Saturday, June 03, 2006

Watch what they do not what they say.

Many in the international and Venezuelan press are trying to trumpet the failure of the recently concluded OPEC summit to call for quota and output reductions as a setback for Venezuela and Iran. Those two countries had been warning about growing oil inventories and the risk of a price collapse unless production was cut back. But, according to most of the press, "moderates" such as Saudi Arabia had prevailed upon the organization not to cut back production in the face of still quite high oil prices. Or so it is said.

The reality of what is being done is apparently more complex as this article from page 2 of June 2nds Wall Street Journal shows:

OPEC had seemed to be in something of a pickle. Oil inventories are growing quite large and a sudden price collapse is possible. But the obvious solution of a cutback in production quotas would be a public relations disaster with oil selling at $70 per barrel. The solution? Leave quotas officially the same to assuage consumers but in reality cut back on your production. A very elegant solution by OPEC which has been completely missed by most people who are just focusing on the news about the quotas not being changed.

So while the opposition is gleefully asserting that the summit was a failure for Chavez in reality he has been getting precisely what he wanted - a price supporting production cutback. Once again we see that Chavez and OPEC are quite shrewd while the dunces that make up the opposition just don't get it. They are fixated on bombast and rhetoric while missing what is really going on behind the scenes.

|

The reality of what is being done is apparently more complex as this article from page 2 of June 2nds Wall Street Journal shows:

OPEC Maintains Output Targets but Trims Supply

Caracas - With oil prices still above $70 a barrel, the Organization of Petroleum Exporting Countries left its oil-output targets unchanged as expected. But behind the scenes, some major exporters already have begun making moves to effectively trim oil supply, said delegates attending the meeting.

The cartel didn't take up the hawkish call by Venezuelan President Hugo Chavez to formally cut output, set a price ceiling of "infinity" or shift the pricing of petroleum to euros instead of dollars. Qatari oil minister Abdullah bin Hamad Al-Attiyah said yesterday OPEC ministers had decided to leave output unchanged.

.....................................................

But some analysts estimate that oil supply from OPEC nations is already well below the formal output quota of 28 million barrels a day, exluding Iraq, and is running as much as one million barrelsa day less than a year ago.

.....................................................

The Saudis are producing less oil, say cartel officials. Saudi and Iranian producers, through a pricing mechanism that either encourages or discourages buyers, also have taken steps to reduce the amount of oil that reaches the market, the officals said.

...............................................

The reason for the cutbacks: While oil use is rising, global inventories are flush. This is causing concern in OPEC that if investors cut back on heavy purchases of oil futures, prices could fall precipitously. Underscoring those concerns, Saudi Oil Minister Ali Naimi said yesterday the oil market is both oversupplied and overpriced, adding that the OPEC heavyweight is seeing no extra dmeand from its customers for oil, especially the heavy crude that's more difficult to refine into fuels like gasoline.

Oil ministers are saying oil prices are being driven up by financial investors, not by fundamentals of supply and demand. "Oil could drop to $40 per barrel" if hedge and pension funds decide the price has peaked and redirect money into other markets, said one senior delegate from a major Middle Eastern country.

Such worries may seem misplaced at a time when the world economy is using up more oil. OPEC's leaders reply that they have seen oil markets turn quickly in the past. In the late 1990s, prices plunged below $11 a barrel as Asian economies tanked when inventories were high. While markets can turn on a dime, curtailing production and reducing inventory can take months.

As a result, key OPEC members are adjusting their prodution and deliveries downward to preclude further, price-threatening increases in consumer stockpiles of oil, thus preparing for the day when markets turn against them. But they are doing so quietly, because of consumer anger over high prices at the pump. As a whole, OPEC's output has fallen by about 600,000 compared with less than a year ago, at about 27.3 million barrels a day excluding Iraq, according to PFC Energy, a Washington oil-consulting company. That doesn't include oil pumped but put in storage instead of sold. Saudi Arabia, Iran, Venezuela, and Nigeria are all producing less oil than they did a year ago.

"They're starting to draw down hefty crude stocks" world-wide, said Roger Diwan, a PFC analyst, on the sidelines of the OPEC meeting. "This will position them better for any downturn in price or demand."

Some of the decline, say OPEC officials, results from an attempt by Saudi Arabia and Iran to keep world oil supplies in check. They are dong this by opting not to discount heavy, high-sulfur grades of crude oil.

OPEC had seemed to be in something of a pickle. Oil inventories are growing quite large and a sudden price collapse is possible. But the obvious solution of a cutback in production quotas would be a public relations disaster with oil selling at $70 per barrel. The solution? Leave quotas officially the same to assuage consumers but in reality cut back on your production. A very elegant solution by OPEC which has been completely missed by most people who are just focusing on the news about the quotas not being changed.

So while the opposition is gleefully asserting that the summit was a failure for Chavez in reality he has been getting precisely what he wanted - a price supporting production cutback. Once again we see that Chavez and OPEC are quite shrewd while the dunces that make up the opposition just don't get it. They are fixated on bombast and rhetoric while missing what is really going on behind the scenes.

|

Friday, June 02, 2006

Keeping tabs on Oil Wars

Sorry to interrupt the discussion on Venezuela but there is an important public service announcement for Oil Wars reads that needs to be made. It has just been announced that in an effort to combat terrorism, child pornography, and general lawlessness the U.S. government is probably going to start tracking all the Internet surfing activities of the entire U.S. (and world?) population. That’s right, the revolution may not be televised but it will be tracked by the CIA, NSA, and FBI. Plus Rumsfeld won't want to be left behind so I'm sure the defense intelligence agencies will get their grubby hands in there too.

Why does this affect you - Oil Wars readers? Well, you may not think of this as a "terroristic" site but please remember the powers that be have quite an expansive definition of "terrorism". In fact, anything which "terrifies" the rich, business owners, the U.S. government or South American oligarchs probably qualifies as terrorism.

Hence, you would be wise to start thinking up a good reason what you were doing reading this site. And that goes for you too, opposition readers. Do you really think the highly intelligent people at the F.B.I. are going to buy your story of "I just went there to troll". Not likely. I'd really hate to see someone as uninformed, naive, and just plain silly as Latin Dreams wind up doing hard time in Leavenworth just because he was coming to this site trying to learn a thing or two about Venezuela.

Think this can't be true, that this must all be a figment of O.W.'s imagination? Think again as you read this from today's New York Times:

Now, before everyone goes and gets all agitated please keep in mind its not going to be easy for them to do this. Whereas a few years ago they could just utter the word "terrorism" or "Osama Bin-Laden" and get whatever they want, eliminating taxes on inheritance, that now seems not to work so well. So they are having to come up with new scare tactics:

Personally, I'm not all that worried about the child porn angle to this. When I'm checking out a new porn video I am very conscientious and always make sure all the actors involved are over 18. Although I did have a problem one time. Some co-workers and I downloaded a video of some guy having sex with a German Sheppard. The guy was clearly over 18 but the dog we weren't so sure about. Plus we didn't know if for purpose of determining majority age with a dog you are supposed to use human years or doggie years. After spending two hours in vain searching through Wilkepedia trying to figure that out we did the prudent thing, we deleted the file without ever having watched it.

But I am digressing. What I really want to know (and I want to hear from opposition supporters on this) is how in Gods name did this guy get away with showing child pornography in a government meeting without getting arrested? I know if at my job I started off a meeting showing slides of kiddy porn it probably wouldn't take more than 10 minutes for me to escorted out of the building in handcuffs. Yet the chief law enforcement official in the land, the Attorney General of the United States, can sit in an official meeting and look at child pornography!! Your tax dollars hard at work.

So I defy any of our PSP (Pendejos Sin Poder) friends,the same ones that bitch about Chavez breaking the law by wearing a military uniform, to come here and explain how the U.S. is a nation of laws yet it allows top government officials to sit around looking at kiddy porn. If there were truly separation of powers and rule of law how could someone so flagrantly break the law and nothing happens to them? And please tell us how many times Chavez, Rangel, or Isaias Rodriguez have started off meetings with slide shows of child pornography? So, my PSP friends, its put up or shut up time. We're awaiting your explanation.

|

Why does this affect you - Oil Wars readers? Well, you may not think of this as a "terroristic" site but please remember the powers that be have quite an expansive definition of "terrorism". In fact, anything which "terrifies" the rich, business owners, the U.S. government or South American oligarchs probably qualifies as terrorism.

Hence, you would be wise to start thinking up a good reason what you were doing reading this site. And that goes for you too, opposition readers. Do you really think the highly intelligent people at the F.B.I. are going to buy your story of "I just went there to troll". Not likely. I'd really hate to see someone as uninformed, naive, and just plain silly as Latin Dreams wind up doing hard time in Leavenworth just because he was coming to this site trying to learn a thing or two about Venezuela.

Think this can't be true, that this must all be a figment of O.W.'s imagination? Think again as you read this from today's New York Times:

The Justice Department is asking Internet companies to keep records on the Web-surfing activities of their customers to aid law enforcement, and may propose legislation to force them to do so.

The director of the Federal Bureau of Investigation, Robert S. Mueller III, and Attorney General Alberto R. Gonzales held a meeting in Washington last Friday where they offered a general proposal on record-keeping to a group of senior executives from Internet companies, said Brian Roehrkasse, a spokesman for the department. The meeting included representatives from America Online, Microsoft, Google, Verizon and Comcast.

The attorney general has appointed a task force of department officials to explore the issue, and that group is holding another meeting with a broader group of Internet executives today, Mr. Roehrkasse said. The department also met yesterday with a group of privacy experts.

The Justice Department is not asking the Internet companies to give it data about users, but rather to retain information that could be subpoenaed through existing laws and procedures, Mr. Roehrkasse said. [hmm. wonder if that will be the same subpoena system they use for wiretaps? - ow]

While initial proposals were vague, executives from companies that attended the meeting said they gathered that the department was interested in records that would allow them to identify which individuals visited certain Web sites and possibly conducted searches using certain terms. [ Today, August 15, 2008, an internet addict who goes by the screen name Pulp was sentenced to 28 consecutive live sentences - one for each time he did a Google search for "Hugo Chavez" - with no possibility of parole. In a nationally televised address President Bush told Americans they should sleep easier knowing their government had "taken a vile accomplice of South American terrorism off the internet". - ow]

It also wants the Internet companies to retain records about whom their users exchange e-mail with, but not the contents of e-mail messages, the executives said. The executives spoke on the condition that they not be identified because they did not want to offend the Justice Department.

Now, before everyone goes and gets all agitated please keep in mind its not going to be easy for them to do this. Whereas a few years ago they could just utter the word "terrorism" or "Osama Bin-Laden" and get whatever they want, eliminating taxes on inheritance, that now seems not to work so well. So they are having to come up with new scare tactics:

In a speech in April, Mr. Gonzales said that investigations into child pornography had been hampered because Internet companies had not always kept records that would help prosecutors identify people who traded in illegal images.

"The investigation and prosecution of child predators depends critically on the availability of evidence that is often in the hands of Internet service providers," Mr. Gonzales said in remarks at the National Center for Missing and Exploited Children in Alexandria, Va. "This evidence will be available for us to use only if the providers retain the records for a reasonable amount of time," he said.

An executive of one Internet provider that was represented at the first meeting said Mr. Gonzales began the discussion by showing slides of child pornography from the Internet. But later, one participant asked Mr. Mueller why he was interested in the Internet records. The executive said Mr. Mueller's reply was, "We want this for terrorism."

At the meeting with privacy experts yesterday, Justice Department officials focused on wanting to retain the records for use in child pornography and terrorism investigations.

Personally, I'm not all that worried about the child porn angle to this. When I'm checking out a new porn video I am very conscientious and always make sure all the actors involved are over 18. Although I did have a problem one time. Some co-workers and I downloaded a video of some guy having sex with a German Sheppard. The guy was clearly over 18 but the dog we weren't so sure about. Plus we didn't know if for purpose of determining majority age with a dog you are supposed to use human years or doggie years. After spending two hours in vain searching through Wilkepedia trying to figure that out we did the prudent thing, we deleted the file without ever having watched it.

But I am digressing. What I really want to know (and I want to hear from opposition supporters on this) is how in Gods name did this guy get away with showing child pornography in a government meeting without getting arrested? I know if at my job I started off a meeting showing slides of kiddy porn it probably wouldn't take more than 10 minutes for me to escorted out of the building in handcuffs. Yet the chief law enforcement official in the land, the Attorney General of the United States, can sit in an official meeting and look at child pornography!! Your tax dollars hard at work.

So I defy any of our PSP (Pendejos Sin Poder) friends,the same ones that bitch about Chavez breaking the law by wearing a military uniform, to come here and explain how the U.S. is a nation of laws yet it allows top government officials to sit around looking at kiddy porn. If there were truly separation of powers and rule of law how could someone so flagrantly break the law and nothing happens to them? And please tell us how many times Chavez, Rangel, or Isaias Rodriguez have started off meetings with slide shows of child pornography? So, my PSP friends, its put up or shut up time. We're awaiting your explanation.

|

Thursday, June 01, 2006

Follow the money

Recently in the comments section some information was given regarding direct foreign investment (FDI) in Venezuela that showed it having gone up significantly. Some, however, questioned the accuracy or relevancy of those numbers.

Today some numbers were given in the Wall Street Journal (page A6) on on foreign investment in various Latin American countries. While it is not directly comparable to overall FDI because it only gives U.S. investment is is still very revealing. Here is the information:

Foreign Direct Investment/Latin America

Net Investment from the U.S., in millions of dollars, quarterly frequency

Country Latest; Previous

Mexico 1,905; 1,101

Brazil 56; 881

Argentina 384; 180

Venezuela 504; 330

Colombia 151; 40

Chile 197; -207

Peru 52; 111

Note: Negative values indicate net inflow into the U.S.

Source: Moody's Economy.com

So lets see what we have here. First, the biggest investment winner is Mexico as they get far more than everyone else. But look at who is number two. Yup, good old Venezuela at 504 million in the last quarter. And if you take into account that Mexico's population is about 4 times greater than Venezuela's Venezuela matches them on a per capita basis.

What's just as illuminating is to see who the laggards are - Chile which as had negative net investment from the U.S. over the past half year, Peru which is quite low, Colombia which is quite low, and Brazil which, factoring in the size of the country, is also quite low.

So its interesting to see how Venezuela actually outperforms a lot of these other ballyhooed economies when it comes to one of the main capitalist measurements. So it would seem that when it comes time to put up or shut up as to whether or not Venezuela is a good place to invest American investors are more than happy to put up. So it would seem yet more anti-Chavez propoganda, in this case that Venezeula is not getting investment, has been debunked.

|

Today some numbers were given in the Wall Street Journal (page A6) on on foreign investment in various Latin American countries. While it is not directly comparable to overall FDI because it only gives U.S. investment is is still very revealing. Here is the information:

Foreign Direct Investment/Latin America

Net Investment from the U.S., in millions of dollars, quarterly frequency

Country Latest; Previous

Mexico 1,905; 1,101

Brazil 56; 881

Argentina 384; 180

Venezuela 504; 330

Colombia 151; 40

Chile 197; -207

Peru 52; 111

Note: Negative values indicate net inflow into the U.S.

Source: Moody's Economy.com

So lets see what we have here. First, the biggest investment winner is Mexico as they get far more than everyone else. But look at who is number two. Yup, good old Venezuela at 504 million in the last quarter. And if you take into account that Mexico's population is about 4 times greater than Venezuela's Venezuela matches them on a per capita basis.

What's just as illuminating is to see who the laggards are - Chile which as had negative net investment from the U.S. over the past half year, Peru which is quite low, Colombia which is quite low, and Brazil which, factoring in the size of the country, is also quite low.

So its interesting to see how Venezuela actually outperforms a lot of these other ballyhooed economies when it comes to one of the main capitalist measurements. So it would seem that when it comes time to put up or shut up as to whether or not Venezuela is a good place to invest American investors are more than happy to put up. So it would seem yet more anti-Chavez propoganda, in this case that Venezeula is not getting investment, has been debunked.

|

Wednesday, May 31, 2006

Less is more

Tomorrow begins the meeting of OPEC ministers in Caracas Venezuela. While this meeting will probably be uneventful this is a good time to take a look back at how Venezuelan President Hugo Chavez helped revitalize OPEC and turn less oil into more money. This concept of less oil often equals more money is generally lost on the Venezuelan opposition who have their own reasons for wanting to maximize production. But it is not lost on those who monitor the global oil industry as shown by this article from 2000 in Oil Monthly. Their overview of what the trends were in the oil industry at that time give an insiteful account of how Chavez changed both Venezuela and OPEC. Here are some exertpts:

Seems like a pretty clear demonstration of the utility of restraining oil production as prices went from about $12 per barrel to $30 per barrel in one year as this chart shows:

And even the Norwegians can see the benefit of restraining production and reaping more revenue. To bad none of the candidates running against Chavez this year can. Some people never learn.

|

Less becomes more for OPEC - Organization of Petroleum Exporting Countries - Industry Overview

Although many analysts and industry skeptics never thought it would happen, OPEC finally managed to make one of its quota agreements stick. In the process, the group also achieved a significant reduction in global oil production. In March 1999, OPEC members (exclusive of Iraq) agreed to cut an additional 1.7 million bopd on top of two earlier accords reached in 1998. Now, nearly a year later, the agreement is still in effect, and OPEC has achieved its goal of raising oil prices significantly. Some observers would say that they have succeeded too well, as prices were hovering near $30/bbl as this article went to press.

.............................

Mexico. A three-year escalation of crude and condensate production came to an end last year. Output averaged 3.01 million bopd, down 5% from 1998's figure. The decline can be traced to Mexico's informal agreement with OPEC for mutual reductions in oil output, to shore up crude prices.

..............................

Venezuela. The days of Venezuelan quota-busting are gone. President Hugo Chavez and his appointees at the Ministry of Mines & Energy, and state firm PDVSA, have adhered fastidiously to OPEC quota reductions that have revived oil prices. As a result, the country's oil production fell nearly 12% in 1999, averaging 2.78 million bpd.

.............................

Norway. After cutting oil production by 100,000 bpd during 1998 and early 1999, Norwegian officials reduced output another 100,000 bpd to help prop up prices. As a result, Norwegian crude and condensate production declined 2%, to 3.04 million bpd. Statoil operated roughly 40% of all output. The government indicated that it would stick with the 200,000-bopd reduction through the first quarter of 2000.

...........................

After two consecutive years of significant increases, Middle Eastern oil production declined 2.30, to 20.878 million bpd. The decrease can be traced to OPEC's agreement to lower output, in an effort to raise oil prices. Most countries reduced production, although Iraq added more than 500,000 bopd as part of its United Nations-approved "oil for food" sales.

Seems like a pretty clear demonstration of the utility of restraining oil production as prices went from about $12 per barrel to $30 per barrel in one year as this chart shows:

And even the Norwegians can see the benefit of restraining production and reaping more revenue. To bad none of the candidates running against Chavez this year can. Some people never learn.

|

Tuesday, May 30, 2006

Chavez and OPEC

I try to avoid simply posting entire newspaper articles. However, in the run up to the OPEC meeting in Caracas I think its important to give as much background on OPEC and Venezuela's relationship with it as possible. Hence, I found this New York Times article to be worth reproducing:

A few points here merit comment. First, it is good that OPECs ranks may be expanding. The more of the oil market that OPEC controls the more clout it will have. Ecuador's production is small but it will be interesting to see if AMLO wins in Mexico if he can be pursuaded to join OPEC. The other big fish would be Russia. It would seem to be a natural fit as Putin clearly seems to understand that holding oil off the market and boosting prices can be very beneficial. However, I think he is a little too independent to actually joine OPEC. Norway, like Russia, understands the benefit of reducing production and, as we will see in future posts, has co-operated with OPEC by cutting production. But they are also unlikely to join.

However, while OPEC only controls about 40% of actual production they control over 70% of actual reserves because they produce much less oil in relation to what they have than others do. That means as time goes by OPECs power should grow as non-OPEC countries deplete their supplies.

Another important point from the article is that whereas previous Venezuelan governments emphasized production volume what Chavez cares about is how much money is coming into the country. It would seem a no brainer that what matters is profits, not production. Yet I can't tell you how many times I've heard opposition supporters claim that PDVSA and Venezuela are not as good as they used to be because they are producing less oil. This is particulary ironic because PDVSA's previous management always bragged about how they ran the company as a commercial concern. Yet this would be a rather odd commercial enterprise as generally commercial enterprises emphasize profits rather than production volume. So in point of fact PDVSA is now run much more like a commercial enterprise, in that it maximizes profits, than it was previously.

Of course, it seems no article can go by without the standard errors, and this one is no exception. I trust by now most people can easily spot them.

|

HOUSTON, May 29 — When President Hugo Chávez of Venezuela wraps up this week's meeting of OPEC's 11 members in Caracas with an excursion for delegates to Canaima National Park, the location of the world's tallest waterfall, it will be another chance to remind energy markets of his influence in helping drive oil prices above $70 a barrel.

Of course, most delegates to the Thursday meeting are expected to nod politely to Venezuela's calls for output cuts that could drive prices even higher, while doing the opposite by reaping all they can from the current bonanza of high prices. The oil minister of the United Arab Emirates rejected talk on Monday of a possible cut in the cartel's output quotas of 28 million barrels a day.

Mohamed Binhttp Dhaen al-Hamli, head of the U.A.E.'s delegation to the Organization of the Petroleum Exporting Countries, told reporters in Abu Dhabi that he did "not expect a change in the production level." Officials from Iran, an ally of Venezuela and OPEC's second-largest producer after Saudi Arabia, recently said they did not expect any output cuts this week.

Still, Mr. Chávez is using the meeting as a platform to celebrate energy policies that irk the United States. The meeting is the organization's first in Caracas since 2000, when Mr. Chávez emerged triumphant from an effort to instill discipline within OPEC after oil had plunged to $8 a barrel in the late 1990's. (Oil prices ended last week at $71.37 a barrel; markets were closed on Monday for a holiday.)

One of Mr. Chávez's goals is to increase OPEC's ranks. Mr. Chávez said last week that Venezuela would back Ecuador if it decided to rejoin OPEC, following Ecuador's decision this month to expel its largest foreign investor, Occidental Petroleum of Los Angeles. Venezuela also offered to refine at subsidized rates oil exported by Ecuador, which was an OPEC member from 1973 to 1992, when it dropped out saying that it could not afford OPEC's membership fees. In another move that could add friction to the competition for oil resources between the United States and China, Sudan said last week that it was considering an invitation from Nigeria to join OPEC. With sanctions preventing American oil companies from investing in Sudan, China has emerged as a key investor in the country, Africa's third-largest oil producer after Nigeria, a longtime OPEC member, and Angola.

These efforts to enlarge OPEC, responsible for about 40 percent of the world's 84 million barrels a day of production, play directly into the ambitions of Mr. Chávez. He has been pushing for more nationalistic energy policies in Venezuela and other countries in South America like Bolivia, which has received generous financial backing from Venezuela.

It was a Venezuelan, after all, who was largely responsible 46 years ago for creating OPEC by modeling the group in part on the Texas Railroad Commission, an entity formed to prevent wild plunges in oil prices in the United States due to overproduction. Juan Pablo Pérez Alfonso, Venezuela's oil minister at the time, persuaded four nations from the Middle East to join OPEC at a meeting in Baghdad in September 1960.

While that meeting set the stage for the nationalization of oil assets in OPEC countries like Venezuela and Saudi Arabia in the 1970's, by the 1990's Venezuela was widely considered a saboteur of OPEC's efforts to raise oil prices by persistently producing above its official quotas and inviting foreign oil companies to help expand output.

It may seem like a distant memory in today's context of more belligerent rhetoric, but Venezuela had plans to double its oil production to seven million barrels a day before Mr. Chávez was elected president in 1998. Mr. Chávez reversed that policy, while also persuading OPEC members that output cuts, not ambitious investment programs, were needed to boost oil revenues.

"The Chávez administration doesn't care about market share," said David Mares, a professor of political science at the University of California at San Diego who closely follows Venezuela's energy industry. "They care about the absolute amount of money coming into the country."

Few of Mr. Chávez's critics within Venezuela argue that high oil prices, whether driven earlier by his push for production discipline within OPEC or by today's robust demand for oil by China, India and the United States, have not increased Venezuela's financial clout. Oil export revenue climbed by $4.1 billion in the first quarter from a year earlier, increasing Venezuela's current account surplus by $2.8 billion to $7.5 billion, according to Barclays Capital.

Venezuela's stagnant oil production, however, points as much to a bounty lost as one gained. Venezuela produces just 2.2 million to 2.5 million barrels of oil a day, according to most analysts. That figure is down considerably from its output peak of about 3.5 million barrels a day, reached before Mr. Chávez purged Petroleos de Venezuela, the national oil company, of middle- and upper-management employees who had shut the company down in an effort to destabilize his presidency.

Meanwhile, OPEC's most pivotal member, Saudi Arabia, has comfortably raised production in recent years, even though much of its excess capacity is not easy to refine. With almost every OPEC member producing flat-out in an effort to meet unprecedented global demand, Venezuela lost an opportunity to earn even more from oil.

"The Saudis took their market share," said Amy Myers Jaffe, associate director of the energy program at Rice University. "They're pumping a million barrels a day more at $70 a barrel, while Venezuela is pumping about a million barrels a day less."

It may be with somewhat token symbolism, then, if Mr. Chávez calls for more cuts in OPEC's output this week. For Mr. Chávez to enhance his influence inside OPEC and to finance his ambitious foreign and domestic policies, analysts estimate that Venezuela needs to carry out plans to double its production to 5 million barrels a day.

It remains to be seen how this increase can be accomplished as Venezuela exerts greater control over international oil companies, which account for as much as half of its oil production. Venezuelan energy officials have signaled in recent days that they would seek up to a 60 percent controlling stake in exploration projects in the Orinoco River basin, one of the world's most promising, though politically complicated, oil reserves.

A few points here merit comment. First, it is good that OPECs ranks may be expanding. The more of the oil market that OPEC controls the more clout it will have. Ecuador's production is small but it will be interesting to see if AMLO wins in Mexico if he can be pursuaded to join OPEC. The other big fish would be Russia. It would seem to be a natural fit as Putin clearly seems to understand that holding oil off the market and boosting prices can be very beneficial. However, I think he is a little too independent to actually joine OPEC. Norway, like Russia, understands the benefit of reducing production and, as we will see in future posts, has co-operated with OPEC by cutting production. But they are also unlikely to join.

However, while OPEC only controls about 40% of actual production they control over 70% of actual reserves because they produce much less oil in relation to what they have than others do. That means as time goes by OPECs power should grow as non-OPEC countries deplete their supplies.

Another important point from the article is that whereas previous Venezuelan governments emphasized production volume what Chavez cares about is how much money is coming into the country. It would seem a no brainer that what matters is profits, not production. Yet I can't tell you how many times I've heard opposition supporters claim that PDVSA and Venezuela are not as good as they used to be because they are producing less oil. This is particulary ironic because PDVSA's previous management always bragged about how they ran the company as a commercial concern. Yet this would be a rather odd commercial enterprise as generally commercial enterprises emphasize profits rather than production volume. So in point of fact PDVSA is now run much more like a commercial enterprise, in that it maximizes profits, than it was previously.

Of course, it seems no article can go by without the standard errors, and this one is no exception. I trust by now most people can easily spot them.

|

Monday, May 29, 2006

Will the Faja impress OPEC?

Later this week the OPEC oil ministers will be meeting in Caracas. Unfortuntely, it looks like production cuts, which Venezuela and Iran have been pushing for, and rightly so in my view, are non-starters. To a certain extent I can see why - cutting back production as oil is selling for over $70 per barrel could come across quite badly. Nevertheless, with oil and gasoline stocks rising and approaching record levels one has to wonder if oil prices are close to taking a big plunge and if the ministers won't later see the Caracas meeting to have been a significant lost oppertunity.

So if production cuts are off the table what can Venezuela hope to get out of this meeting? Probably the biggest thing is the recognition of the huge unconventional oil reserves in the Faja del Orinco which were nicely explained in this article:

For reference I am republishing a map of where these reserves lie:

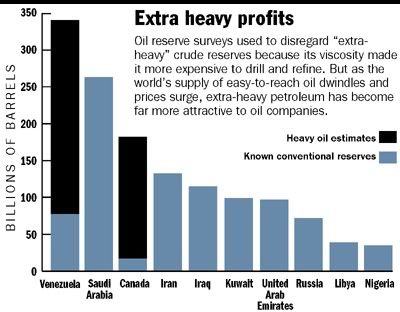

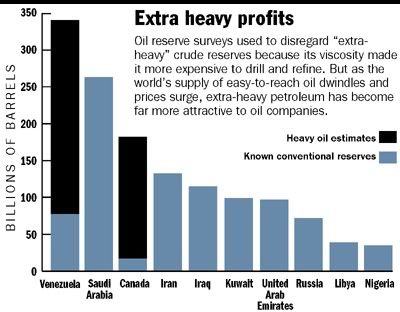

And a table comparing Venezuela's reserves to other countries if the Faja del Orinoco reserves were included:

How exactly OPEC sets its quotas is something of a mystery. But in theory a countries quota is supposed to be proportional to its proven reserves. Therefore, if Venezuela can get the Faja reserves recognized by OPEC its quota could be significantly increased allowing it to up its production without violating quotas and trashing prices. This would be a major victory for Venezuela and if this meeting helps bring it about it would make this meeting more than worthwhile from Venezuela's point of view.

|

So if production cuts are off the table what can Venezuela hope to get out of this meeting? Probably the biggest thing is the recognition of the huge unconventional oil reserves in the Faja del Orinco which were nicely explained in this article:

Oil-rich Venezuela looks to vast tar deposits to supply surging global energy needs

Monday May 29, 2006

By NATALIE OBIKO PEARSON

AP Business Writer

JOSE, Venezuela (AP) Beneath the plains and winding tributaries of the Orinoco River lie what Venezuela believes is the planet's largest oil deposit a tar-soaked basin that could help meet spiraling global energy needs.

It's known as the ``Faja,'' or ``belt'': a strip three times the area of Kuwait potentially holding 1.2 trillion barrels of extra-heavy oil.

Jet-black, sticky and oozing like molasses, Orinoco oil was long written off as too difficult and costly to produce. Now rising oil prices make it increasingly attractive.

President Hugo Chavez, who hosts a meeting of the Organization of Petroleum Exporting Countries on Thursday, says these unconventional reserves mean Venezuela will become the world's leading oil source for decades to come.

``Venezuela has the largest oil reserves in the world,'' Chavez declared recently, referring to the more than 300 billion barrels of oil he believes is recoverable, mostly from the Orinoco belt.

Saudi Arabia, which pumps more oil than any other nation, claims 260 billion barrels of so-called proven reserves, or roughly 25 percent of the world's conventional oil, according to the U.S. Department of Energy.

Chavez, who accuses multinationals of looting Venezuela's oil wealth, has squeezed a greater share of profits from the industry. A new tax on Orinoco operations takes effect this week and the government plans to take majority control of the projects eventually.

But private companies largely locked out of the Middle East and many other conventional oil reserves have not been scared away.

As light, easy-to-producetuff at very low cost,'' he said, expaining that producing a barrel of Venezuelan synthetic crude can cost $16 (12.50 euros) a barrel, compared to a barrel from Canadian tar sands that can go as high as $30 (23 euros). Orinoco crude can be produced economically as long as the oil price stays above $22 (17 euros) a barrel, he said.

Shell Venezuela President Sean Rooney says his company is interested in bringing technology it uses with tar sands in Canada to the Orinoco. Venezuela has agreed to study the possibility.

ConocoPhillips Chief Executive James Mulva said last month that his company also hopes to have a chance to ``expand our investments'' in extra-heavy crude.

Venezuela, meanwhile, is wooing other companies interested in quantifying and certifying untouched areas of the Orinoco.

Chavez has turned to companies from politically friendly countries: Iran's Petropars, India's ONGC, Brazil's Petrobras, China's CNPC, Russia's Gazprom and Lukoil and Spanish-Argentine Repsol YPF.

But Venezuela faces significant hurdles. Much depends on improving the percentage of Orinoco oil that can be extracted.

The recovery rate in the Orinoco is currently as low as 7 percent, though Venezuela is aiming to extract at least 22 percent. Current worldwide average recovery rates are about 35 percent.

Venezuela already boasts the largest proven reserves outside of the Mideast that is, some 80 billion barrels that can be recovered at current prices and current technologies. It hopes to quadruple to 315 billion by counting its Orinoco reserves by the end of 2008.

Chevron's Moshiri says meeting those goals will require 30 new upgrader plants and more than $200 billion (150 billion euros) of investment.

For reference I am republishing a map of where these reserves lie:

And a table comparing Venezuela's reserves to other countries if the Faja del Orinoco reserves were included:

How exactly OPEC sets its quotas is something of a mystery. But in theory a countries quota is supposed to be proportional to its proven reserves. Therefore, if Venezuela can get the Faja reserves recognized by OPEC its quota could be significantly increased allowing it to up its production without violating quotas and trashing prices. This would be a major victory for Venezuela and if this meeting helps bring it about it would make this meeting more than worthwhile from Venezuela's point of view.

|