Sunday, February 18, 2007

OPEC for Dummies

Seeing as the subject of OPEC keeps coming up and most of my posting regarding it was towards the beginning of this blog maybe it is time for refresher. This especially true given that some want to cling to the notion that things other than OPEC – China, the weather, SUVs, etc – are what are driving oil prices.

Fortunately, I don’t have to write much of this myself. The Joint Economic Committee of the U.S. Congress was nice enough to do it for me:

Quite frankly, the executive summary on this page pretty much tells you everything you need to know. Oil is in fact a plentiful resource and costs about $5 to produce. The reason it sells for so much more is the “artificial scarcity” created by OPEC.

However, reading through the paper you can find a wealth of important data that debunks many misconceptions. For example, it debunks the notion that prices are high because the world is running short of oil. From the bottom of page 2:

Yet despite oil supplies becoming even MORE abundant prices have gone up. As this document makes clear, it is OPEC keeping huge quantities of oil that would readily produced under normal market forces off the market and boosts prices. As is shown on page 9, OPEC reaps huge dividends by doing this:

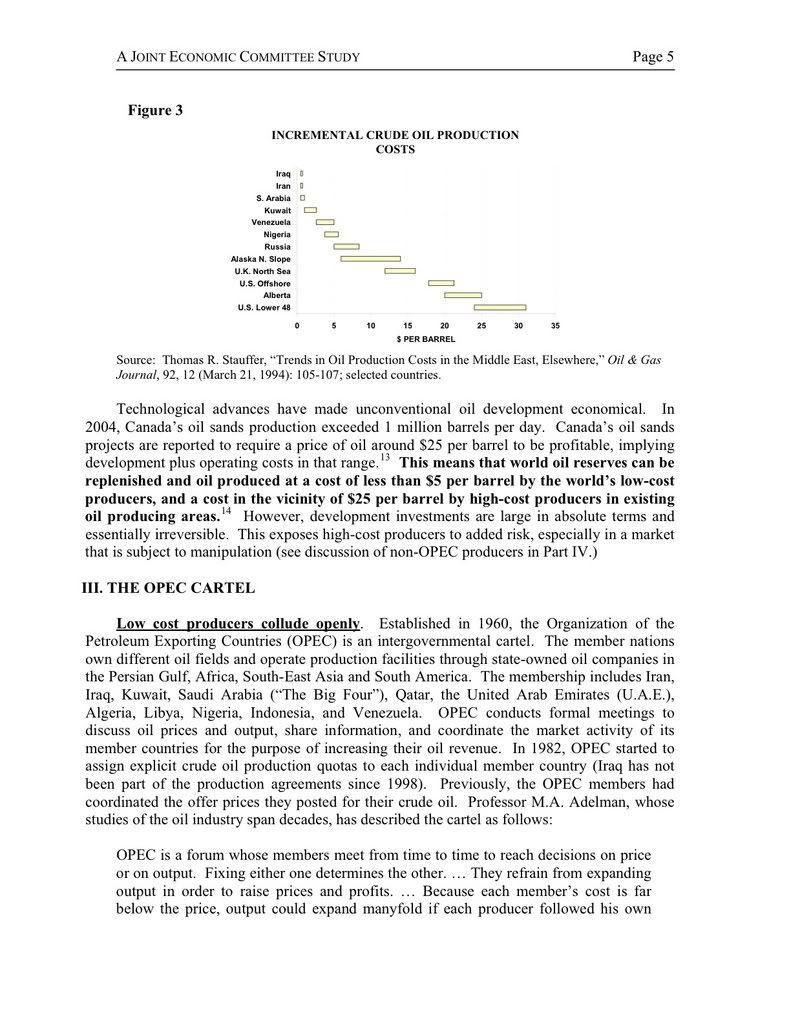

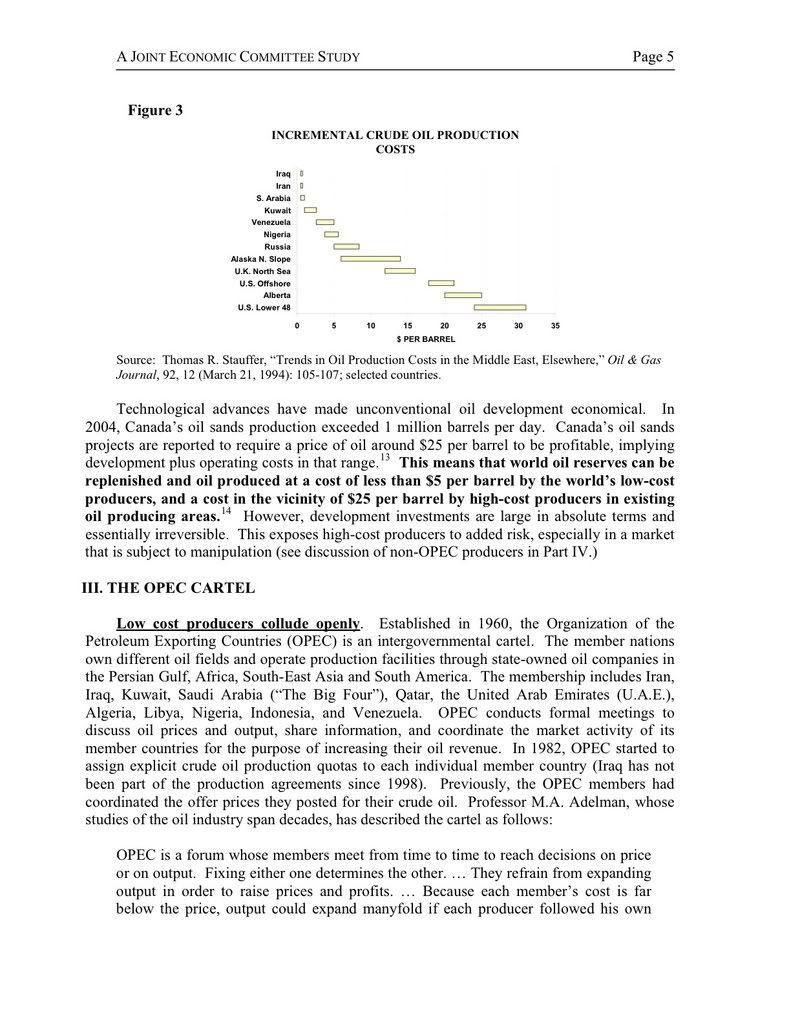

"Kept high only by collusion" - can't be much more clear than that - there is no doubt that OPEC is effective. A big part of the reason that it works so well is that it doesn’t just include the countries with most of the worlds oil reserves but he countries with LOW COST oil. Look at this chart it provides in the cost of production for different countries:

All the low cost producers are OPEC members – Iraq, Iran, Saudi Arabia, Kuwait, Venezuela, and Nigeria. The U.S. and Canada by contrast are very high cost producers. By being low cost producers these countries can even manage to restrict investment and production in higher cost non-OPEC countries. From page 10:

That is, OPEC not only boost prices by keeping supplies off the world market by also by scaring off investment that knows OPEC can also collapse prices thereby making their investments unprofitable.

Finally, the article points out that the seeming impact of other events, wars, political instability, hurricanes, terrorism, etc. only seemingly boost prices because OPEC keeps supplies so tight to begin with. From page 15:

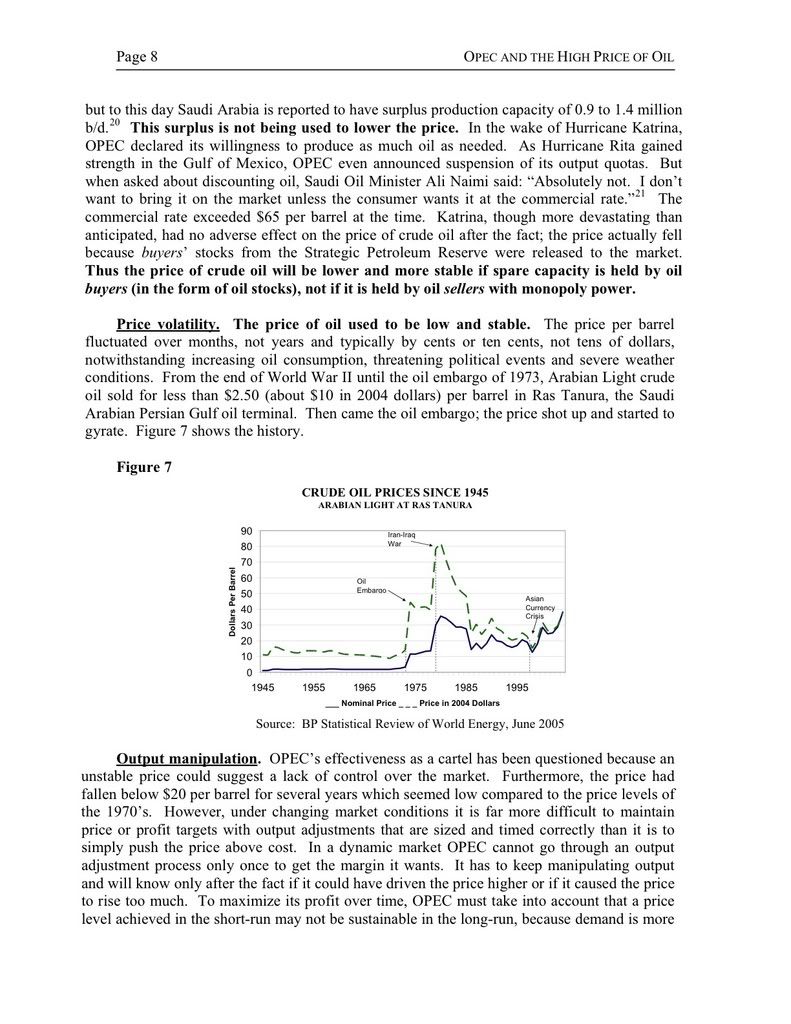

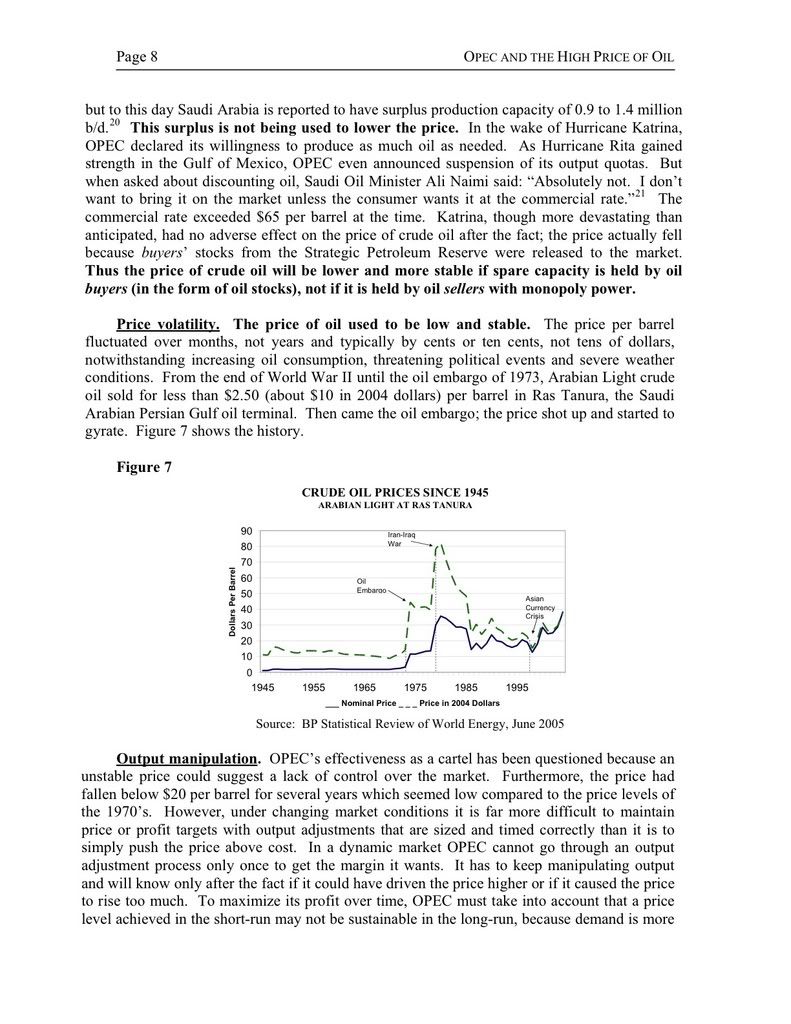

Stated another way, without OPEC sharply restricting oil production these other events – from Hurricanes to coups – would have next to no impact. And as the article pointed out, before OPEC they indeed had next to no impact. Just look at the graph:

Prior to the mid 1960’s when OPEC was formed prices were nice and flat with barely a ripple. It should also be noted they were pretty constant at $10 in current terms. Since the formation of OPEC as can be clearly seen that fluctuate quite dramatically and are generally well above $10 per barrel.

To sum up, what we have is a cartel, OPEC, which artificially restricts production in order to boost prices. Without OPEC there would be an unfettered market in which production would keep ramping up until prices were only marginally above the cost of production – say $10 a barrel which probably not coincidentally is about what they were in the decades before OPECs creation. It is the enforced and artificial scarcity brought about by OPEC that puts today’s prices where they are. Isolated events can cause temporary peaks and troughs but without OPEC they wouldn’t exist – and indeed they didn’t prior to OPEC.

The end result is by supporting OPEC Venezuela gets to sell its oil for $50 as opposed to $10. Sounds like a good deal to me and a smart policy on Chavez’s part to make sure that OPEC remains strong and its quotas are respected. Quota busters like Giusti, Sosa-Pietri, and Toro-Hardy can go elsewhere. Venezuela is a lot better off without them.

|

Fortunately, I don’t have to write much of this myself. The Joint Economic Committee of the U.S. Congress was nice enough to do it for me:

Quite frankly, the executive summary on this page pretty much tells you everything you need to know. Oil is in fact a plentiful resource and costs about $5 to produce. The reason it sells for so much more is the “artificial scarcity” created by OPEC.

However, reading through the paper you can find a wealth of important data that debunks many misconceptions. For example, it debunks the notion that prices are high because the world is running short of oil. From the bottom of page 2:

One approach to measuring whether the supply of oil is keeping up with demand is to track the size of the world’s in-ground oil inventory and compare it to the rate of production. In 1980 known oil reserves stood at 645 billion barrels; today they stand at 1.278 trillion barrels. This means that enough new oil was developed to replace all the oil produced in 25 years and nearly double the reserves. In 1980, the rate of production was 64 million barrels per day (b/d). The known reserves would have lasted for 28 years at that rate, if no new oil had been developed. Much was said at the time about the world running out of oil, because the price was at an all-time high. But, in 2004 the rate of production was 83 million b/d and at that rate today’s reserves would last more than 40 years.

Yet despite oil supplies becoming even MORE abundant prices have gone up. As this document makes clear, it is OPEC keeping huge quantities of oil that would readily produced under normal market forces off the market and boosts prices. As is shown on page 9, OPEC reaps huge dividends by doing this:

Indeed, OPEC has collected enormous monopoly rents since 1973.

In 2003, The Economist cited a study that estimated the wealth transfer from American consumers to oil producers at more than $1 trillion since the 1973 embargo, because the oil price has been held above the competitive level.27

According to the EIA, OPEC collected $193 billion in net oil export revenues in 2002, $243 billion in 2003, $338 billion in 2004, and will collect an estimated $430 billion in 2005; that represents a 123 percent increase in just three years on a 17 percent increase in OPEC’s averagerate of oil production.28 Stable or not, high oil prices are hugely profitable for OPEC and they are kept high only by collusion.

"Kept high only by collusion" - can't be much more clear than that - there is no doubt that OPEC is effective. A big part of the reason that it works so well is that it doesn’t just include the countries with most of the worlds oil reserves but he countries with LOW COST oil. Look at this chart it provides in the cost of production for different countries:

All the low cost producers are OPEC members – Iraq, Iran, Saudi Arabia, Kuwait, Venezuela, and Nigeria. The U.S. and Canada by contrast are very high cost producers. By being low cost producers these countries can even manage to restrict investment and production in higher cost non-OPEC countries. From page 10:

Non-OPEC producers will respond to a rising oil priceby keeping older wells operating longer and by drilling new ones. But upfrontinvestment in new production is essentially irreversible. Since investors know that OPEC can movethe price up as well as down but do not know what its plan is, they are more hesitant to invest than they would be if the market were not subject to manipulation.

That is, OPEC not only boost prices by keeping supplies off the world market by also by scaring off investment that knows OPEC can also collapse prices thereby making their investments unprofitable.

Finally, the article points out that the seeming impact of other events, wars, political instability, hurricanes, terrorism, etc. only seemingly boost prices because OPEC keeps supplies so tight to begin with. From page 15:

Other explanations for high oil prices. An inadequate supply side response to increasing demand magnifies the price impact of any disturbance that lessens, even minimally, the amount of oil available for purchase. In the short-run, input substitution typically is a very limited option, which makes oil buyers willing to bid the crude oil price up disproportionately to try to meet their requirements (demand is highly inelastic).

This raises concerns over events that normally would not move the price of oil on the world market, such as accidents or labor strikes somewhere in the oil supply chain. Supply disruptions of larger magnitude also are usually compensated for in short order in an unfettered market. Natural disasters, terrorist attacks or production problems in a major oil producing country certainly can have an effect on the price of oil but it does not last very long. Supply shocks occurred prior to the oil embargo of 1973 as well, but they were absorbed so quickly that annualized price data shows virtually no variation (see the nominal price line in Figure 7). It is useful to recall the complaint by Mr. Ali I. al-Naimi that Saudi Arabia—the largest oil producer in the world—cannot hold up the market price of oil by itself, which strongly suggests that no other country can either, whatever the particular circumstances. The reason for high oil prices is the ongoing, collective restriction of the oil supply by the cartel members, not isolated events.

Stated another way, without OPEC sharply restricting oil production these other events – from Hurricanes to coups – would have next to no impact. And as the article pointed out, before OPEC they indeed had next to no impact. Just look at the graph:

Prior to the mid 1960’s when OPEC was formed prices were nice and flat with barely a ripple. It should also be noted they were pretty constant at $10 in current terms. Since the formation of OPEC as can be clearly seen that fluctuate quite dramatically and are generally well above $10 per barrel.

To sum up, what we have is a cartel, OPEC, which artificially restricts production in order to boost prices. Without OPEC there would be an unfettered market in which production would keep ramping up until prices were only marginally above the cost of production – say $10 a barrel which probably not coincidentally is about what they were in the decades before OPECs creation. It is the enforced and artificial scarcity brought about by OPEC that puts today’s prices where they are. Isolated events can cause temporary peaks and troughs but without OPEC they wouldn’t exist – and indeed they didn’t prior to OPEC.

The end result is by supporting OPEC Venezuela gets to sell its oil for $50 as opposed to $10. Sounds like a good deal to me and a smart policy on Chavez’s part to make sure that OPEC remains strong and its quotas are respected. Quota busters like Giusti, Sosa-Pietri, and Toro-Hardy can go elsewhere. Venezuela is a lot better off without them.

|