Thursday, October 25, 2007

The virus spreads

When Chavez was pushing foriegn oil companies to pay higher royalties and taxes he was of course attacked by the usual suspects for detering investment and driving out the oil companies.

Those same people held up Canada and their supposedly very liberal attitude towards oil companies in the oil sands area of Alberta as the counter point to Chavez.

Well, it looks like they might not be able to do that much longer:

Sorry but I have to interrupt here. Don't you just love the tone of this - "well if they were going to spend the additional royalties on something meaningful maybe we could understand but given they are just going to waste it on education and fucking poor people..."

Ok, back to the article:

Sorry, can't let this go either. Yep, Venezuela was first - read, that commie motherfucker Chavez started all this.

Well, what can you expect from Nigerians - they are just a bunch of third world losers who would do stupid things like tax oil companies. But Canadians?!?!?!?!?!?!?!?!?!?!

Has Chavez even been to Canada? Has anyone in Venezuela ever even heard of Canada? Most Americans haven't.

Oh, yeah, "they'll go elsewhere". That is a real threat. Where the fuck are they gonna go, Venezuela?

Fuck, it is bad enough the Bolivians have turned their country over to the Venezuelans but now Alberta?

Hey, remember all those PDVSA workers who were fired and supposedly went to work in the Alberta oil fields? Do you think the whole thing could have been a set up and they are really a bunch of quasi communist infiltraters intent on spreading noxious ideas like taxing oil companies?

If the Canucks were smart they'd immediately deport them all.

Building infrastructure? They probably got that idea from Chavez too. If they build a subway in Edmonton you know who to blame.

This contagion of populist/socialist/Bolivarian/Commie ideas is spreading rapidly.

Bush needs to quit salivating over the prospect of bombing Iran and pay attention to what is going on in our own backyard (or at least to what is going on in our attic). Personally, I think if any U.S. companies are effected then military action against Canada is justified.

Fortunately, it won't distract from the upcoming show in Iran. As John Candy knew, the U.S. wouldn't need to send in troops - the Niagra Falls New York police department is sufficient to kick Canada's ass. Hopefully they are on their way to Toronto to put an end to this farce right now.

UPDATE I understand the Niagra Falls police department is in fact on the way to Toronto and probably would have already captured it already but they got stuck in traffic on the QEW. Figures.

|

Those same people held up Canada and their supposedly very liberal attitude towards oil companies in the oil sands area of Alberta as the counter point to Chavez.

Well, it looks like they might not be able to do that much longer:

Governments Demand a Bigger Share of Oil

TORONTO (AP) — The oil industry is under assault globally by nations and even provinces who want companies like Exxon Mobil, Chevron and Suncor to cough up more royalties they can use to address issues like poverty and education.

Sorry but I have to interrupt here. Don't you just love the tone of this - "well if they were going to spend the additional royalties on something meaningful maybe we could understand but given they are just going to waste it on education and fucking poor people..."

Ok, back to the article:

First it was Venezuela.

Sorry, can't let this go either. Yep, Venezuela was first - read, that commie motherfucker Chavez started all this.

Now, Nigeria is reviewing its relationships with international oil companies and the oil-rich Canadian province of Alberta is set to announce a decision Thursday on increasing royalties from the energy industry. It's a move the industry warns could devastate Alberta's oil patch.

Well, what can you expect from Nigerians - they are just a bunch of third world losers who would do stupid things like tax oil companies. But Canadians?!?!?!?!?!?!?!?!?!?!

Has Chavez even been to Canada? Has anyone in Venezuela ever even heard of Canada? Most Americans haven't.

At least once analyst compared Alberta to Venezuela last month after a government-appointed panel called for the province to boost its total take from the energy industry by 20 percent a year, or roughly $2 billion.

Under President Hugo Chavez, Venezuela raised royalty and tax rates on foreign oil companies, then later took majority control of all oil projects as part of a larger nationalization drive of "strategic" economic sectors. Chavez says those policies are ensuring that oil benefits Venezuelans instead of foreign corporations and governments.

Russia and Bolivia have also asserted greater state control over their oil or natural gas assets in recent years.

A report by Alberta's provincial panel says royalties have not kept pace with world energy markets — a barrel of crude oil has reached record levels of more than $90 recently. It says all projects in the booming oil region should pay more because "Albertans do not receive their fair share from energy development."

"There's definitely been a trend over the last year or two, a lot of countries looking to nationalize oil reserves," said Kyle Preston, an oil and gas analyst with Salman Partners. "It's a function of higher commodities prices. Oil companies are making more money and governments want a bigger share."

Alberta is home to vast reserves of oil sands, a tar-like bitumen that is extracted using mining techniques. Industry officials estimate the region will yield as much as 175 billion barrels of oil, making Canada second only to Saudi Arabia in crude oil reserves.

"Chavez is not the kinda guy you want to be compared to. But yes, I could see that comparison since Chavez has increased royalties in his country," Preston said.

Greg Stringham, vice president of the Canadian Association of Petroleum Producers, called increased revenue sharing the biggest economic decision in Canada this year.

"The energy industry has been a phenomenal driver," Stringham said. "It not only affects Alberta ... It's going to set the direction for where this industry goes and where Alberta goes the next five to 10 years."

Stringham said there's more room for sharing revenues but says it costs $55-60 a barrel to develop the oil sands because of rising costs in steel and labor.

Many companies have said they'll shut down future projects and invest elsewhere if Alberta adopts the recommendations in full. EnCana Corp. has said it will cut its capital investment in Alberta by a $1 billion next year if the province raises royalties as much as proposed.

Oh, yeah, "they'll go elsewhere". That is a real threat. Where the fuck are they gonna go, Venezuela?

Alberta's Conservative government repeatedly rejected advice in the past to raise royalties but the province has a new premier who is expected to face an election soon.

Canada's constitution grants the provinces control over their natural resources and gives them the right to levy direct taxes on them.

"Canada has been a politically safe region and that has somewhat changed now," said Philip Skolnick, an oil analyst with Genuity Capital Markets. "Yes, oil prices have come up significantly but so has the cost to develop them."

"Our first reaction to the Alberta government's recent royalty review panel report was that it was authored by a visiting delegation of Venezuelans," Deutsche Bank North America analyst Paul Sankey wrote in a note to investors.

Fuck, it is bad enough the Bolivians have turned their country over to the Venezuelans but now Alberta?

Hey, remember all those PDVSA workers who were fired and supposedly went to work in the Alberta oil fields? Do you think the whole thing could have been a set up and they are really a bunch of quasi communist infiltraters intent on spreading noxious ideas like taxing oil companies?

If the Canucks were smart they'd immediately deport them all.

Last year, Alberta collected $10 billion in energy royalties, which have not been updated since the mid-1990s. The province is debt-free but has struggled to build infrastructure needed for the booming industry.

Building infrastructure? They probably got that idea from Chavez too. If they build a subway in Edmonton you know who to blame.

This contagion of populist/socialist/Bolivarian/Commie ideas is spreading rapidly.

Bush needs to quit salivating over the prospect of bombing Iran and pay attention to what is going on in our own backyard (or at least to what is going on in our attic). Personally, I think if any U.S. companies are effected then military action against Canada is justified.

Fortunately, it won't distract from the upcoming show in Iran. As John Candy knew, the U.S. wouldn't need to send in troops - the Niagra Falls New York police department is sufficient to kick Canada's ass. Hopefully they are on their way to Toronto to put an end to this farce right now.

UPDATE I understand the Niagra Falls police department is in fact on the way to Toronto and probably would have already captured it already but they got stuck in traffic on the QEW. Figures.

|

Wednesday, October 24, 2007

We can sleep safe now I guess

The govt did a mild U-turn and decided to drop the removal of "due process" from article 337 with the patented constitutional wizardry of simply adding more protections that pretty much say the same thing.

In short, stuff I did not know we had but nevertheless neat to have in case an emergency is declared.

Right to live

Right not to be tortured or incommunicado

Right to a defense

Right to personal integrity

Right to be judged by a a civilian?

Right to not exceed the historical penal limit (30 years)

Of course the right to information was removed but oh well, the apocalypse was averted.

Now some of you are still stuck with the PATRIOT act so I will celebrate for you.

Link

|

In short, stuff I did not know we had but nevertheless neat to have in case an emergency is declared.

Right to live

Right not to be tortured or incommunicado

Right to a defense

Right to personal integrity

Right to be judged by a a civilian?

Right to not exceed the historical penal limit (30 years)

Of course the right to information was removed but oh well, the apocalypse was averted.

Now some of you are still stuck with the PATRIOT act so I will celebrate for you.

Link

|

Now it is official

Tuesday, October 23, 2007

Houses or cars? - what Bolivar tells you to do.

Given the abstractness of the discussion about the value of the Venezuelan currency I think it will be good to look at an actual situation in which it significantly, and in my view adversley, effects the Venezuelan economy.

Over the past several years Venezuela has experienced a huge boom in the purchase of automobiles. Sales have set all time records year after year and look to go over 400,000 units this year. It should be noted that the great majority of cars are imported, or if assembled in Venezuela, made almost entirely with imported components. That is, very little of the value of those automobiles is actually created in Venezuela.

It is also known that Venezuela has a huge housing shortage. Many people live in substandard units, sometimes little more than shacks, or in overcrowded homes with relatives. The housing shortfall is generally put at at least 1.5 million units.

In contrast to cars, most all the value of home contruction stays in Venezuela - the actual construction is in Venezuela, the cement and reinforcing steel is made in Venezuela, ceramic tiles and other fixtures are made in Venezuela, and furniture is made in Venezuela.

Given that, when money is spent building a house in Venezuela nearly all the value accrues to the Venezuelan economy. Venezuelan construction workers get jobs building it. Venezuelan cement, steel, tile, and furniture factories also get more demand for their products. Therefore money spent on housing goes almost entirely to Venezuelans and creates a multiplier effect through putting money in the pockets of other Venezuelans that really boosts the economy.

By way of contrast, virtually every Bolivar spent on cars promptly leaves the country due to the cars either being made overseas or made with imported parts. So that money goes into the pockets of people in Detroit and Stutgart much more than the in the pockets of people in Valencia.

Further, while housing fills an urgent societal need of helping people live better private transportation creates additional burdens on society by consuming subsidized gasoline and producing a lot of pollution.

Given that building homes would seem to do a lot more to better Venezuela than importing cars we would think the Venezuelan government would make sure that happens. But it doesn't. Witness the following chart from a VenAmCham presentation:

As you can see, while housing has stayed flat for most of the Chavez administration and picked up only a little of late automobile sales have sky rocketed. Given the above this is clearly not good.

But why is this happening? Why would people be so heavily favoring automobiles when houses are needed just as badly (if not more so) and are almost always a better investment?

The answer to takes us right back to the Venezuelan currency, the Bolivar, and how it relates to the dollar. In fact, the above chart is really a damning indictment of the aspect of Chavez's economic policy whereby he has allowed the Venezuelan currency to become so overvalued.

Remember, houses are almost entirely Venezuelan made. So as prices in Venezuela go up in Venezuela housing prices also go up. As Venezuelan inputs like labor get more expensive, houses get more expensive. The end result is that houses have been getting more expensive in Venezuela. Yes peoples salaries have gone up, maybe even more than the housing prices, but the point is housing prices have been going up alot.

Now lets contrast that with cars. They are not made with Venezuelan inputs (or only mimimaly so) given that they are imported. Being imported they are originally priced in dollars and what determines how their price changes in Venezuela is determined by how the value of Venezuelan currency varies compared to the dollar.

As we know, a dollar is still worth 2,150 bolivares and that hasn't changed in years. That is a car that cost $50,000 dollars cost 107 million Bolivares three years ago and it still costs 107 million Bolivares today. Therefore, during the past three years of inflation, of housing prices going up, and of wage increases, the price of an imported car has stayed the same. This of course means that cars have become MUCH, MUCH cheaper for Venezuelans relative to other things like houses that are made in Venezuela. No wonder people are running out and buying cars instead of houses.

People buy more of things that get cheaper and less of things that get more expensive. The Bolivar not being devalued has made cars get much cheaper relative to cars in Venezuela over the past several years. Therefore Venezuelans are buying cars rather than houses - this isn't rocket science.

As an additional point on this it should be noted that the government actually subsidizes new home purchases for most people by giving them grants of up to $8,000 for the purchase. Yet even that subsidy is not enough to overcome the huge bargain that the overvalued Bolivar makes cars and get people to buy houses instead.

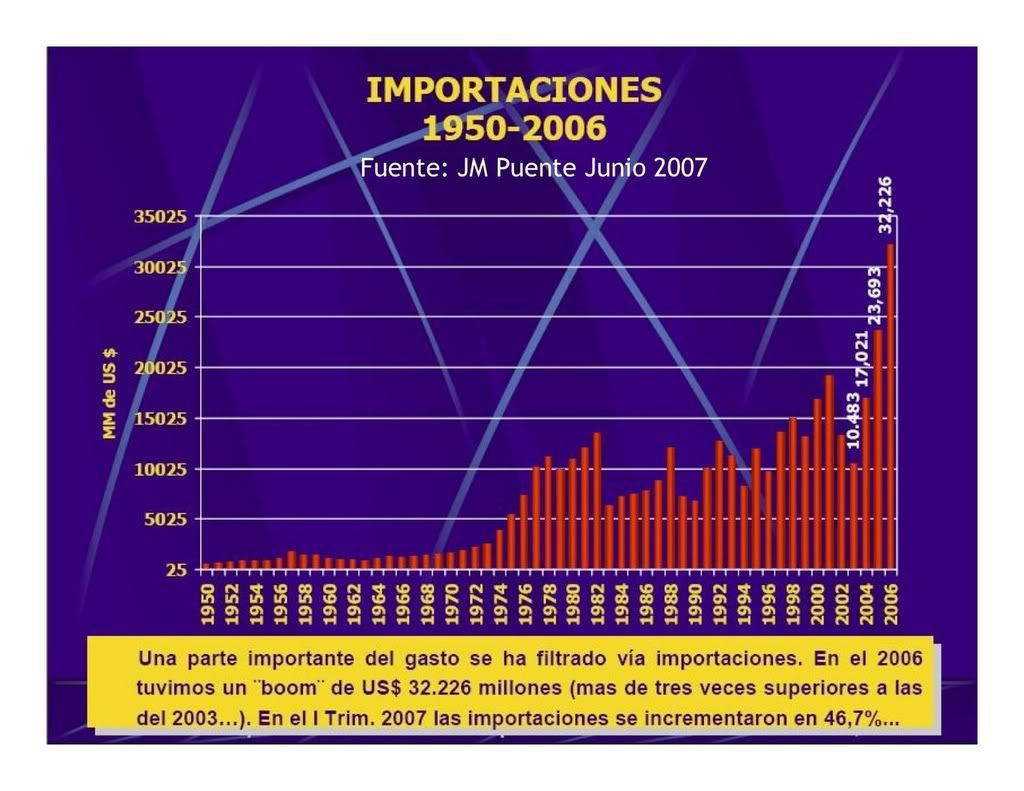

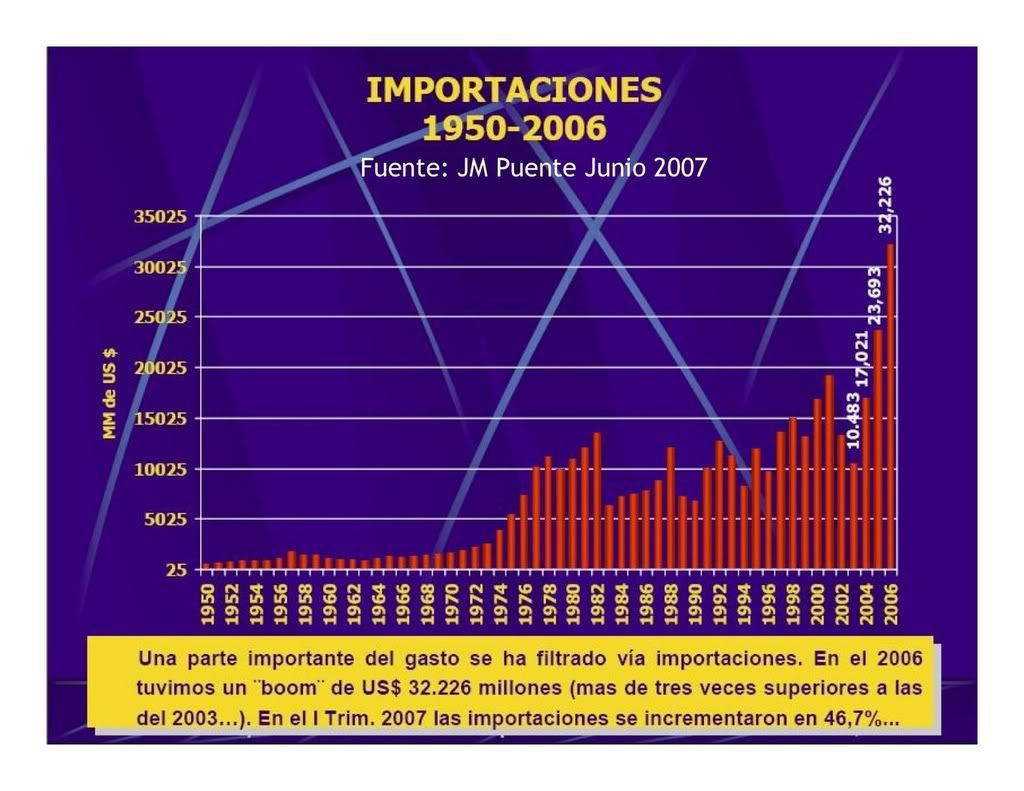

This also manifests itself in a couple of other charts given in the presentation such as this one showing imports:

Note the huge boom in imports doesn't even include 2007 which will likely be way over $40 billion and off this chart. Again, those imports, some of which ARE necessary, create jobs for foriegners not Venezuelans.

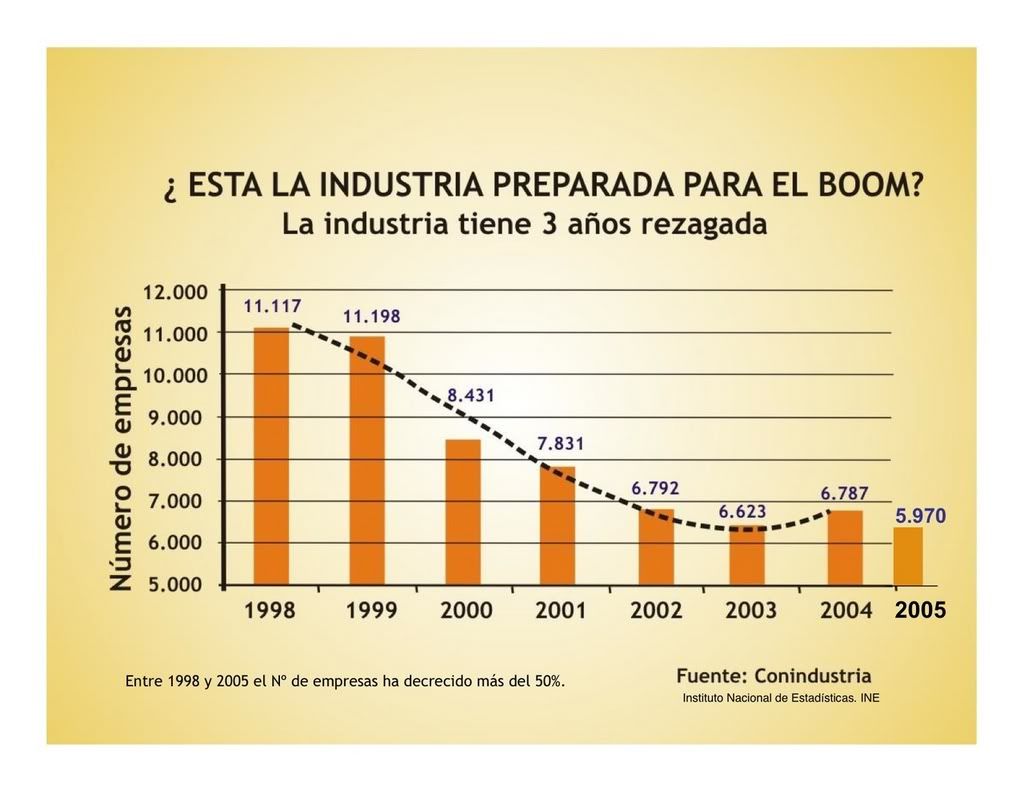

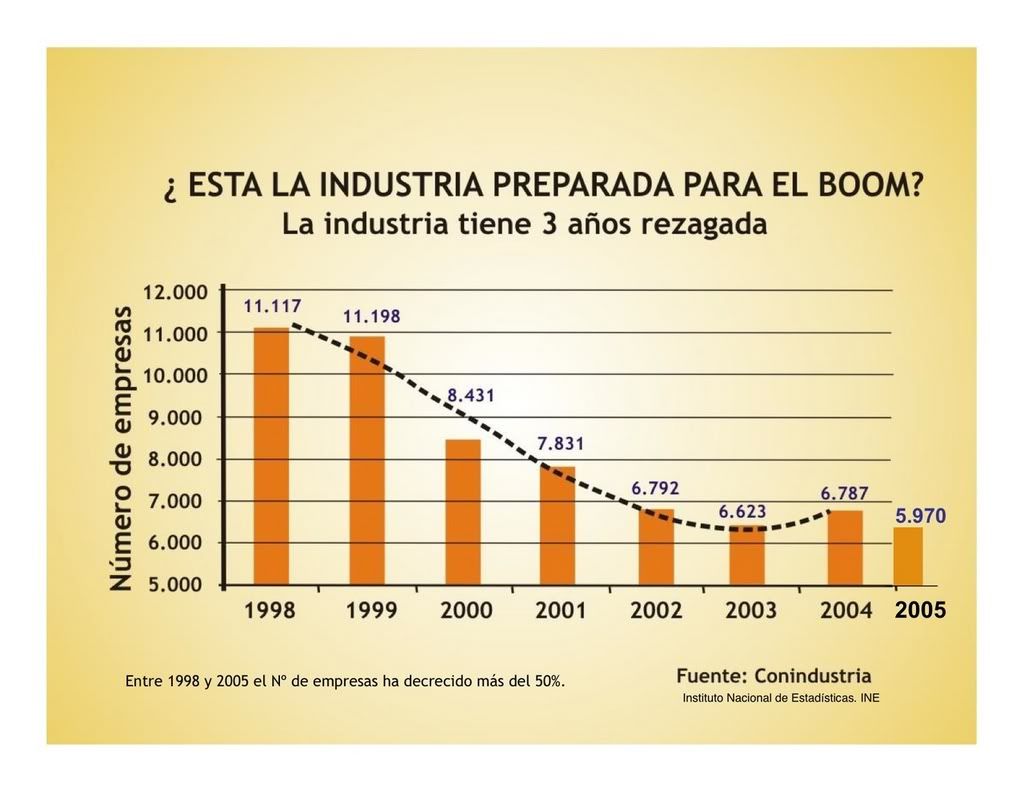

The repurcussions of this can see in the constuction industry where the number of firms had decreased at least through 2005:

I would expect that 2006 and 2007 would show an increase in the number of construction firms. Still, contrast this chart with that of the imports and you should be able to see part of what the problem is.

This has shown how just a couple of segments of the Venezuelan economy are impacted by nefarious policy of having an overvalued currency. It is great for U.S., German, Korean, Japanese, Brazilian and Colombian autoworkers and companies. Yet it isn't so great for Venezuelan construction workers and suppliers. Money that could greatly benefit the Venezuelan economy by creating tens or even hundreds of thousands of construction jobs in Venezuela instead leaves the country while creating maybe a handful of jobs in car dealerships.

This mistaken economic policy creates very large losses for Venezuela because the incentives this policy creates are so strong they easily overwhelm government subsidies meant to counteract them.

One really has to wonder why this is allowed to happen and how much longer it will continue.

|

Over the past several years Venezuela has experienced a huge boom in the purchase of automobiles. Sales have set all time records year after year and look to go over 400,000 units this year. It should be noted that the great majority of cars are imported, or if assembled in Venezuela, made almost entirely with imported components. That is, very little of the value of those automobiles is actually created in Venezuela.

It is also known that Venezuela has a huge housing shortage. Many people live in substandard units, sometimes little more than shacks, or in overcrowded homes with relatives. The housing shortfall is generally put at at least 1.5 million units.

In contrast to cars, most all the value of home contruction stays in Venezuela - the actual construction is in Venezuela, the cement and reinforcing steel is made in Venezuela, ceramic tiles and other fixtures are made in Venezuela, and furniture is made in Venezuela.

Given that, when money is spent building a house in Venezuela nearly all the value accrues to the Venezuelan economy. Venezuelan construction workers get jobs building it. Venezuelan cement, steel, tile, and furniture factories also get more demand for their products. Therefore money spent on housing goes almost entirely to Venezuelans and creates a multiplier effect through putting money in the pockets of other Venezuelans that really boosts the economy.

By way of contrast, virtually every Bolivar spent on cars promptly leaves the country due to the cars either being made overseas or made with imported parts. So that money goes into the pockets of people in Detroit and Stutgart much more than the in the pockets of people in Valencia.

Further, while housing fills an urgent societal need of helping people live better private transportation creates additional burdens on society by consuming subsidized gasoline and producing a lot of pollution.

Given that building homes would seem to do a lot more to better Venezuela than importing cars we would think the Venezuelan government would make sure that happens. But it doesn't. Witness the following chart from a VenAmCham presentation:

As you can see, while housing has stayed flat for most of the Chavez administration and picked up only a little of late automobile sales have sky rocketed. Given the above this is clearly not good.

But why is this happening? Why would people be so heavily favoring automobiles when houses are needed just as badly (if not more so) and are almost always a better investment?

The answer to takes us right back to the Venezuelan currency, the Bolivar, and how it relates to the dollar. In fact, the above chart is really a damning indictment of the aspect of Chavez's economic policy whereby he has allowed the Venezuelan currency to become so overvalued.

Remember, houses are almost entirely Venezuelan made. So as prices in Venezuela go up in Venezuela housing prices also go up. As Venezuelan inputs like labor get more expensive, houses get more expensive. The end result is that houses have been getting more expensive in Venezuela. Yes peoples salaries have gone up, maybe even more than the housing prices, but the point is housing prices have been going up alot.

Now lets contrast that with cars. They are not made with Venezuelan inputs (or only mimimaly so) given that they are imported. Being imported they are originally priced in dollars and what determines how their price changes in Venezuela is determined by how the value of Venezuelan currency varies compared to the dollar.

As we know, a dollar is still worth 2,150 bolivares and that hasn't changed in years. That is a car that cost $50,000 dollars cost 107 million Bolivares three years ago and it still costs 107 million Bolivares today. Therefore, during the past three years of inflation, of housing prices going up, and of wage increases, the price of an imported car has stayed the same. This of course means that cars have become MUCH, MUCH cheaper for Venezuelans relative to other things like houses that are made in Venezuela. No wonder people are running out and buying cars instead of houses.

People buy more of things that get cheaper and less of things that get more expensive. The Bolivar not being devalued has made cars get much cheaper relative to cars in Venezuela over the past several years. Therefore Venezuelans are buying cars rather than houses - this isn't rocket science.

As an additional point on this it should be noted that the government actually subsidizes new home purchases for most people by giving them grants of up to $8,000 for the purchase. Yet even that subsidy is not enough to overcome the huge bargain that the overvalued Bolivar makes cars and get people to buy houses instead.

This also manifests itself in a couple of other charts given in the presentation such as this one showing imports:

Note the huge boom in imports doesn't even include 2007 which will likely be way over $40 billion and off this chart. Again, those imports, some of which ARE necessary, create jobs for foriegners not Venezuelans.

The repurcussions of this can see in the constuction industry where the number of firms had decreased at least through 2005:

I would expect that 2006 and 2007 would show an increase in the number of construction firms. Still, contrast this chart with that of the imports and you should be able to see part of what the problem is.

This has shown how just a couple of segments of the Venezuelan economy are impacted by nefarious policy of having an overvalued currency. It is great for U.S., German, Korean, Japanese, Brazilian and Colombian autoworkers and companies. Yet it isn't so great for Venezuelan construction workers and suppliers. Money that could greatly benefit the Venezuelan economy by creating tens or even hundreds of thousands of construction jobs in Venezuela instead leaves the country while creating maybe a handful of jobs in car dealerships.

This mistaken economic policy creates very large losses for Venezuela because the incentives this policy creates are so strong they easily overwhelm government subsidies meant to counteract them.

One really has to wonder why this is allowed to happen and how much longer it will continue.

|

Debt reduction for fiscal year 2008

Today we learn from the El Universal that the debt payments in 08 will be $7.45 billion or 12% of the budget, $1.81 billion for the internal and $5.64 billion for the external debt. The latter being divided in $2.51 in debt repayment and $3.08 billion in interest paid.

Now what is interesting is how this will be financed. 54% will be paid in cash and the rest will be refinanced (ie more loans with better interests). Eventually there are plans to only pay without the need to even refinace.

Venezuela is one of the countries with the lowest external debt per nominal GDP, with the latter growing exponentially (almost 30% each year) it is good to know that overall external debt is also falling as well.

|

Now what is interesting is how this will be financed. 54% will be paid in cash and the rest will be refinanced (ie more loans with better interests). Eventually there are plans to only pay without the need to even refinace.

Venezuela is one of the countries with the lowest external debt per nominal GDP, with the latter growing exponentially (almost 30% each year) it is good to know that overall external debt is also falling as well.

|

Sunday, October 21, 2007

Too cool to spend?

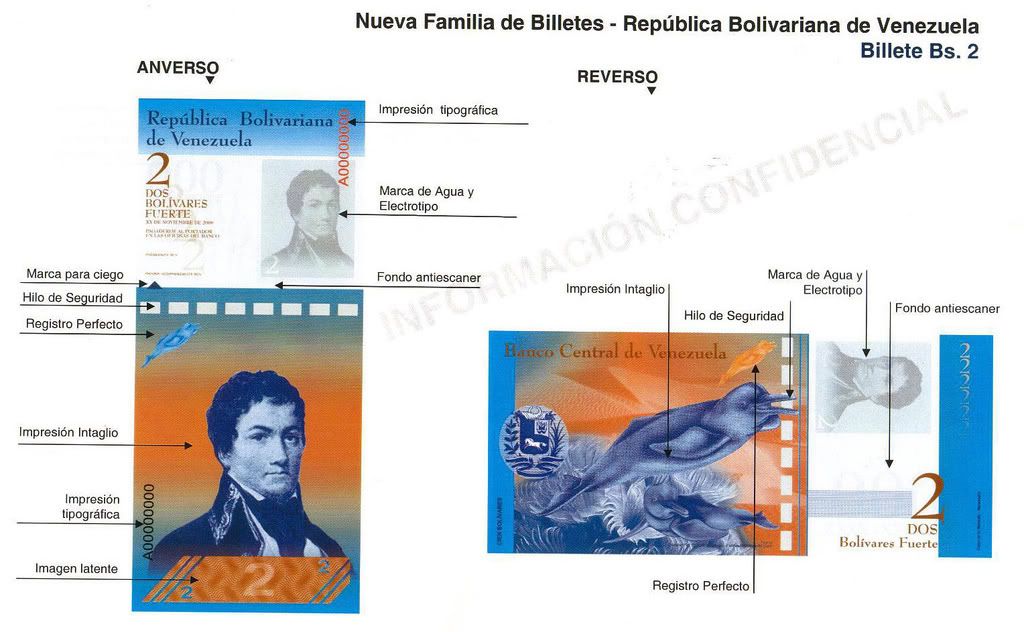

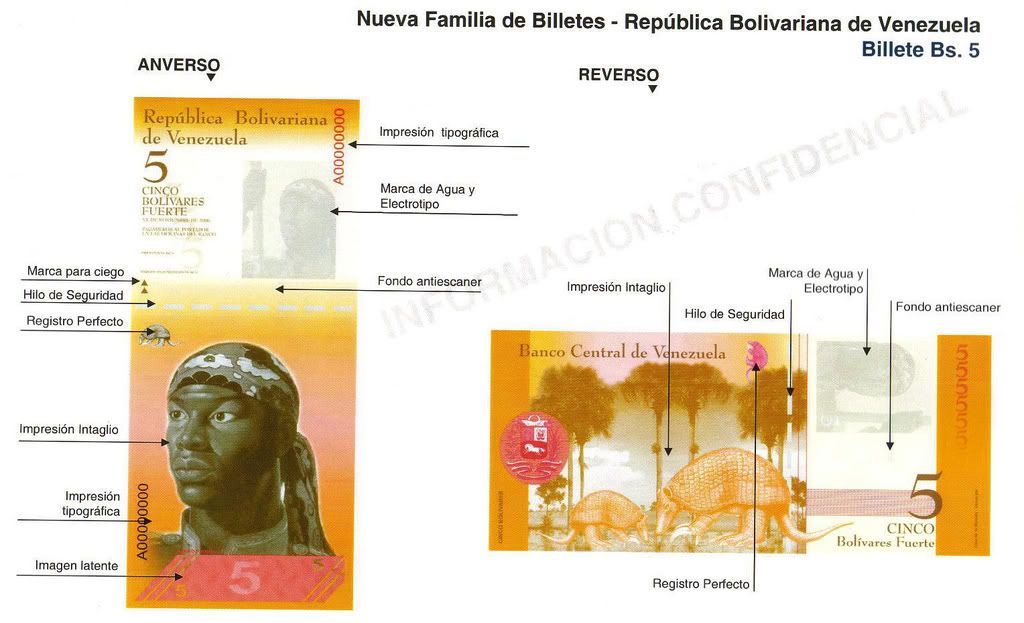

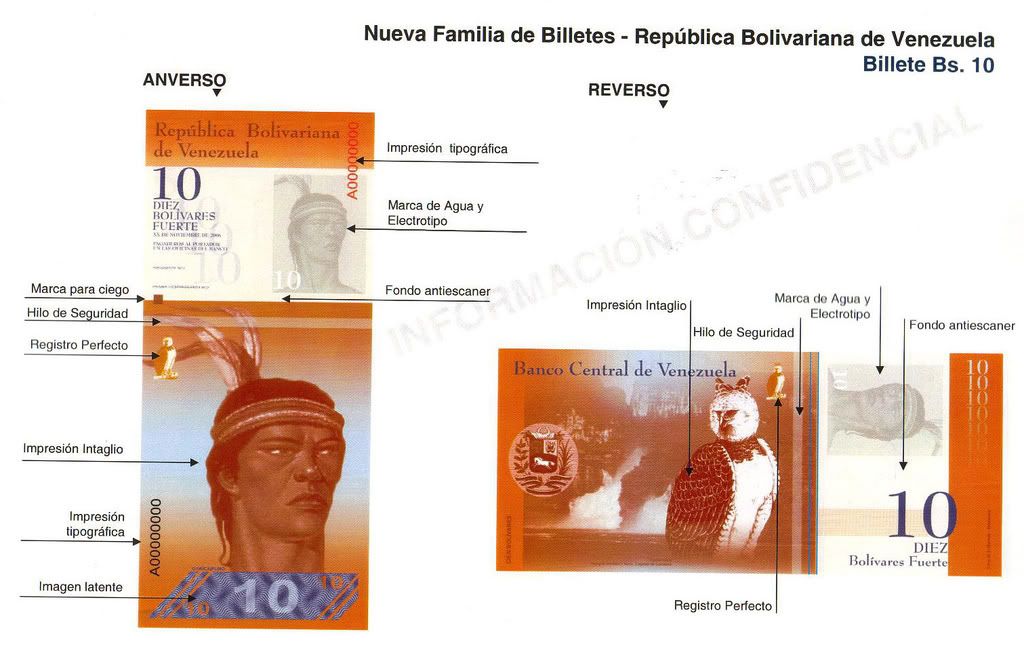

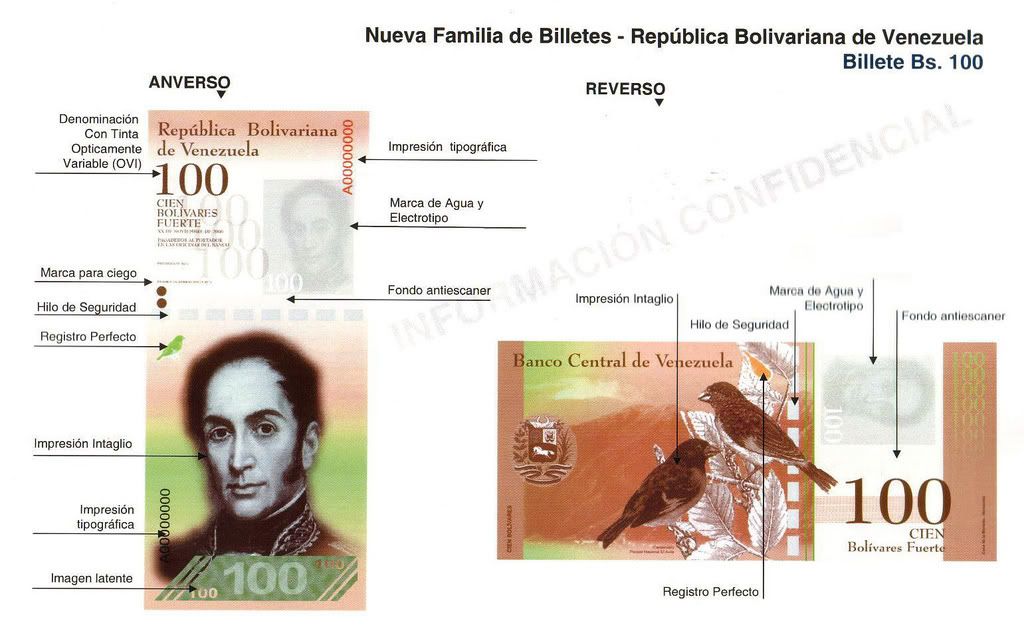

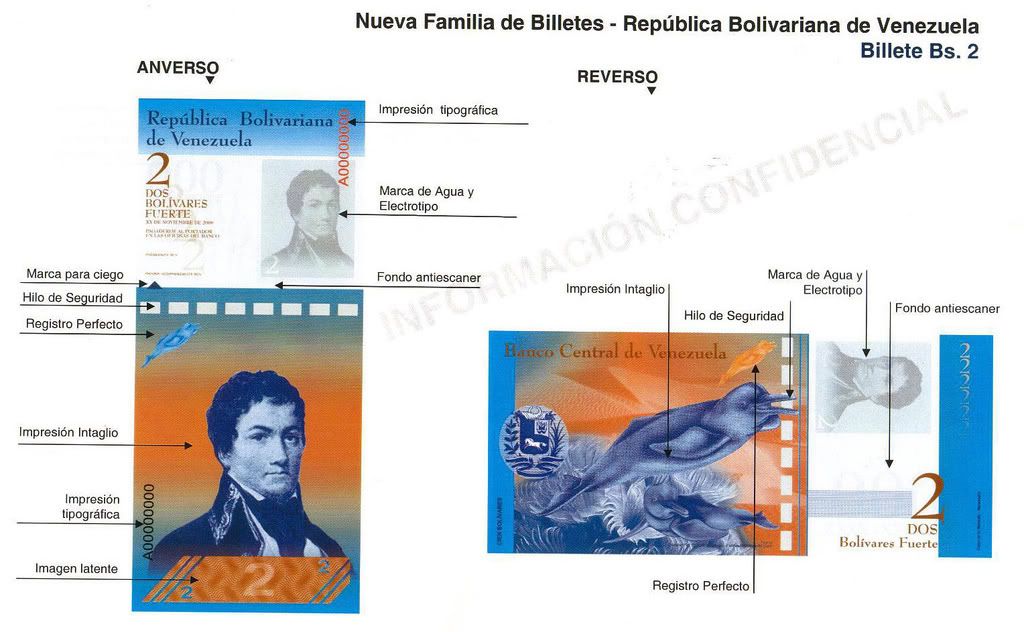

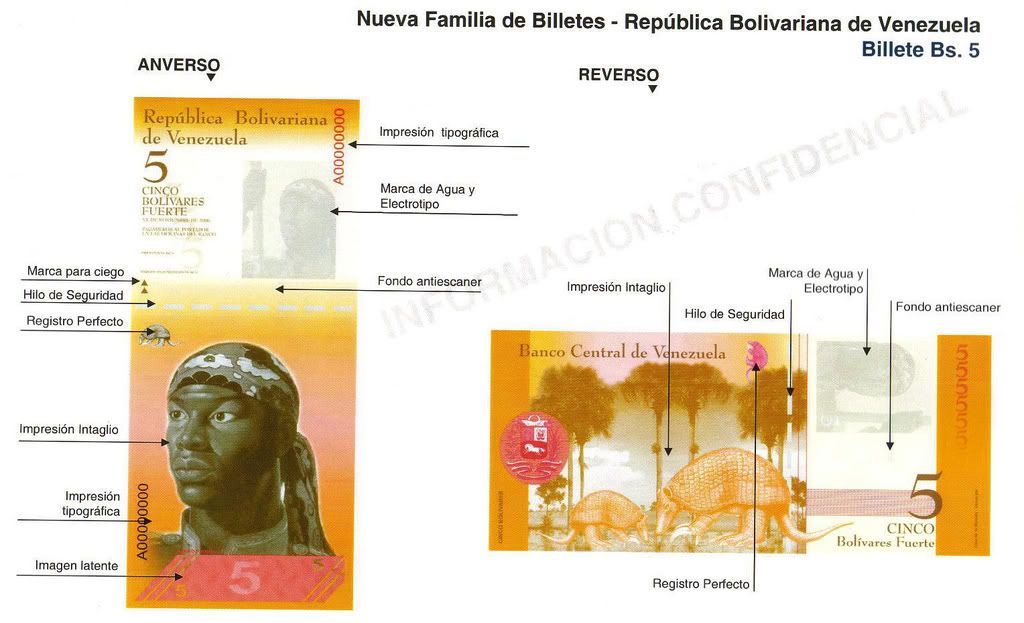

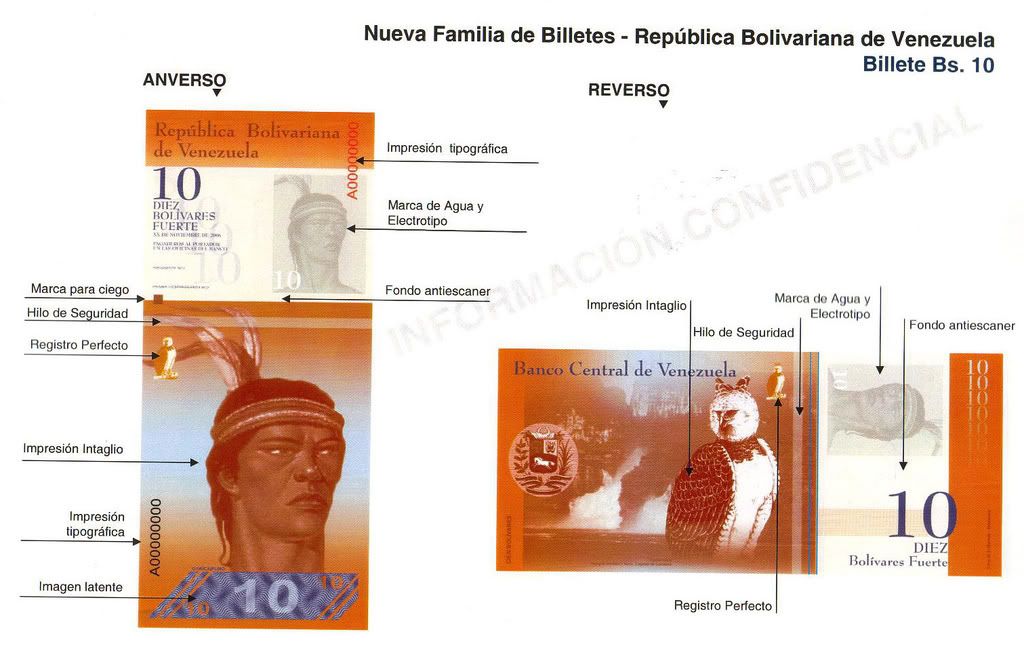

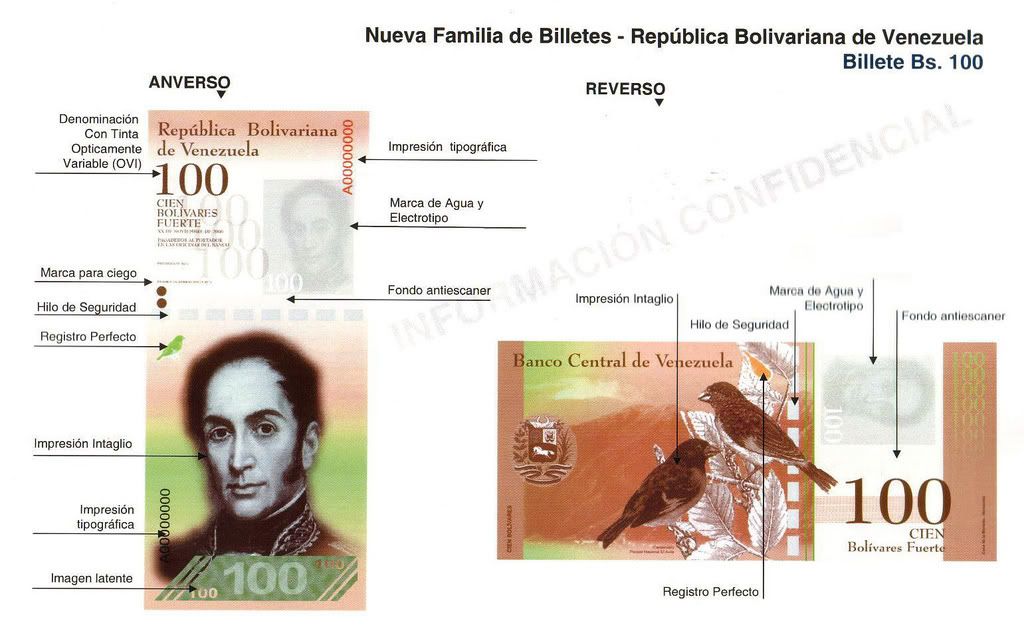

I thought I'd take a break today from all the dry discussion about the value of Venezuela's currency and instead discuss the currency itself - you know, the actual paper stuff with numbers on it.

As most of you know Venezuela will soon be switching to a new currency called the Bolivar Fuerte (strong Bolivar) which will have more value than the current Bolivar. In effect they will be lopping off three zeros so that whereas 2,150 Bolivares equaled one dollar now 2.15 Bolivar Fuertes will equal a dollar.

Sounds good. It should keep the batteries on peoples calculators from wearing down so fast, if nothing else.

But one thing that does need to be noted is that this is some really, really nice looking money. Here are what the basic paper bills will look like:

That surely puts U.S. money to shame - doesn't it. I can't wait to stock up on some of this stuff. Question is, looking so good, will people really be willing to spend it?

One minor critique though, they really should have thought of a different name. After all, if a currency really is "strong" you probably don't need to make that word part of its name.

|

As most of you know Venezuela will soon be switching to a new currency called the Bolivar Fuerte (strong Bolivar) which will have more value than the current Bolivar. In effect they will be lopping off three zeros so that whereas 2,150 Bolivares equaled one dollar now 2.15 Bolivar Fuertes will equal a dollar.

Sounds good. It should keep the batteries on peoples calculators from wearing down so fast, if nothing else.

But one thing that does need to be noted is that this is some really, really nice looking money. Here are what the basic paper bills will look like:

That surely puts U.S. money to shame - doesn't it. I can't wait to stock up on some of this stuff. Question is, looking so good, will people really be willing to spend it?

One minor critique though, they really should have thought of a different name. After all, if a currency really is "strong" you probably don't need to make that word part of its name.

|