed a transparent election, and seemed more than a little impressed by what he saw:

Of course, it doesn't take all that much to impress him. The idea of having a clear, transparent, and verifiable voting process as they have in Venezuela is something most Americans can only dream of given their own faith-based voting system.

Mr. Cohen went on to congratulate Venezuelans on their civics lesson. Yeah, I guess.

But the people to be really congratulated are those who supported this proposal and accepted its defeat with such grace.

Not one rock was thrown, not one fire set, no traffic blocked and no-one hurt or killed. One week ago today Chavistas showed their true colors - as people committed to their ideals but who who believe in implementing them peacefully and democratically. They are the ones to be congratulated.

|

But guess what? He went to Venezuela, observed a transparent election, and seemed more than a little impressed by what he saw:

Democracy in the Americas

By ROGER COHEN

CARACAS, Venezuela

I salute you, Hugo Chávez.

Those are words I never thought I’d write. But nor did I think it possible that a Latin American strongman, issued from the barracks, accumulating power through threats, slandering opponents as “traitors,” buying support with $150 million a day in oil money, and bent on a socialist revolution, would accept a marginal electoral defeat.

No, if it came to the humiliation of a 51 to 49 percent rejection of his proposal to end term limits and undermine private property rights and centralize authority, he would surely use a controlled Election Commission to tweak the numbers for Venezuela’s glorious march to socialism.

And yet, there was a glum Chávez declaring in the unadorned language no totalitarian system can abide that: “The people’s decision will be upheld in respect of the basic rule of democracy: the winning option is the one that gets most votes.”

The United States might ponder those words — not just because of what happened in the presidential election of 2000; not just because the arithmetic of voting has proved unpalatable in Palestine; not just because of the past U.S.-abetted trampling of elected Latin American leaders in Chile and elsewhere — but because democracy was alive and vital in Venezuela on Sunday in a way foreign to President Bush’s America.

I watched as “Chávistas” and their opponents exchanged arguments in the sun. The issue was grave — a change of economic system under a comandante eyeing lifelong rule — but civility prevailed. When the result came in the early hours Monday, supporters of the “No” campaign partied undisturbed.

Venezuela’s democratic credentials are robust for Latin America — democracy has held since 1958 — but pale by U.S. standards. Yet there was a directness, meaningfulness and civic responsibility about the proceedings that make the early running in the American election look pitiful.

Of course, it doesn't take all that much to impress him. The idea of having a clear, transparent, and verifiable voting process as they have in Venezuela is something most Americans can only dream of given their own faith-based voting system.

Mr. Cohen went on to congratulate Venezuelans on their civics lesson. Yeah, I guess.

But the people to be really congratulated are those who supported this proposal and accepted its defeat with such grace.

Not one rock was thrown, not one fire set, no traffic blocked and no-one hurt or killed. One week ago today Chavistas showed their true colors - as people committed to their ideals but who who believe in implementing them peacefully and democratically. They are the ones to be congratulated.

|