Wednesday, January 03, 2007

The new PDVSA; not only redder, but better run as well.

Last November PDVSA’s audited financial statements for 2004 were posted on the web-site of the U.S. Securities and Exchange Commission (SEC). The Venezuelan state oil company is requited to file with the SEC because back in the 1990s the previous management not only ran the company very poorly but put it in debt. By virtue of selling bonds in the U.S. PDVSA was required to file with the SEC. Given that the new PDVSA management has been paying down its debt it may not have to send audited statements to the SEC much longer, but for now it still does. Lets see what the 2004 financial statement tells us.

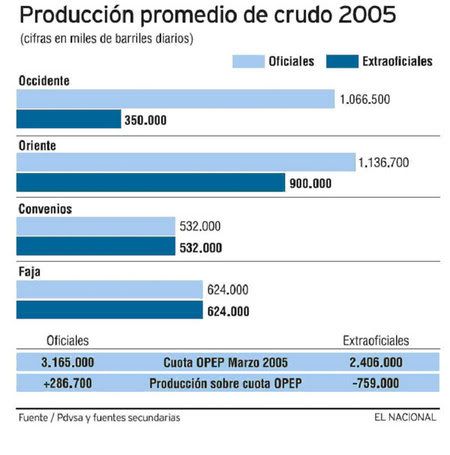

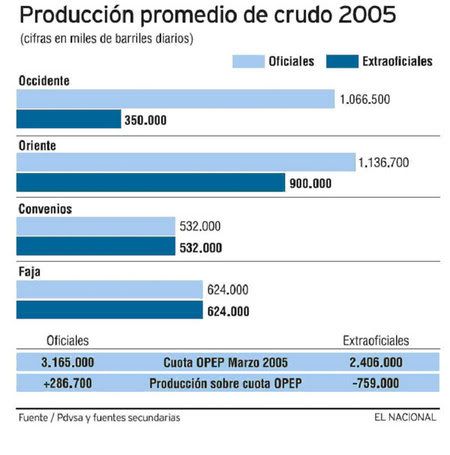

First and foremost it tells us that the Venezuelan government has been telling the truth about its production numbers and that its opposition doubters have been wrong. Recall this graph from El Nacional which showed production numbers from 2005:

Note how while the “official” sources said production was over 3.1 million barrels per day the “extra-official” sources (the old management fired by Chavez most likely) put it at 2.4 million barrels per day.

Now note what the audited financial statement about 2004 [note: this differs by a year but production went UP between 2004 and 2005 so the comparison more than applies] said on page 21:

We therefore see, in plain black and white from an AUDITED financial statement, that the Venezuelan government has been telling the truth about its petroleum production all along. Of course, this blog has suspected that all along. Still the vindication is nice.

The fact that all that oil is being produced is also reflected in the fact that PDVSA sales have had a huge increase. From $42 billion in 2002 they have increased to $63 billion in 2004 (schedule F-4). This largely resulted from increased export prices which went from $24.35 in 2003 to $32.22 in 2004 (page 21.) However, the increased sales, given that they largely result from an increase in the price of oil don’t tell us much about PDVSA itself. What they are really an indication of its Venezuela’s successful oil policies, not whether the company is itself better run.

Yet, we can see that PDVSA is indeed a better run company. One item that shows that is in this financial statement is the number of people who work for PDVSA. The opposition has claimed that employment has been increasing at PDVSA and productivity is therefore going down. Upon close examination of the numbers on page 81 this turns out not to be the case. There are two categories of “workers” at PDVSA, the actual employees who are on the payroll and “contractors” who are paid as consultants (what Microsoft has been infamous for doing in the U.S.). In this financial statement the two categories are reported separately. While the number of employees on payroll has gone from 33,998 in 2003 to 49,180 in 2005, the number of contractors has fallen from 38,166 to 10,498 as they have been incorporated into the regular PDVSA workforce. So the total number of workers actually fell from 72,164 to 59,678 for a decrease of 12,486. Yet over the same time span Venezuela has produced more oil meaning oil output per worker has increased! It should also be noted (from page 21) that the cost of production dropped from $3.92 per barrel to $3.77 over the same period. Rising productivity and falling costs sure seem good to me.

Those metrics alone show the improvements in PDVSA. But the icing on the cake is that is all happening while the executive staff of the company is being paid less. From page 80 we have:

With an executive staff consisting of 12 that comes to $122,500. Certainly they PDVSA’s executives aren’t living in poverty, especially by Venezuelan standards. But comparing that to what executives at large corporations earn, typically tens of millions of dollars per year, it is quite reasonable. In fact even by historical PDVSA standards it is quite reasonable. Referring back to the 2001 PDVSA financial statement, when PDVSA was still run by the old management, we find this on page 65:

During that time period there were 8 executive staff making compensation $300,000 per executive. In the post-strike wage restructuring that PDVSA undertook executive compensation was more than cut in half!! Done in conjunction with the previously mentioned operational improvements that is quite impressive.

It is also important to note that this audited financial statement was prepared in conformity with the very stringent requirements of the Sarbanes Oxley Act, which instituted very strong reporting requirements as well as strong penalties for non-compliance in the wake of the Enron scandal. So in reviewing all of PDVSA’s activities was any of the much talked about in Venezuela corruption found in PDVSA? Well, a little (from page 90):

A grand total of two acts of corruption were found?!?! In one a senior executive (since fired) accepted kick backs to try to influence the purchase of drilling rigs and in another case a vendor may have paid a bribe to have some past due invoices. In a $60 billion dollar corporation with over 40,000 employees this hardly represents corruption on any kind of significant scale. Clearly PDVSA is a clean company with its accounts fully in order and everything properly accounted for.

The Venezuelan opposition has also bemoaned the fact that PDVSA’s resources have been used to help fund various social and infrastructure projects claiming that is not an appropriate use of PDVSA’s money (as a State enterprise PDVSA’s entire reason for being is to fund the Venezuelan State but that seems completely lost on some people) and that it is a black hole – that it is not disclosed how much money PDVSA is spending on those projects. This financial statement lays bare that lie too. On page F-27 it is pointed out that PDVSA spent $116 million on “Programs and Projects for Housing and Infrastructure Development, $429 million on Programs and Projects related to the Ezequiel Zamora Fund for Agricultural Development, and $442 million for the social development fund,FONDESPA. This direct social spending by PDVSA added up to just under $1 billion in 2004 and was an entirely appropriate use of its resources.

So lets summarize what we know as the result of these financial statement. Venezuela is produced 3.1 MBPD of oil in 2004 just like the government always said, and which the opposition lied about. The workforce is smaller. Productivity is up. Costs are down. The company is paying lots of money for social programs. The books are in order and transparent with only trivial instances of malfeance. And last, but not least, the executives took a big pay cut.

If this is what it means to be “red, very red” than the color red is something companies all over the world should be aspiring to!

|

First and foremost it tells us that the Venezuelan government has been telling the truth about its production numbers and that its opposition doubters have been wrong. Recall this graph from El Nacional which showed production numbers from 2005:

Note how while the “official” sources said production was over 3.1 million barrels per day the “extra-official” sources (the old management fired by Chavez most likely) put it at 2.4 million barrels per day.

Now note what the audited financial statement about 2004 [note: this differs by a year but production went UP between 2004 and 2005 so the comparison more than applies] said on page 21:

“Venezuelan Crude Oil Production:

In 2004, Venezuela’s total crude oil production subject to royalties amounted to 3,148 mbpd, which includes 2,733 mbpd from PDVSA’s own production, 38 mbpd from PDVSA’s own production of less than 8° API extra heavy crude oil, 62 mbpd from PDVSA’s participation in Petrozuata production and 315 mbpd from third party participation in the Orinoco Oil Belt Association.”

We therefore see, in plain black and white from an AUDITED financial statement, that the Venezuelan government has been telling the truth about its petroleum production all along. Of course, this blog has suspected that all along. Still the vindication is nice.

The fact that all that oil is being produced is also reflected in the fact that PDVSA sales have had a huge increase. From $42 billion in 2002 they have increased to $63 billion in 2004 (schedule F-4). This largely resulted from increased export prices which went from $24.35 in 2003 to $32.22 in 2004 (page 21.) However, the increased sales, given that they largely result from an increase in the price of oil don’t tell us much about PDVSA itself. What they are really an indication of its Venezuela’s successful oil policies, not whether the company is itself better run.

Yet, we can see that PDVSA is indeed a better run company. One item that shows that is in this financial statement is the number of people who work for PDVSA. The opposition has claimed that employment has been increasing at PDVSA and productivity is therefore going down. Upon close examination of the numbers on page 81 this turns out not to be the case. There are two categories of “workers” at PDVSA, the actual employees who are on the payroll and “contractors” who are paid as consultants (what Microsoft has been infamous for doing in the U.S.). In this financial statement the two categories are reported separately. While the number of employees on payroll has gone from 33,998 in 2003 to 49,180 in 2005, the number of contractors has fallen from 38,166 to 10,498 as they have been incorporated into the regular PDVSA workforce. So the total number of workers actually fell from 72,164 to 59,678 for a decrease of 12,486. Yet over the same time span Venezuela has produced more oil meaning oil output per worker has increased! It should also be noted (from page 21) that the cost of production dropped from $3.92 per barrel to $3.77 over the same period. Rising productivity and falling costs sure seem good to me.

Those metrics alone show the improvements in PDVSA. But the icing on the cake is that is all happening while the executive staff of the company is being paid less. From page 80 we have:

For the year ending December 31, 2004, the aggregate amount paid by PDVSA as compensation to its directors and executive officers for services in all capacities was approximately $1.47 million (based on the 2004 average exchange rate of Bs.1,885.93 to $1). For the year ended December 31, 2005, the aggregate amount paid by PDVSA as compensation to its directors and excutive officers for services in all capacities was approximately $1.76 million (based on the 2005 average exchange rate of Bs. 2,110.00 to $1).

With an executive staff consisting of 12 that comes to $122,500. Certainly they PDVSA’s executives aren’t living in poverty, especially by Venezuelan standards. But comparing that to what executives at large corporations earn, typically tens of millions of dollars per year, it is quite reasonable. In fact even by historical PDVSA standards it is quite reasonable. Referring back to the 2001 PDVSA financial statement, when PDVSA was still run by the old management, we find this on page 65:

“6.B Compensation

For the year ended December 31, 2001, the aggregate amount paid by Petróleos de Venezuela as compensation to its directors and executive officers for services in all capacities was approximately $2.4 million (based on the 2001 average exchange rate of Bs/$ 722.01). “

During that time period there were 8 executive staff making compensation $300,000 per executive. In the post-strike wage restructuring that PDVSA undertook executive compensation was more than cut in half!! Done in conjunction with the previously mentioned operational improvements that is quite impressive.

It is also important to note that this audited financial statement was prepared in conformity with the very stringent requirements of the Sarbanes Oxley Act, which instituted very strong reporting requirements as well as strong penalties for non-compliance in the wake of the Enron scandal. So in reviewing all of PDVSA’s activities was any of the much talked about in Venezuela corruption found in PDVSA? Well, a little (from page 90):

“Item 15. Controls and Procedures

Our President and Chief Executive Officer and our Chief Financial Officer have evaluated the effectiveness of the design and operation of the our disclosure controls and procedures (as defined under Rules 13a-15(e) and 15d-15(e) of the Exchange Act) as of December 31, 2004.

Based upon that evaluation, our President and Chief Executive Officer and our Chief Financial Officer observed that there were certain weaknesses in our disclosure controls and procedures and our internal controls that temporarily impacted the timely processing of PDVSA’s operational and financial data. The company’s financial reporting systems continue to suffer delays in the generation and preparation of financial statements. In particular, there were delays in closing the year-end accounting records and in the analysis of accounts. However, PDVSA has commenced a project to meet the requirements of Section 404 of the Sarbanes Oxley Act, regarding the evaluation and improvement of its Financial Internal Control Process.

During 2006 we were made aware that two of our private sector contractors in Venezuela had disclosed to the SEC that they were involved in making improper payments to certain of our employees. As a result, PDVSA began an internal audit review and retained outside counsel to assist it.

In the first matter, the Company has substantially concluded its internal audit review and determined that the kick back scheme disclosed by this contractor implemented by overcharges for certain field services, was limited to falsification of certain procurement records by three field level personnel of the Company.

In the second matter the contractor has stated that it made payments during 2003 and 2004, through third parties to a senior official of the Company, who has subsequently left in January 2005. The contractor has told the Company that the payments were intended to influence the outcome of contract renewals for three drilling rigs. The renewal of the most important of these contracts was made by the unanimous decision of senior management, in which decision this senior official participated, but who did not have sole power to make the decision.

The Company has reviewed the record backing up the decision extending that contract and has concluded that standard procedures were followed in the decision, including a unanimous decision of the Company’s senior management. Nevertheless, although the Company is unable to determine whether the senior official was able to exert informal influence on the final decision, it has definitively concluded that this senior official had no formal authority to influence the contracting of this service and was not a party to the internal administrative procedures that were followed to approve the contract.

The two smaller contracts were renewed during this period pursuant to alternative contracting procedures that were adopted by the Company due to the work stoppages that the Company suffered during 2003. These procedures resulted in special procedures for contracts below a certain value. Nevertheless, the Company has found no evidence that the senior official was involved in the decisions with respect to renewals of these two contracts but has not been able to determine whether in fact he had any kind of informal influence with respect to these decisions. Subsequent to the reinstitution of normal procedures and the departure of the senior official from the Company, these contracts were renewed in the ordinary course.

The second contractor also stated that it made payments to a mid-level official of the Company in order to expedite the payment of invoices that were long overdue. The Company has confirmed the existence and payment of the invoices, whose processing had been affected by the disruption in the Company’s systems due to the work stoppages, but has not been able to determine whether there was any influence exerted in connection with these payments, because they were overdue invoices.”

A grand total of two acts of corruption were found?!?! In one a senior executive (since fired) accepted kick backs to try to influence the purchase of drilling rigs and in another case a vendor may have paid a bribe to have some past due invoices. In a $60 billion dollar corporation with over 40,000 employees this hardly represents corruption on any kind of significant scale. Clearly PDVSA is a clean company with its accounts fully in order and everything properly accounted for.

The Venezuelan opposition has also bemoaned the fact that PDVSA’s resources have been used to help fund various social and infrastructure projects claiming that is not an appropriate use of PDVSA’s money (as a State enterprise PDVSA’s entire reason for being is to fund the Venezuelan State but that seems completely lost on some people) and that it is a black hole – that it is not disclosed how much money PDVSA is spending on those projects. This financial statement lays bare that lie too. On page F-27 it is pointed out that PDVSA spent $116 million on “Programs and Projects for Housing and Infrastructure Development, $429 million on Programs and Projects related to the Ezequiel Zamora Fund for Agricultural Development, and $442 million for the social development fund,FONDESPA. This direct social spending by PDVSA added up to just under $1 billion in 2004 and was an entirely appropriate use of its resources.

So lets summarize what we know as the result of these financial statement. Venezuela is produced 3.1 MBPD of oil in 2004 just like the government always said, and which the opposition lied about. The workforce is smaller. Productivity is up. Costs are down. The company is paying lots of money for social programs. The books are in order and transparent with only trivial instances of malfeance. And last, but not least, the executives took a big pay cut.

If this is what it means to be “red, very red” than the color red is something companies all over the world should be aspiring to!

|